Promotions/Fund Highlight

Krungsri Global Millennials Equity Fund (KFGMIL)

Opportunity for your portfolio to ride the strongest currents of Millennials that have changed the global consumption and become the market’s Top Spenders through an investment in Goldman Sachs Global Millennials Equity Portfolio, Morningstar 5-Star rated fund* and an early thought leader in Millennial-themed investing.

*Source: Goldman Sachs Asset Management as of 30 Jun 2021. The above awards and rankings are not relevant to the AIMC.Who are the Millennials?

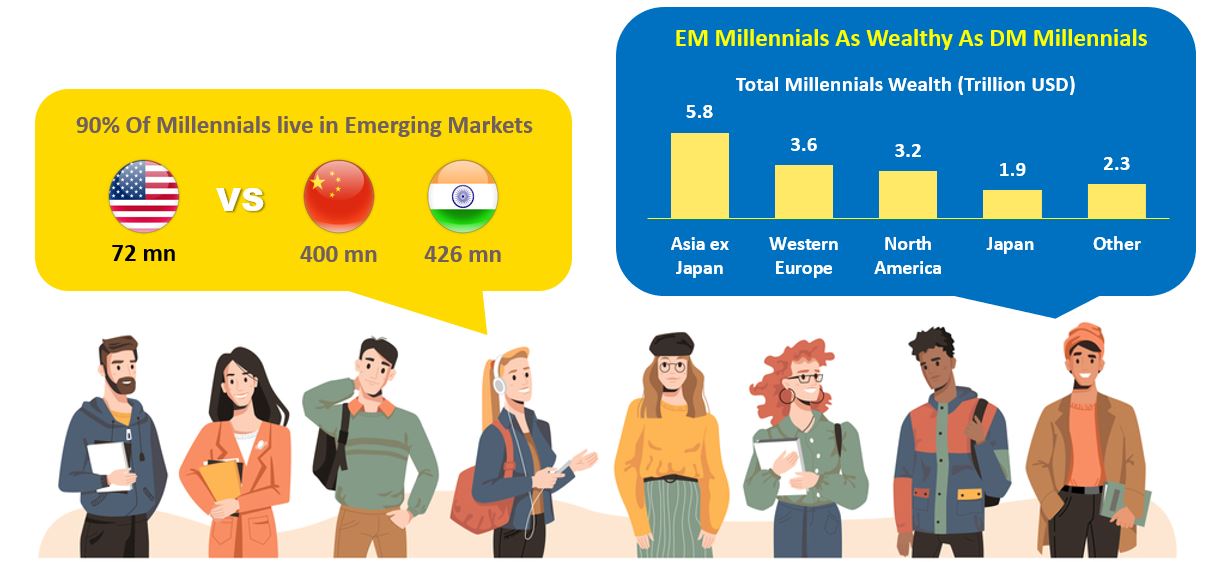

- People who were born roughly between 1980 - 1999, meaning anyone between the ages of 22 - 41 in 2021.

- The world's most powerful consumers according to around 2.3bn worldwide population1 and their strong purchase power together with growing income base (1 Source: World Population Survey, United Nations as of 2019 )

- Trend setters affecting habits adaptation in other generations

- Their different spending habits and attitude towards life are driving disruption for many businesses.

-

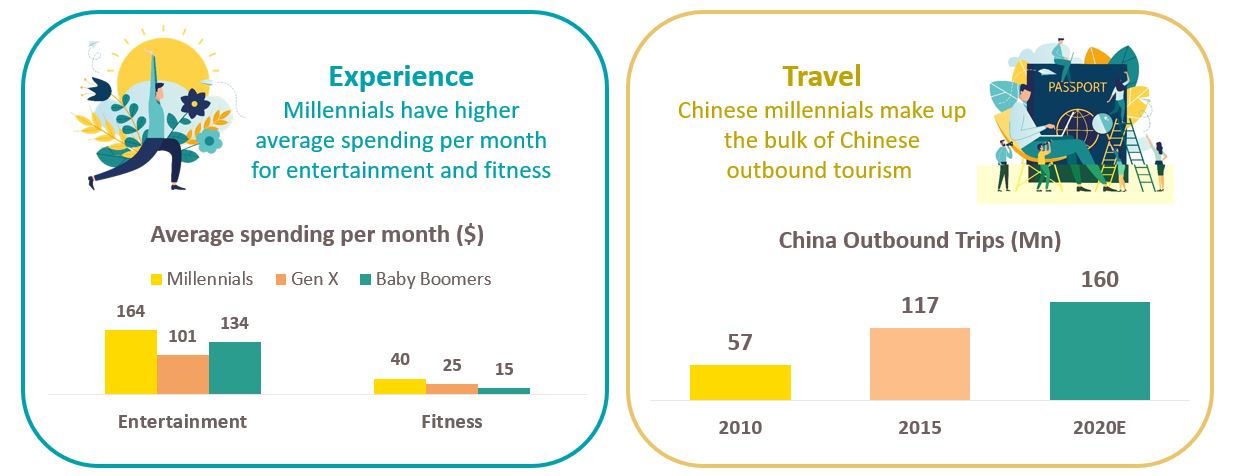

Based on their changing values according to ages, Millennials are creating a long term and secular growth opportunities for investors.

