Fund Transaction

Foreign Currency Funds

Enhance Your Investment Choices and Maximize Return Potential

with

“Foreign Currency Funds”

Why Invest in Foreign Currency Funds?

- Investing in major global currencies such as USD helps enhance long-term value stability.

- Potential to achieve returns similar to directly investing in offshore funds, without incurring overseas investment tax.

- Mitigates foreign exchange impact with no currency hedging cost

Expand your investment opportunities with foreign currency-denominated fundsthat offer the potential to fully capture the returns of underlying offshore funds. These funds are denominated in foreign currencies such as the US dollar, matching the base currency of the underlying fund to mitigate foreign exchange risk.Simply open a Foreign Currency Deposit (FCD) account and a unit holder account by following these easy steps:

For Krungsri Foreign Currency Funds Information, click here

Opening e-FCD Savings Account of Kiatnakin Phatra Bank (KKP)

Eligibility and Conditions for Opening a KKP e-FCD Account:

- The KKP e-FCD Savings Account is a passbook-less savings account available in USD, EUR, GBP, HKD, SGD, CHF, CNY, AUD, and JPY.

- Applicants must be Thai nationals aged 15 or above, possess a Smart ID card, and meet the bank’s eligibility criteria. Only individual accounts with a single owner are permitted - one account per currency per person.

- Joint accounts or accounts on behalf of others are not allowed.

- Account holders must have an email address and register for KKP e-Banking for account opening and transactions.

| Customer Groups | Download/ Scan the Manual (Thai only) | Download App: KKP Mobile |

| Existing customers with a THB savings account and KKP Mobile App | Click here.aspx)  |

.aspx)  |

| Existing customers without the KKP Mobile App | Click here.aspx)  |

|

| New customers without the KKP Mobile App | Click here.aspx)  |

Opening Unitholder Account

In opening an account, each unitholder account number must be linked to only one currency but can be used to invest in multiple funds denominated in that same currency of that unitholder account number.

Two Available Channels for Opening Unitholder Account as follows:

