Fund Type

Please see details in prospectus summary.

Dividend Policy

None

Objective

Please see details in prospectus summary.

Inception Date

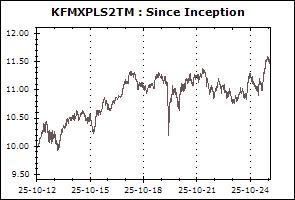

25 October 2012

Investment Policy

1. To invest primarily in domestic debt instruments issued by government 2. Maximum of 40% of fund assets are invested in equities with attractive dividend yield. 3. Maximum of 10% of fund assets are invested in mutual fund in foreign countries named SPDR Gold Trust (Please see details in prospectus summary.)

Fund Manager

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

12.09%

Instruments issued by Sovereign or Supra-national organization

17.53%

Fixed Income Instruments issued by Bank of Thailand

8.03%

Deposits and Fixed Income Instruments issued by Financial Institutions

36.94%

Fixed Income Instruments Issued by Corporates

1.39%

Other Assets

-1.40%

Other Liabilities

18.39%

Equity and Unit Trusts

7.02%

Foreign CIS - Commodity

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Daily during commercial bank`s business hours.

Proceeds Payment Period: 3 working days after the execution

Fund Redemption Period: 2 times per month on every 1st or 16th of month, with advance notice at least 10 business day before redemption date by 15.30 hrs.

Transaction Channel: AGENT

Asset Allocation (30 Dec 2025)

| Instruments issued by Sovereign or Supra-national organization | 12.09% |

| Fixed Income Instruments issued by Bank of Thailand | 17.53% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 8.03% |

| Fixed Income Instruments Issued by Corporates | 36.94% |

| Equity and Unit Trusts | 18.39% |

| Foreign CIS - Commodity | 7.02% |

| Other Assets | 1.39% |

| Other Liabilities | -1.40% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| SPDR Gold Trust | - | 7.02% |

| Bank of Thailand Bond 10/FRB363/2025 | - | 5.08% |

| Government Housing Bank | AAA | 3.45% |

| Bank of Thailand Bond 1/FRB364/2025 | - | 3.33% |

| Debentures of The Siam Cement Public Company Limited No. 3/2567 Series 1 Due B.E. 2570 | A | 3.23% |

Krungsri 2TM

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Mixed 2TM Fund (KFMX2TM) | +0.67% | +3.82% | +4.36% | +4.36% | +2.07% | +1.33% | +1.31% | +1.24% | 288 |

| Benchmark(4) | +1.33% | +6.97% | +5.94% | +5.94% | +4.24% | +3.82% | +3.81% | +3.32% | |

| Standard Deviation of Fund | +1.97% | +2.10% | +2.37% | +2.37% | +2.06% | +2.01% | +2.13% | +2.11% | |

| Standard Deviation of Benchmark | +3.51% | +3.47% | +3.87% | +3.87% | +3.05% | +2.85% | +3.20% | +3.39% | |

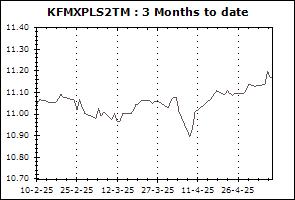

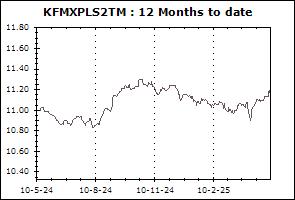

| Krungsri Mixed Plus 2TM Fund (KFMXPLS2TM) | +0.58% | +4.86% | +3.87% | +3.87% | +1.31% | +1.03% | +1.18% | +1.12% | 1,382 |

| Benchmark(5) | +1.13% | +10.23% | +4.26% | +4.26% | +2.85% | +3.65% | +4.20% | +3.64% | |

| Standard Deviation of Fund | +2.65% | +2.94% | +3.45% | +3.45% | +2.99% | +2.96% | +3.35% | +3.33% | |

| Standard Deviation of Benchmark | +5.97% | +6.25% | +7.28% | +7.28% | +5.65% | +5.29% | +6.02% | +6.23% | |

Remark