Krungsri Value Stock Fund-I (KFVALUE-I)

Old Name: Krungsri-Primavest Value Fund (KPV)

Information as of Sep 30, 2025

ファンドタイプ

Equity Fund

分配方針

None

Objective

To generate the return from medium term to long term investment of listed stock.

設定日

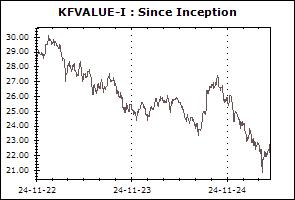

24 November 2022

投資方針

To invest at least 80% of its net asset value on average in listed stocks and mainly invest in stocks that potentially pays consistent dividends.

ファンドマネージャー

Satit Buachoo, Thalit Choktippattana

Asset Allocation

-

Transaction Details

最低購入金額 (バーツ): None

Minimum Redemption Amount (Unit): None

解約資金受領日数: 3 business days after the execution (T+3)

Fund Subscription Period: Every dealing date of the fund by 15.30 hrs.

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

販売会社 : Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Sep 2025)

| Energy and Utilities | 22.26% |

| Commerce | 10.92% |

| Banking | 10.70% |

| Property Development | 8.37% |

| Finance & Securities | 7.60% |

Top Five Holdings (30 Sep 2025)

| PTT Plc. | 5.98% |

| CP ALL Plc. | 5.27% |

| TMBThanachart Bank Plc. | 4.28% |

| Advanced Info Service Plc. | 4.11% |

| MBK Plc. | 4.02% |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock Fund (KFSDIV) | +13.06% | +6.11% | -6.08% | -12.44% | -5.87% | -0.89% | -1.99% | +5.06% | 6,931 |

| Standard Deviation of Fund | +15.27% | +18.36% | +17.99% | +16.87% | +13.41% | +13.55% | +14.79% | +15.49% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | +13.03% | +6.18% | -5.78% | -12.09% | -5.65% | -0.80% | -1.85% | +4.05% | 565 |

| Standard Deviation of Fund | +15.18% | +18.24% | +17.81% | +16.70% | +13.29% | +13.46% | +14.73% | +17.78% | |

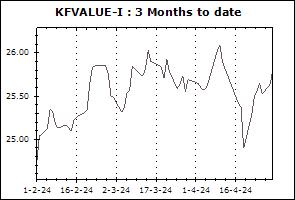

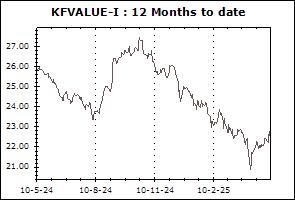

| Krungsri Value Stock Fund-I (KFVALUE-I) | +13.03% | +6.18% | -5.78% | -12.09% | N/A | N/A | N/A | -6.90% | 0 |

| Standard Deviation of Fund | +15.18% | +18.24% | +17.81% | +16.70% | N/A | N/A | N/A | +13.43% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | +12.79% | +4.18% | -8.91% | -15.87% | -7.17% | -0.24% | -1.52% | +6.97% | 809 |

| Standard Deviation of Fund | +16.00% | +19.28% | +19.04% | +17.87% | +13.94% | +13.40% | +15.20% | +21.76% | |

| Krungsri Star Equity Fund (KFSEQ) | +12.52% | +4.00% | -8.94% | -15.89% | -7.19% | -0.31% | -1.58% | +2.98% | 719 |

| Standard Deviation of Fund | +15.70% | +18.98% | +18.83% | +17.66% | +13.82% | +13.33% | +15.12% | +19.09% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | +12.95% | -0.31% | -15.70% | -22.35% | -6.60% | +3.75% | +2.75% | +5.15% | 338 |

| Standard Deviation of Fund | +17.79% | +21.39% | +20.64% | +19.14% | +14.79% | +14.58% | +16.23% | +19.23% | |

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +12.48% | +7.94% | +3.72% | +1.51% | +2.12% | +9.77% | +5.16% | +7.25% | 1,627 |

| Standard Deviation of Fund | +10.31% | +14.85% | +14.45% | +13.78% | +12.75% | +14.28% | +16.91% | +20.95% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | +13.00% | -0.47% | -15.92% | -22.53% | -6.72% | +3.61% | +2.74% | +5.25% | 837 |

| Standard Deviation of Fund | +17.82% | +21.46% | +20.74% | +19.21% | +14.96% | +14.72% | +16.29% | +19.60% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | +12.37% | +4.12% | -8.72% | -15.87% | -7.27% | -0.37% | N/A | -7.50% | 15 |

| Standard Deviation of Fund | +15.68% | +18.75% | +18.48% | +17.46% | +13.78% | +13.26% | N/A | +15.80% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | +12.37% | +4.12% | -8.72% | -15.87% | -7.27% | -0.37% | -1.45% | +5.00% | 408 |

| Standard Deviation of Fund | +15.68% | +18.75% | +18.48% | +17.46% | +13.78% | +13.26% | +15.07% | +19.10% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +17.52% | +14.20% | -6.36% | -6.93% | -3.05% | +3.07% | +2.02% | +4.53% | 1,983 |

| Standard Deviation of Fund | +17.34% | +21.79% | +21.31% | +19.41% | +14.99% | +15.38% | +16.75% | +20.51% | |

