News/Announcement

Promotions/Fund Highlight

Our Top Picked SSF/ RMF for Your Tax Saving Options.

Special Promotion: Receive KFCASH-A units*

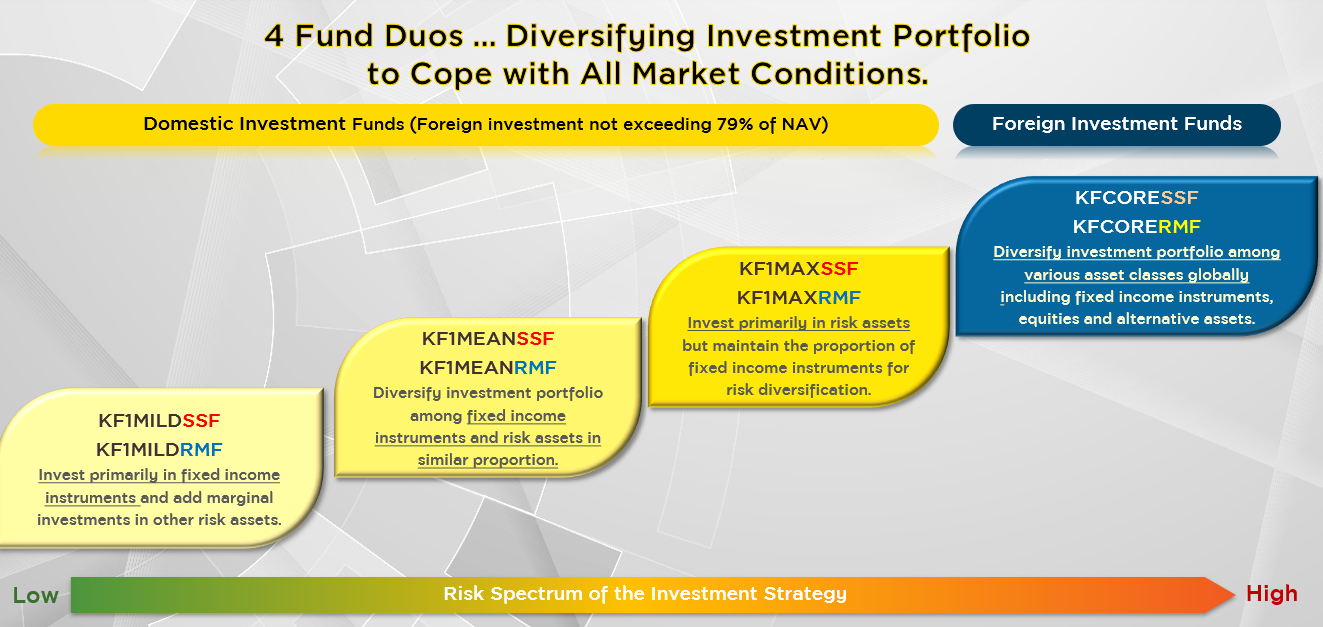

Amid the ongoing economic slowdown and market volatility, investors can now consider new four duos of Krungsri SSF/ RMF that flexibly diversify investment portfolio into multi asset types for your long-term investment with confidence.

Special promotion: Receive KFCASH-A units valued at 100 Baht* for every 50,000 Baht of participating SSF | RMF investments. (*Please study terms & conditions.)

Foster synergy within Krungsri Group with a focus on in-depth perspectives and proactive access to potential investment opportunities.