Investment strategies of the master fund: Goldman Sachs Global Millennials Equity Portfolio

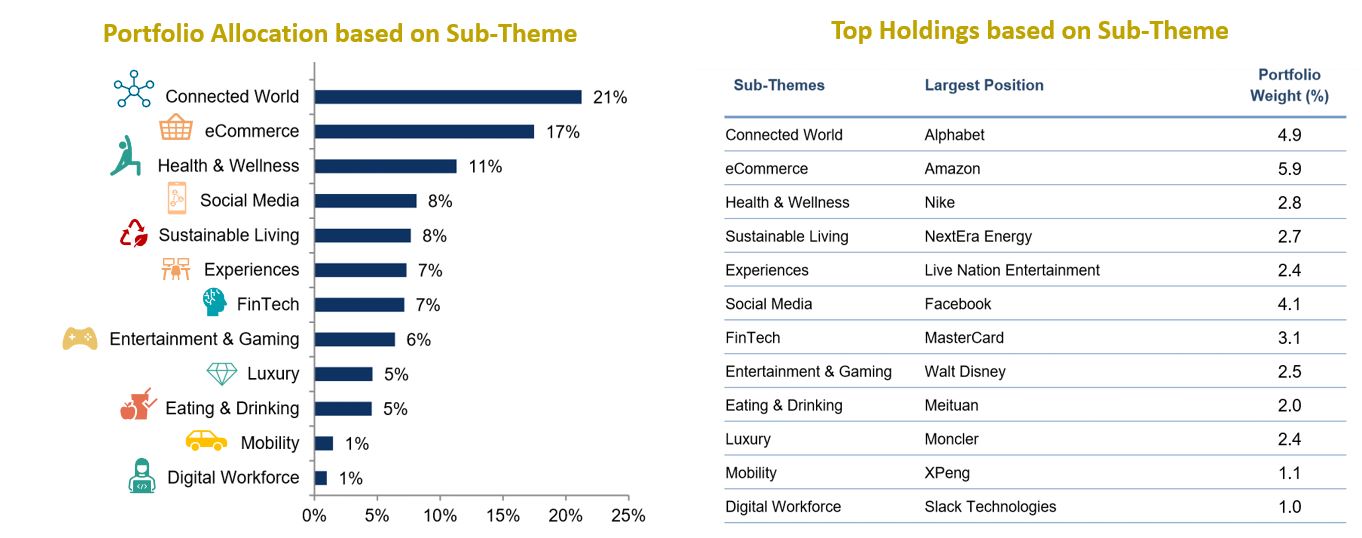

- Capturing a wide range of opportunities from Millennials whose lives were driven by tech-enabled consumption and lifestyle & values

- Finding quality companies at an attractive price aligned to the Millennial Effect to maximize risk-adjusted returns such as Internet of things connecting world, E-Commerce, healthy living, travel, and entertainment, etc.

Source: Goldman Sachs Asset Management, FactSet, as of 30-Jun-2021. The theme chart might not total to 100% due to weight of cash in the portfolio. For illustrative purposes only. Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio's investments. Future investments may or may not be profitable.

- Investing in differentiated ideas and less efficient areas of the market with a focus on long-term winners across global regions and sectors through dynamic allocations