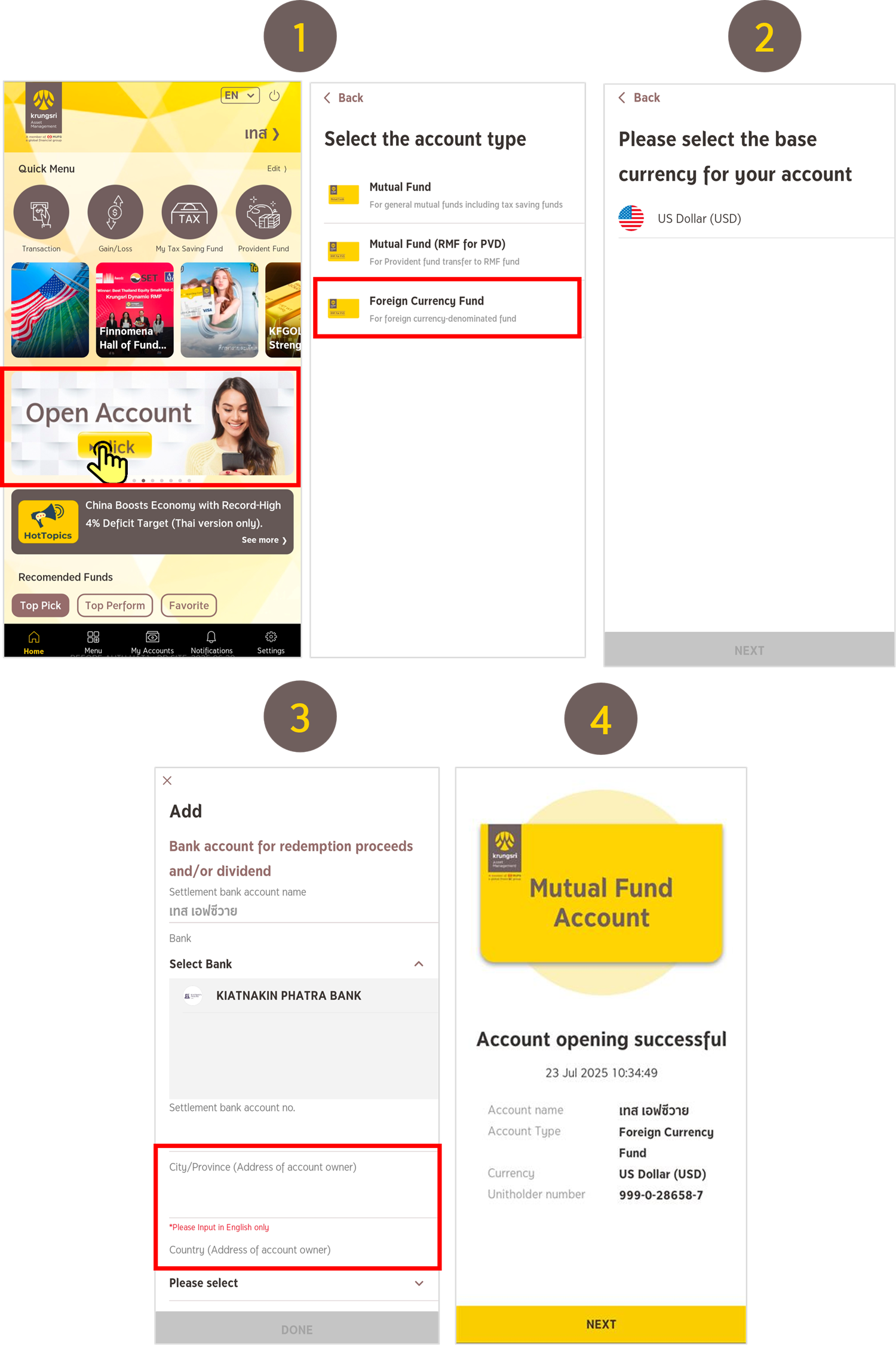

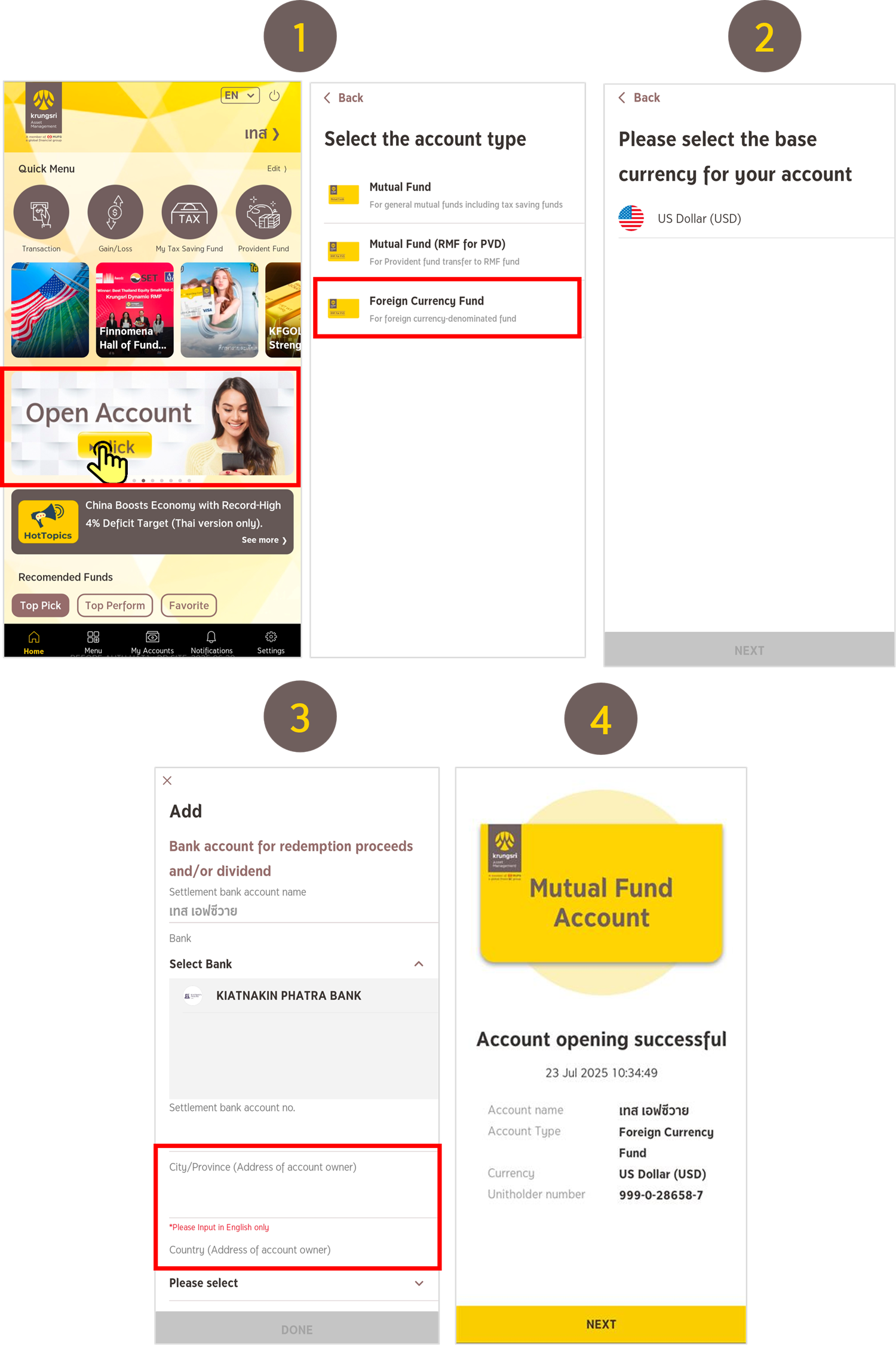

1. Via @ccess Mobile

2. Via Form Submission

Investors must use the designated Fund Account Opening Form for foreign currency funds

Two Available Channels for Opening Unitholder Account as follows:

1. Via @ccess Mobile

- Only individual accounts are accepted (corporate and joint accounts not available).

- Select “Foreign Currency Fund” account type, then choose the desired currency. And the system will proceed to the standard account opening process.

- Other account opening procedures are the same as for general mutual fund accounts, except for the account linking for redemption proceeds, where the investor must additionally provide the city and country information in English only.

2. Via Form Submission

Investors must use the designated Fund Account Opening Form for foreign currency funds

Subscription & Making Payment for Fund Units

Currently, investors can subscribe to Krungsri foreign currency funds through the following channels:

1. Krungsri Asset Management

1.1 Via @ccess Online or @ccees Mobile: Customers must complete the Direct Debit payment in advance, as the system will deduct the amount at the end of the day. During the subscription process, the registered Direct Debit account will be displayed for the customer to select and proceed with the transaction

Click here for KKP Direct Debit registration guide

1.2 Via Subscription Form Submission plus attaching a proof of transfer. In case you wish to use automatic account debit (Direct Debit), you must provide account details on the subscription form that match the deposit account previously registered for the Direct Debit service only.

2. Selling Agents: Kiatnakin Phatra Securities (KKPS) and appointed selling agents for the fund

Fund Subscription Payments

1. Krungsri Asset Management

1.1 Via @ccess Online or @ccees Mobile: Customers must complete the Direct Debit payment in advance, as the system will deduct the amount at the end of the day. During the subscription process, the registered Direct Debit account will be displayed for the customer to select and proceed with the transaction

Click here for KKP Direct Debit registration guide

1.2 Via Subscription Form Submission plus attaching a proof of transfer. In case you wish to use automatic account debit (Direct Debit), you must provide account details on the subscription form that match the deposit account previously registered for the Direct Debit service only.