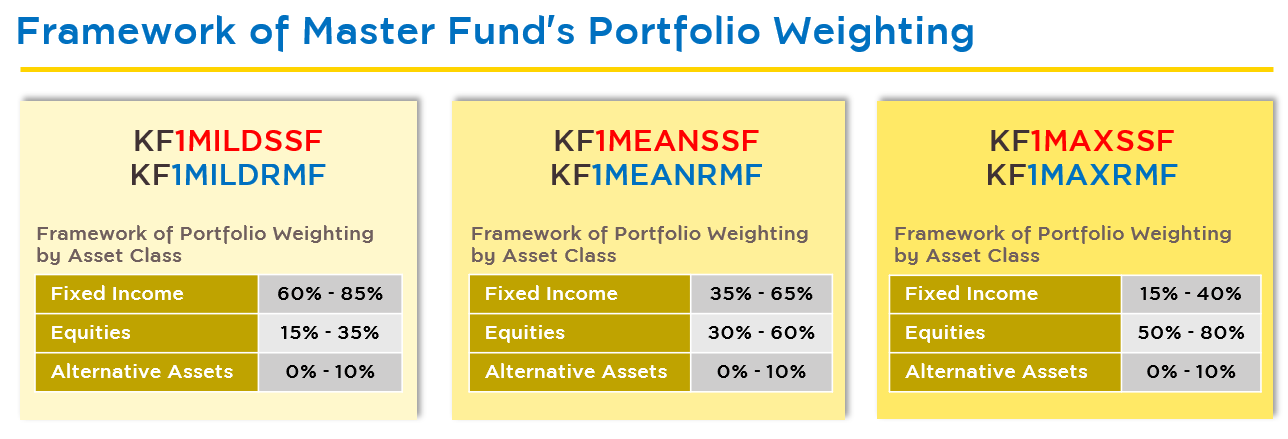

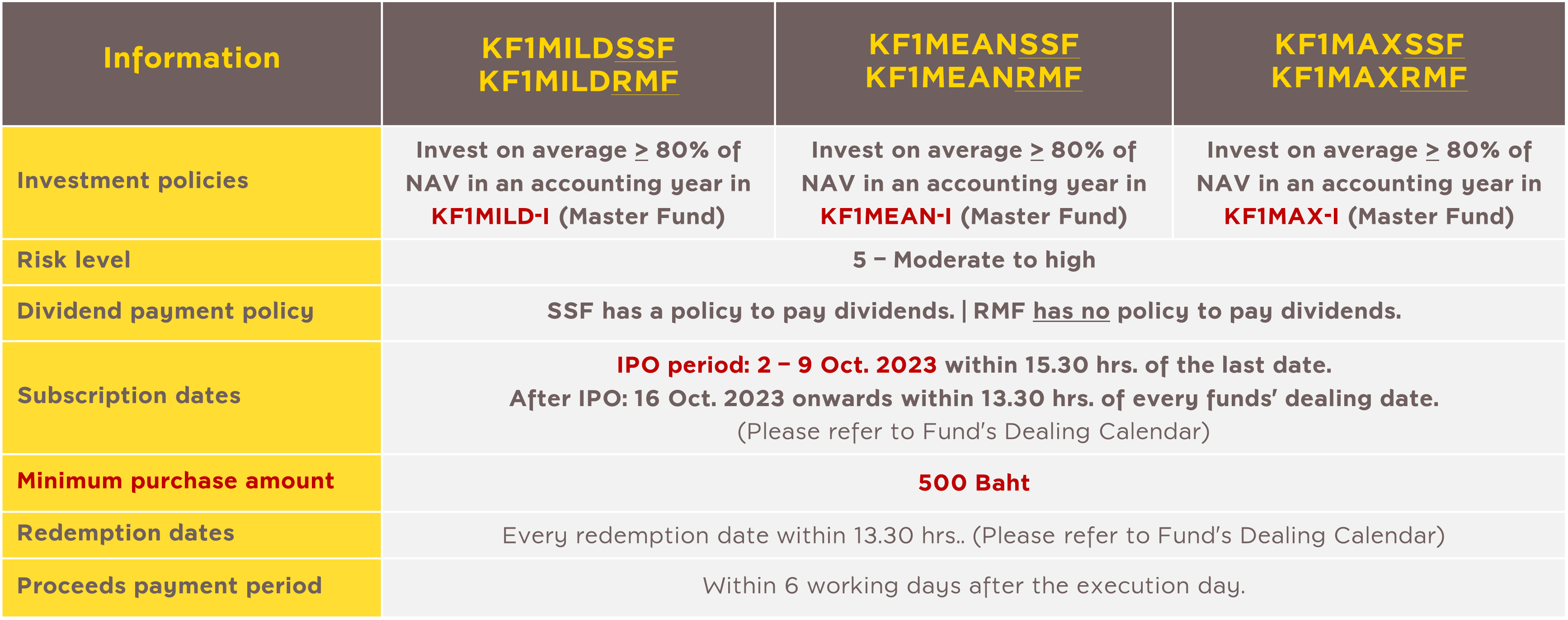

The funds invest in various types of assets through a series of selective mutual funds, ranging from fixed income, domestic equities, global equities, and alternative assets under Krungsri Group’s insights for the best combined portfolio strategies based on investing goals and risk levels being executed in three different funds tailored with active portfolio rebalancing to cope with all market conditions as follows:

- KF1MILDSSF/ RMF: Invest primarily in fixed income instruments and add marginal investments in other risk assets.

