ファンドタイプ

株式ファンド

分配方針

1年に最大12回、ファンドの実現益の最低10%の配当を行います(詳細は要約目論見書でご確認ください)

設定日

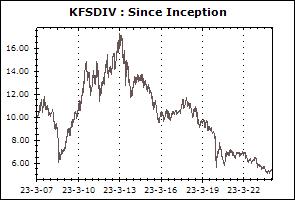

23 March 2007

投資方針

上場株式に本ファンドの純資産総額の平均80%以上投資いたします。投資する銘柄は安定した配当を行う企業を中心としますが、中小型株式にも投資いたします(詳細は要約目論見書でご確認ください)

ファンドマネージャー

Kavin Riensavapak, Peeti Pratipatpong

Asset Allocation

-

Download

Transaction Details

最低購入金額 (バーツ): 2,000

取引受付期間 : 各営業日の15時30分まで

解約資金受領日数: 解約日の3営業日後 (T+3)

Fund Redemption Period: 各営業日の15時30分まで

販売会社 : Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Jan 2026)

| Energy & Utilities | 21.27% |

| Banking | 16.16% |

| Property Development | 9.49% |

| Commerce | 7.17% |

| Food & Beverage | 6.84% |

Top Five Holdings (30 Jan 2026)

| Advanced Info Service Plc. | 5.29% |

| SCB X Plc. | 5.07% |

| PTT Plc. | 5.05% |

| MBK Plc. | 4.78% |

| Minor International Plc. | 3.28% |

Dividend Payment History (Last 10 times or last 5 years)

(Note : Paid 49 times, totalling 19.2000 Baht.)

(Note : Paid 49 times, totalling 19.2000 Baht.)

| 18 Nov 2025 | 0.2000 Bt./unit |

| 19 Nov 2024 | 0.2000 Bt./unit |

| 21 Feb 2023 | 0.2500 Bt./unit |

| 25 May 2022 | 0.1000 Bt./unit |

| 22 Feb 2022 | 0.1000 Bt./unit |

| 17 Nov 2021 | 0.1000 Bt./unit |

| 25 May 2021 | 0.2500 Bt./unit |

| 22 Feb 2021 | 0.2000 Bt./unit |

| 24 Aug 2020 | 0.5000 Bt./unit |

| 16 Aug 2019 | 0.2000 Bt./unit |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

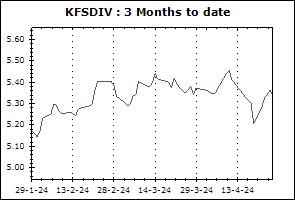

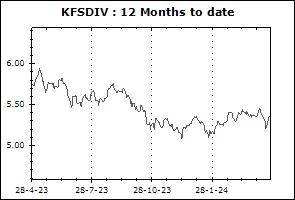

| Krungsri Dividend Stock Fund (KFSDIV) | +1.62% | +2.33% | +3.12% | -0.88% | -7.44% | -3.11% | -1.48% | +4.97% | 6,396 |

| Standard Deviation of Fund | +10.38% | +11.81% | +12.52% | +16.18% | +13.54% | +12.68% | +14.63% | +15.42% | |

| Krungsri Dividend Stock Fund 2-D (KFSDIV2-D) | +2.26% | +5.58% | +4.32% | +0.89% | -6.71% | -2.71% | N/A | -0.67% | 6 |

| Standard Deviation of Fund | +12.14% | +12.46% | +13.16% | +16.86% | +14.06% | +13.04% | N/A | +13.69% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | +1.61% | +2.24% | +3.17% | -0.70% | -7.24% | -3.00% | -1.37% | +3.99% | 489 |

| Standard Deviation of Fund | +10.21% | +11.68% | +12.29% | +16.03% | +13.42% | +12.58% | +14.57% | +17.69% | |

| Krungsri Value Stock Fund-I (KFVALUE-I) | +1.61% | +2.24% | +3.17% | -0.70% | -7.24% | N/A | N/A | -6.18% | 0 |

| Standard Deviation of Fund | +10.21% | +11.68% | +12.29% | +16.03% | +13.42% | N/A | N/A | +13.16% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | +2.46% | +2.99% | +3.54% | -1.49% | -8.32% | -1.87% | -1.32% | +6.93% | 781 |

| Standard Deviation of Fund | +11.05% | +12.33% | +13.39% | +17.07% | +14.12% | +12.92% | +15.13% | +21.67% | |

| Krungsri Star Equity Fund (KFSEQ) | +2.42% | +2.90% | +3.55% | -1.57% | -8.33% | -1.90% | -1.37% | +3.00% | 700 |

| Standard Deviation of Fund | +10.96% | +12.18% | +13.29% | +16.88% | +13.99% | +12.84% | +15.04% | +19.00% | |

| Krungsri Star Equity Fund 2-A (KFSEQ2-A) | +2.65% | +3.15% | +3.64% | -1.83% | -8.50% | -1.91% | N/A | -0.08% | 0 |

| Standard Deviation of Fund | +11.36% | +12.74% | +13.74% | +17.36% | +14.28% | +13.03% | N/A | +13.36% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | -2.11% | -3.36% | +1.42% | -14.10% | -10.87% | -0.19% | +2.34% | +4.78% | 311 |

| Standard Deviation of Fund | +14.27% | +15.11% | +16.25% | +19.10% | +15.22% | +14.12% | +16.20% | +19.17% | |