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | +14.31% | +3.59% | -15.14% | -23.64% | -14.67% | -0.28% | N/A | -1.18% | 130 |

| Standard Deviation of Fund | +15.92% | +19.46% | +19.94% | +18.50% | +14.90% | +14.93% | N/A | +15.90% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | +11.90% | +6.09% | -2.83% | -10.44% | -5.92% | +0.54% | N/A | -4.47% | 552 |

| Standard Deviation of Fund | +13.73% | +17.31% | +17.58% | +16.27% | +13.62% | +13.50% | N/A | +15.06% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | +11.90% | +6.09% | -2.83% | -10.44% | -5.92% | +0.54% | N/A | -6.57% | 464 |

| Standard Deviation of Fund | +13.73% | +17.31% | +17.58% | +16.27% | +13.62% | +13.50% | N/A | +15.47% | |

| Krungsri Thai Equity CG Fund (KFTHAICG) | +12.74% | +6.70% | -3.26% | -9.44% | -3.68% | +3.13% | N/A | -1.53% | 57 |

| Standard Deviation of Fund | +14.45% | +18.15% | +17.88% | +16.80% | +13.53% | +13.09% | N/A | +15.00% | |

| Krungsri SET100 Fund-A (KFS100-A) | +17.84% | +13.73% | -6.09% | -7.82% | -3.06% | +3.19% | N/A | +1.70% | 183 |

| Standard Deviation of Fund | +16.81% | +21.16% | +20.68% | +18.89% | +14.58% | +14.71% | N/A | +14.73% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.24% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +17.84% | +13.73% | -6.09% | -7.82% | N/A | N/A | N/A | -2.94% | 13 |

| Standard Deviation of Fund | +16.81% | +21.16% | +20.68% | +18.89% | N/A | N/A | N/A | +15.44% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.24% | N/A | N/A | N/A | N/A | |

| Krungsri SET50 LTF-A (KFLTF50-A) | +17.00% | +13.55% | -6.09% | -6.86% | -2.47% | N/A | N/A | +3.28% | 8 |

| Standard Deviation of Fund | +16.53% | +21.28% | +20.79% | +18.98% | +14.61% | N/A | N/A | +14.95% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.91% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.80% | N/A | N/A | N/A | N/A | |

| Krungsri Dividend Stock LTF 70/30-D (KFLTFD70-D) | +10.94% | +5.57% | -5.04% | -8.95% | -3.98% | N/A | N/A | -0.43% | 4 |

| Standard Deviation of Fund | +10.59% | +13.28% | +13.03% | +12.09% | +9.71% | N/A | N/A | +9.65% | |

| Krungsri Dividend Stock LTF-D (KFLTFDIV-D) | +15.42% | +7.63% | -7.77% | -12.97% | -5.91% | N/A | N/A | -1.22% | 6 |

| Standard Deviation of Fund | +15.00% | +18.78% | +18.47% | +17.13% | +13.81% | N/A | N/A | +13.78% | |

| Krungsri Equity LTF-A (KFLTFEQ-A) | +13.01% | +3.79% | -9.55% | -16.52% | -7.41% | N/A | N/A | -0.38% | 0 |

| Standard Deviation of Fund | +16.52% | +19.52% | +19.35% | +18.13% | +14.07% | N/A | N/A | +13.47% | |

| SET TRI | +18.03% | +12.79% | -5.43% | -8.40% | -3.84% | +3.86% | +2.66% | N/A | |

| Standard Deviation of Benchmark | +15.66% | +19.51% | +18.86% | +17.25% | +13.56% | +13.64% | +14.87% | N/A | |

| SET50 TRI | +17.52% | +14.23% | -5.41% | -6.06% | -1.56% | +4.20% | +2.56% | N/A | |

| Standard Deviation of Benchmark | +16.67% | +21.42% | +20.76% | +18.96% | +14.66% | +14.99% | +16.71% | N/A | |

| SET100 TRI | +18.42% | +14.19% | -5.89% | -7.58% | -3.05% | +3.38% | +2.24% | N/A | |

| Standard Deviation of Benchmark | +16.94% | +21.42% | +20.74% | +18.95% | +14.69% | +14.79% | +16.49% | N/A | |

Remark