- KF1MEANSSF/ RMF: Diversify investment portfolio among fixed income instruments and risk assets in similar proportion.

- KF1MAXSSF/ RMF: Invest primarily in risk assets but maintain the proportion of fixed income instruments for risk diversification.

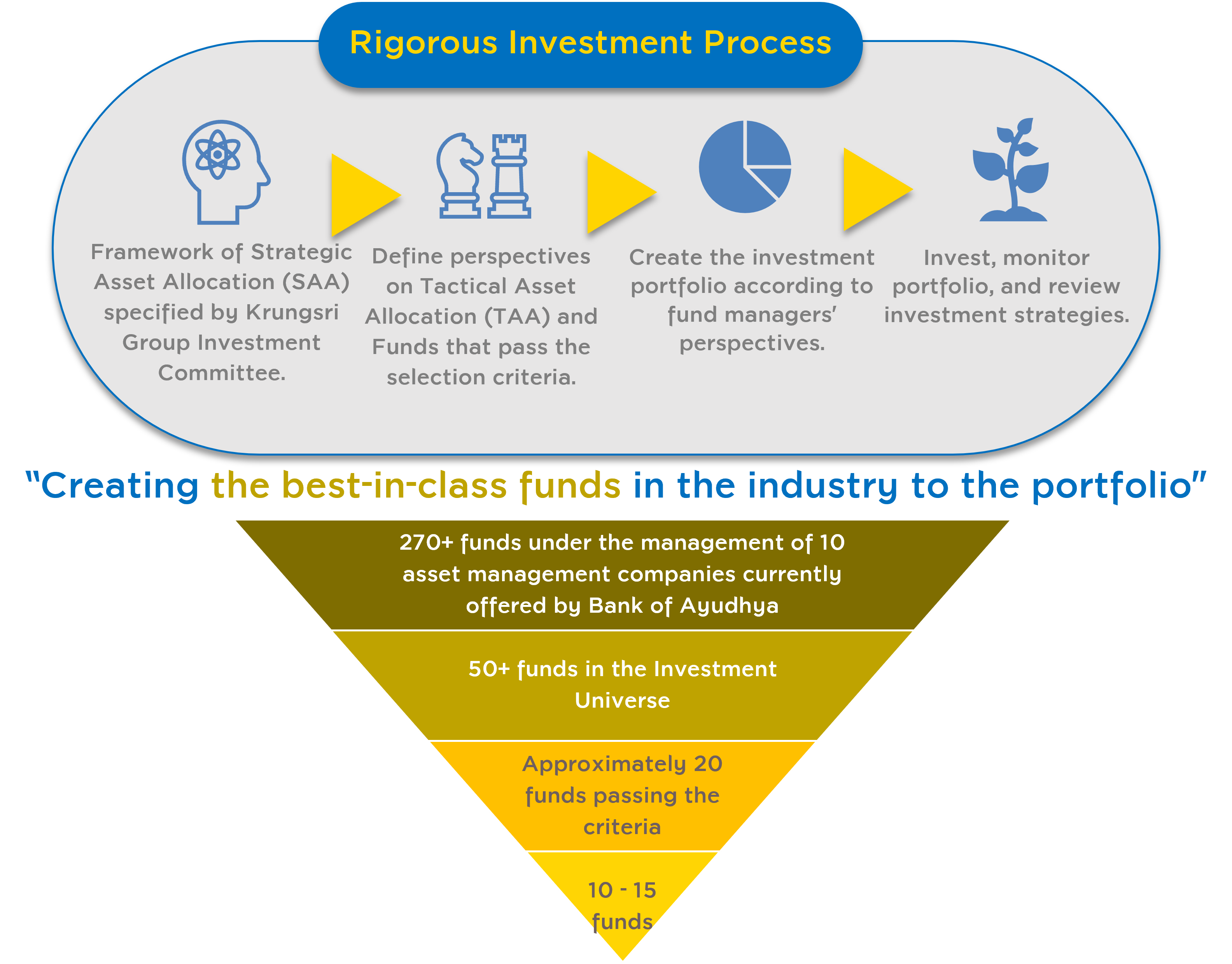

1. Accessing every opportunity through a wide range of investment strategies across global assets through the rigorous investment process selecting the leading mutual funds in each category:

- Money Market Funds to maintain the funds’ liquidity.