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +2.71% | +11.15% | +0.31% | +10.70% | +2.46% | +5.76% | +5.33% | +7.40% | 1,588 |

| Standard Deviation of Fund | +8.64% | +9.80% | +9.61% | +13.17% | +12.72% | +13.03% | +16.67% | +20.83% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | -2.05% | -3.29% | +1.41% | -14.24% | -11.02% | -0.31% | +2.35% | +4.89% | 708 |

| Standard Deviation of Fund | +14.49% | +15.24% | +16.53% | +19.24% | +15.39% | +14.27% | +16.27% | +19.53% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | +2.46% | +3.05% | +3.51% | -1.23% | -8.36% | -1.99% | N/A | -7.03% | 6 |

| Standard Deviation of Fund | +11.28% | +12.32% | +13.49% | +16.63% | +13.98% | +12.79% | N/A | +15.64% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | +2.46% | +3.05% | +3.52% | -1.23% | -8.36% | -1.99% | -1.25% | +4.99% | 376 |

| Standard Deviation of Fund | +11.28% | +12.32% | +13.49% | +16.63% | +13.99% | +12.79% | +15.00% | +19.01% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +3.12% | +8.45% | +5.64% | +5.94% | -2.58% | +0.77% | +3.16% | +4.79% | 2,161 |

| Standard Deviation of Fund | +14.41% | +14.51% | +15.28% | +19.78% | +15.47% | +14.16% | +16.56% | +20.42% | |

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | +0.02% | +0.32% | +1.93% | -7.67% | -15.49% | -3.96% | N/A | -1.41% | 121 |

| Standard Deviation of Fund | +12.15% | +12.83% | +15.40% | +17.89% | +15.04% | +14.44% | N/A | +15.78% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | +5.02% | +5.07% | +4.17% | +6.39% | -6.15% | -1.03% | N/A | -3.99% | 529 |

| Standard Deviation of Fund | +11.66% | +11.51% | +14.68% | +15.95% | +13.74% | +12.82% | N/A | +14.94% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | +5.02% | +5.07% | +4.17% | +6.39% | -6.15% | -1.03% | N/A | -5.98% | 483 |

| Standard Deviation of Fund | +11.66% | +11.51% | +14.69% | +15.95% | +13.74% | +12.82% | N/A | +15.32% | |

| Krungsri Thai Equity CG Fund (KFTHAICG) | +2.62% | +4.52% | +3.14% | +3.78% | -5.01% | +0.89% | N/A | -1.27% | 57 |

| Standard Deviation of Fund | +9.49% | +11.05% | +10.40% | +15.89% | +13.56% | +12.54% | N/A | +14.83% | |

| Krungsri SET100 Fund-A (KFS100-A) | +3.14% | +9.02% | +5.52% | +6.57% | -2.53% | +1.21% | N/A | +2.78% | 147 |

| Standard Deviation of Fund | +14.40% | +14.25% | +15.63% | +19.25% | +15.07% | +13.75% | N/A | +14.72% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.00% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.52% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +3.07% | +9.49% | +5.52% | +7.03% | N/A | N/A | N/A | +0.01% | 0 |

| Standard Deviation of Fund | +14.61% | +14.47% | +15.63% | +19.34% | N/A | N/A | N/A | +15.38% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.10% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.06% | N/A | N/A | N/A | N/A | |

| SET TRI | +1.56% | +8.28% | +5.24% | +5.39% | -4.08% | +1.25% | +3.47% | N/A | |

| Standard Deviation of Benchmark | +14.70% | +14.20% | +16.58% | +17.92% | +14.12% | +13.00% | +14.83% | N/A | |

| SET50 TRI | +3.91% | +9.95% | +5.62% | +7.71% | -0.51% | +2.39% | +3.81% | N/A | |

| Standard Deviation of Benchmark | +13.94% | +13.99% | +14.95% | +19.25% | +15.10% | +13.88% | +16.53% | N/A | |

| SET100 TRI | +3.48% | +9.60% | +5.37% | +7.09% | -2.30% | +1.39% | +3.40% | N/A | |

| Standard Deviation of Benchmark | +14.22% | +14.19% | +15.40% | +19.27% | +15.15% | +13.85% | +16.35% | N/A | |

| Krungsri SET50 Fund-A (KF-SET50-A) | +2.60% | +8.25% | +4.48% | +5.58% | -1.83% | +1.53% | N/A | +4.23% | 17 |

| Benchmark(4) | +2.92% | +8.91% | +4.65% | +6.69% | -0.82% | +2.20% | N/A | +5.18% | |

| Standard Deviation of Fund | +13.51% | +13.75% | +13.83% | +19.20% | +15.04% | +13.81% | N/A | +14.89% | |

| Standard Deviation of Benchmark | +13.56% | +13.81% | +14.02% | +19.19% | +15.07% | +13.86% | N/A | +14.92% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -1.10% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.92% | N/A | N/A | N/A | N/A | |

Remark