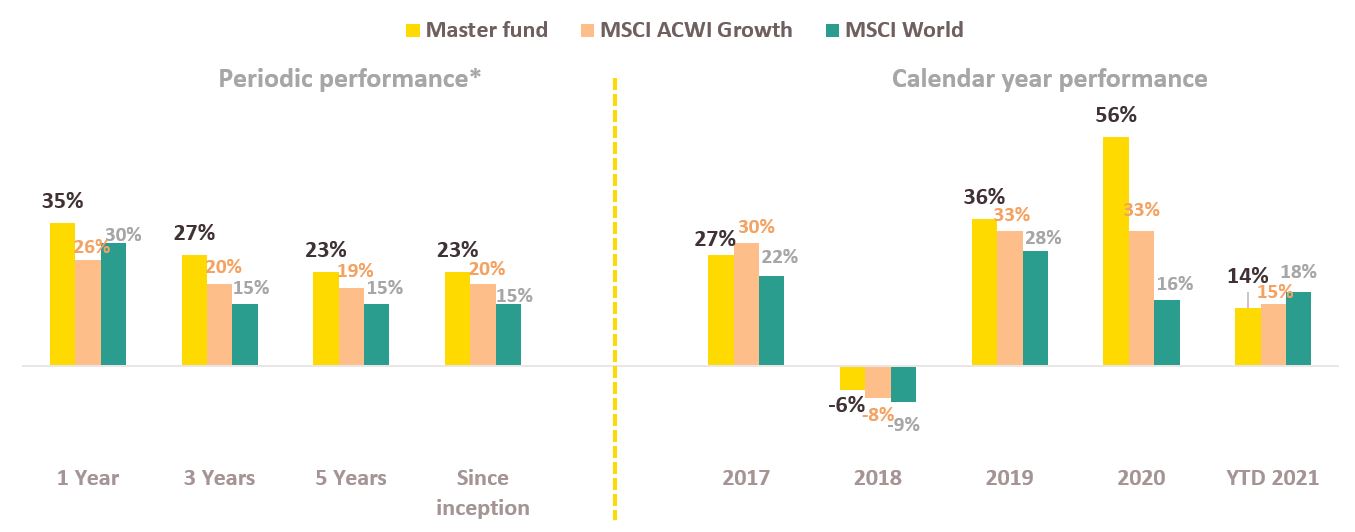

Master Fund Performance

Source: Goldman Sachs Asset Management as of 31 Aug 2021. Inception date: 01 Feb 2016. The returns shown above are for the Institutional Accumulation share class (net of fees in USD). MSCI ACWI Growth is the official benchmark for the portfolio. MSCI World returns have been presented only for comparison purposes. All periods greater than one year are annualized. This shows the performance of the master fund, so it is not complied to AIMC’s standard. Numbers are rounding.

Source: Goldman Sachs Asset Management as of 31 Aug 2021. Inception date: 01 Feb 2016. The returns shown above are for the Institutional Accumulation share class (net of fees in USD). MSCI ACWI Growth is the official benchmark for the portfolio. MSCI World returns have been presented only for comparison purposes. All periods greater than one year are annualized. This shows the performance of the master fund, so it is not complied to AIMC’s standard. Numbers are rounding. About KFGMIL

- Krungsri Global Millennials Equity Fund-A (KFGMIL-A)

- Krungsri Global Millennials Equity Fund-I (KFGMIL-I)

| Investment policy | Invest in the master fund named Goldman Sachs Global Millennials Equity Portfolio, Class I Shares (Acc.), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has the policy to invest in equity which provide exposure to companies that are domiciled anywhere in the world which are beneficiaries from the behavior of the Millennials generation, defined as individuals born between 1980 and 1999. |

| Risk level | 6 – High risk | Fully hedge against foreign exchange rate risk |

| Dividend policy | Both share classes have no dividend payment policy. |

| Dealing date | Daily (Please refer to Fund’s Non-Dealing Calendar) |

| Minimum investment amount | 500 Baht |

| IPO | 20 - 27 October 2021 (After IPO: 2 November 2021) |

Every 100,000 Baht investment amount in

Krungsri Global Millennials Equity Fund-A (KFGMIL-A)

during 20 - 27 October 2021

receive investment units of KFGMIL-A valued at 100 Baht

Terms & conditions

- This promotion is applicable to the NET investment amount in Krungsri Global Millennials Equity Fund-A (KFGMIL-A) during IPO period only. Net investment amount means purchase or switching in value less redemption or switching out value. Investment amount in Krungsri Global Millennials Equity Fund-I (KFGMIL-I) is not eligible for this promotion.

- Investors must hold units until 27 February 2022. The outstanding investment amount is based on the unit balance of the fund as of 27 October 2021. However, customers will not be eligible to join this promotion if they redeem and/or switch out investment units of the fund during 28 October 2021 – 27 February 2022 regardless of the amount of redemption.

- The Management Company will calculate the total investment amount in KFGMIL-A based on each investor’s unitholder account number. In case an investor has more than 1 account, the Management Company will not consolidate the total investment amount from all accounts for this promotion.

- The total amount of investment amount, which is less than 100,000 Baht, will not be counted for the promotion.

- The Management Company will allocate the promotion units of KGMIL-A to the eligible investors within 31 March 2022. The units of KFGMIL-A will be calculated at its NAV price on the allocation date. Front-end fee is waived for the units of KFGMIL-A received from this promotion.

- Subscription and switch-in order through unit-linked life insurance and provident fund are not eligible for this promotion.

- Other terms and conditions may apply for the transaction executed through an omnibus account. Investor should contact your representative selling agents for further information.

- Transferring units, either to the same or different investor, is not eligible for this promotion.

- The Management Company reserves the right to offer other equivalent reward as appropriate or change terms & conditions of this promotion without prior notice.

- This promotion expense is charged to the Management Company, not the fund.