- Domestic and foreign equity funds to generate returns and growth potential.

- Domestic & foreign fixed income funds (short-medium-long-term) to enhance stability and the opportunity to generate excess returns.

- Alternative investment funds (Real estate/ Commodity products) to diversify risks and increase investment alternatives.

2. Actively rebalancing portfolio to ensure consistency with rapidly changing market conditions.

Source: Krungsri Asset Management as of Aug 2023. Remark: The above information is just an investment framework which may change and differ from the actual investment portfolio.

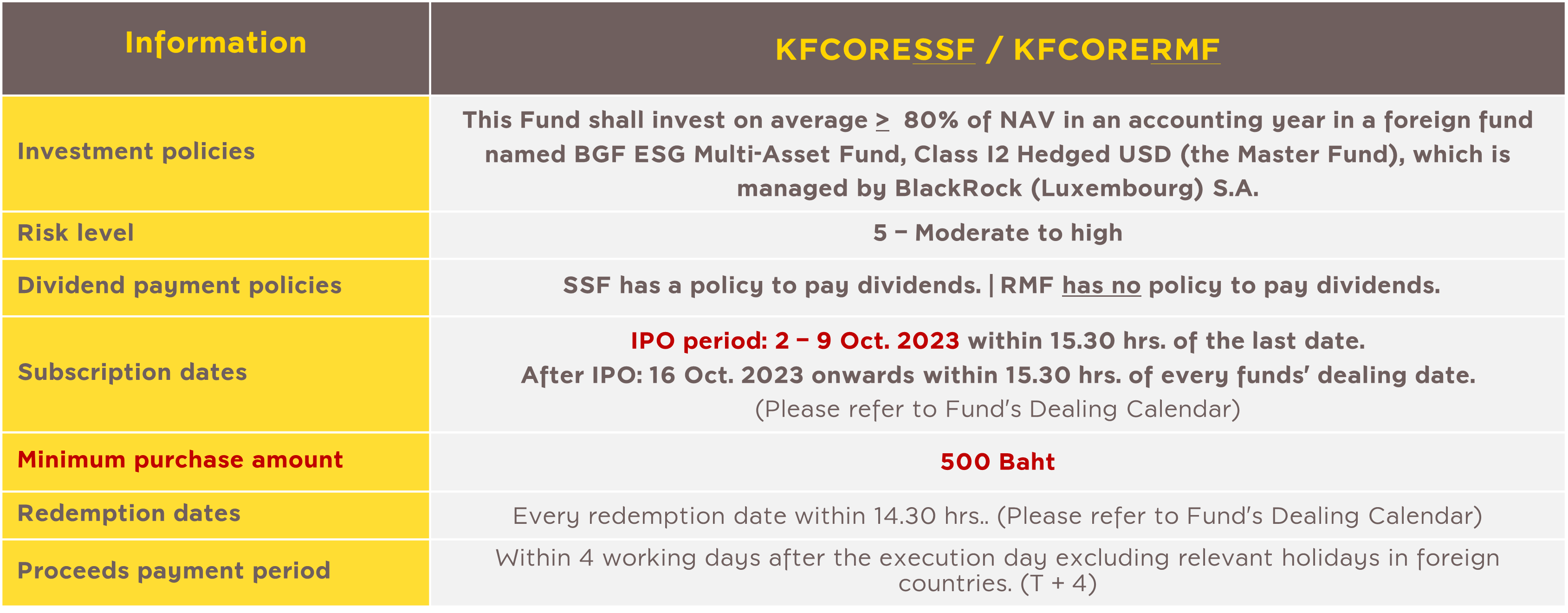

Krungsri Global Core Allocation Fund SSF | RMF

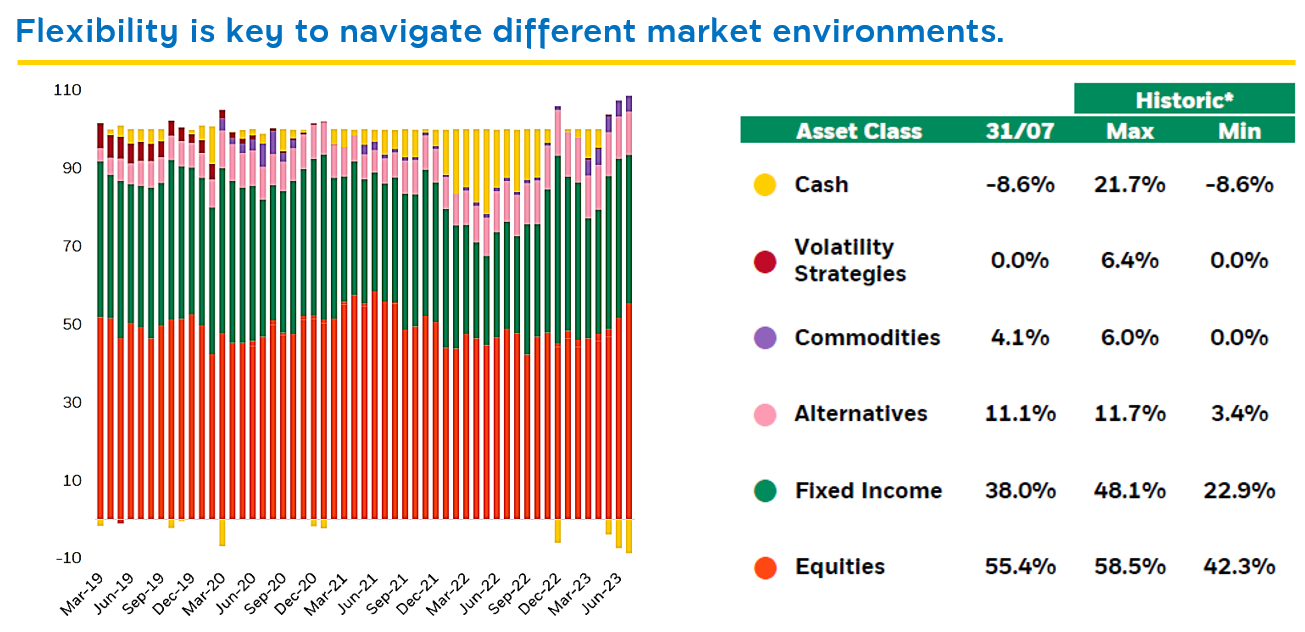

Investing through BGF ESG Multi-Asset Fund, a Morningstar 5-star rated fund* managed by BlackRock, the global fund management company, the Fund has diversified its investment portfolio into a series of global assets, ranging from developed market equities, private sector fixed income, and alternative assets tailored with actively managed flexible portfolio to create opportunities for investments and cope with obstacles amid diverse market conditions together with a strong focus on ESG factors to promote sustainable performance and better future for our planet.

Source: BlackRock as of 31 Jul 2023. For illustrative purpose only. | The statistics of maximum and minimum portfolio weightings are for the period between 19 Jan 2023 and 31 Jul 2023. *The information of Morningstar Rating is from BlackRock as of 31 Jul 2023 and has no connection to the rating of AIMC in any respect.

Asset Allocation Strategy for Major Assets

- Equities: Flexible Asset Allocation/ Focus on Investing in Quality Stocks/ Thematic Asset Allocation Strategy.

- Fixed Income Instruments: Invest with Precautions in the Short-term/ Look for Investment Opportunities in the Long-term/ Increase Portfolio Weights for Investments in Emerging Markets.

- Alternative Assets: Increase Portfolio Weights of Investments related to ESG Themes/ Tactical Investing in Precious Metals/ Use tactical investment approach in volatility strategies.

Source: BlackRock as of 31 Jul 2023. For illustrative purposes only and subject to change in the future. *ESG Rating is based on the information of MSCI.