2. Selling Agents: Kiatnakin Phatra Securities (KKPS) and appointed selling agents for the fund

Fund Subscription Payments

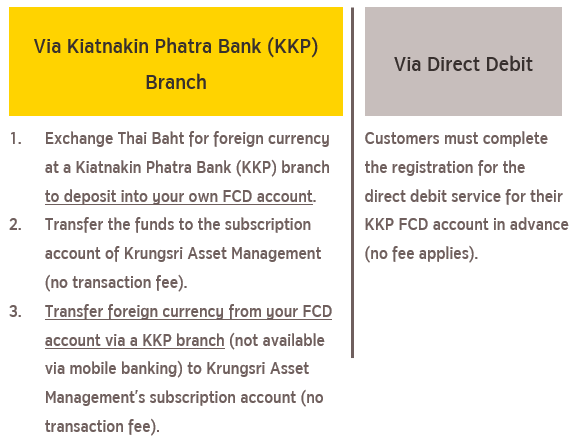

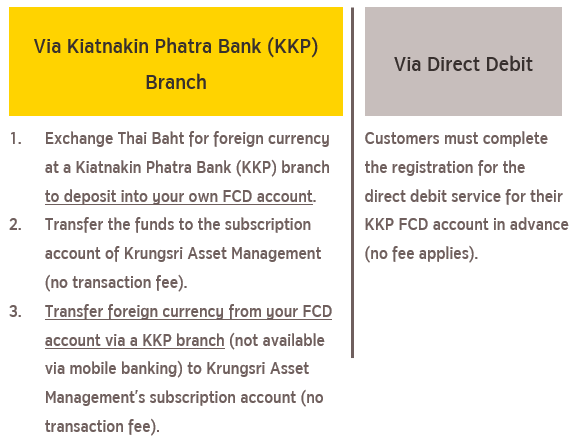

- The subscription account for foreign currency funds managed by Krungsri Asset Management is currently available only at Kiatnakin Phatra Bank (KKP).

- The payment for unit subscription can be made using one of the following methods:

- The subscription payment must be credited to the company’s subscription account within the fund’s cut-off time for the transaction to be considered valid. Therefore, it is not recommended to make transactions through other banks, in order to avoid potential delays in interbank transfers and any additional fees that may arise.

Linking KKP Account to Receive Redemption Proceeds/Dividends

Account to Receive Redemption Proceeds/Dividends

Should understand fund features, return conditions, and associated risks before making an investment decision.

For more information, please contact: Krungsri Asset Management Co., Ltd.

Tel: 02-657-5757 (Press 2)

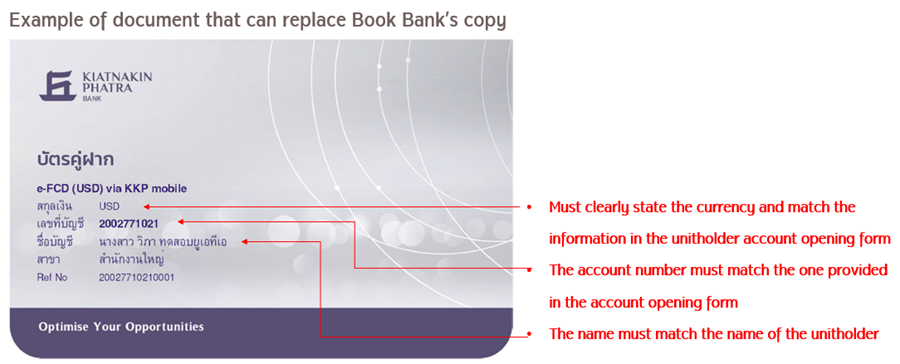

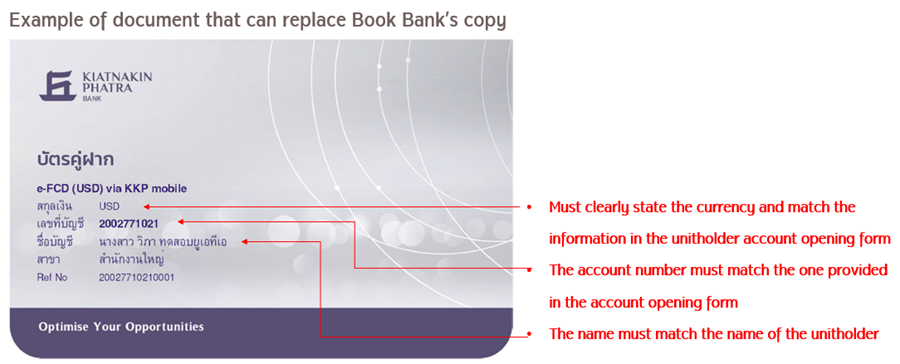

- Specifying a Bank Account for Redemption Proceeds / Dividend Payments: Investors may indicate their preferred receiving account in the account opening form, redemption order form, or information amendment request form. When doing so, please also provide the investor’s address (City & Country) in English only. This information will be used in the payment processing system. A copy of the bank account passbook page showing the account name (which must match the name of the unitholder) must also be attached.

- The bank account designated for receiving redemption proceeds/dividends must meet the following criteria:

- Must be a foreign currency deposit account (FCD) of the savings account type.

- The currency of the FCD account must match the currency of the unitholder’s fund account.

- Currently, the Company only accepts FCD accounts with Kiatnakin Phatra Bank (KKP), including KKP FCD, KKP e-FCD, and Dime FCD accounts.

Should understand fund features, return conditions, and associated risks before making an investment decision.

For more information, please contact: Krungsri Asset Management Co., Ltd.

Tel: 02-657-5757 (Press 2)