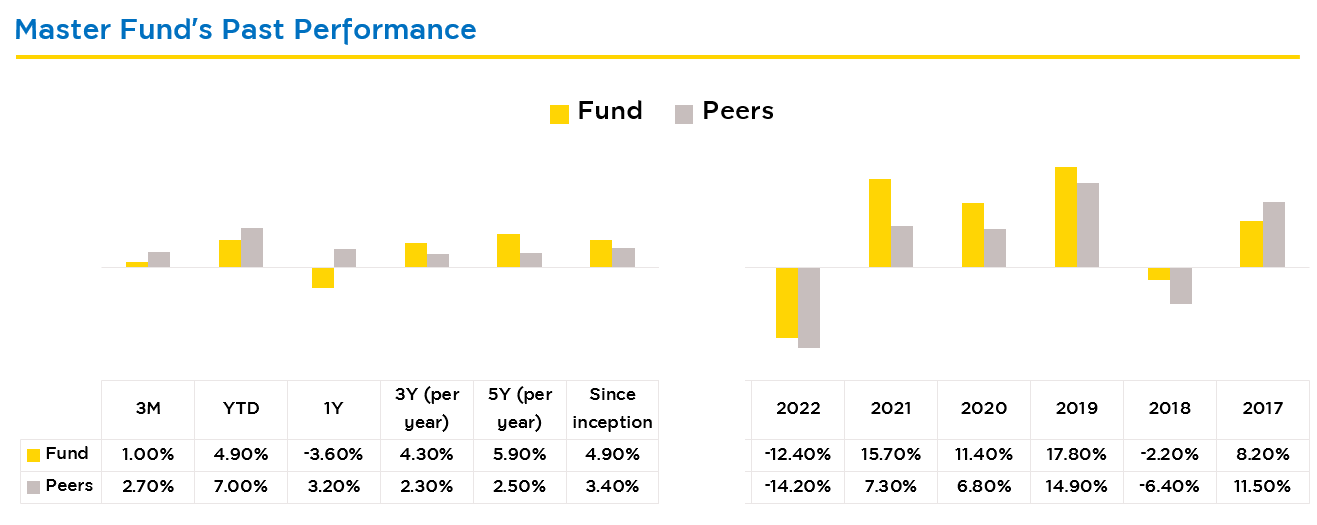

Outstanding Long-term Performance of the Master Fund

Sources: Morningstar, BlackRock; as of 30 Jul 2023. The performance displayed is that of A2 accumulation share class while KFCORESSF and KFCORERMF shall invest in I2 Hedged USD share class. However, both share classes have similar investment policies. Performance of the Master Fund is calculated from the NAV prices deducted by the management fee of 1.2% p.a. in terms of euro. Prior to 25 March 2019, this Fund was known as BGF Flexible Multi-Asset Fund. Peer’s performance is based on the average returns in terms of USD of the funds under the category of Moderate Allocation-Global sector. The performance displayed is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC. Rating by Morningstar has no connection to the AIMC in any respect.Outstanding Long-term Performance of the Master Fund

All four fund duos have a minimum purchase at 500 Baht only and can be purchased via Krungsri’s participating credit cards.

(Investment units from subscription will not join the credit card’s promotion and reward points accumulation.)

And now you can redeem your Krungsri Point and Krungsri First Choice Reward to invest in any SSF/ RMF through @ccess Mobile Application and @ccess Online Service on a condition that 1,000 points = 100 Baht of fund units.

For more information or a request for full prospectus at Krungsri Asset Management Company Limited

Tel. 0 2657 5757 or Bank of Ayudhya PCL. / Selling Agents.

- SSF is the fund to promote savings. | RMF is the fund promoting long-term investment for retirement. Investors will not be eligible for tax benefits in an absence of compliance with investment conditions. | Investors should understand fund features, returns, risks and study tax benefits in the investment manual before making an investment decision. | Past performance does not guarantee the future’s result.

- This document is prepared based on the information obtained from reliable sources at the time of presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to make changes to all information without prior notice.

- All the funds are hedged against foreign exchange risk at the discretion of the fund manager and is therefore subject to exchange rate risk which may cause investors to experience foreign exchange losses or gains/ or receive lower return than the amount initially invested.

Krungsri The One SSF | RMF