Riding out of Volatility...Seeking a Source of High Quality Yield

On 11 October 2019, Krungsri Asset Management Plc. has organized a seminar on “Riding out of Volatility, Seeking a Source of High Quality Yield,” pointing out a new alternative for higher returns amid the economic fluctuations by investing in preferred securities -- hybrid securities providing higher returns than those given by fixed income securities, while having low risks as preferred securities are launched by quality issuers. Therefore, Krungsri Preferred Mix Hedged FX Fund – Accumulation Class (KFPREFER-A) will be launched. KFPREFER-A will invest in the global master fund- Manulife Global Fund - Preferred Securities Income Fund which invests in this type of securities. Fund’s IPO period is set during 21 - 30 October 2019.

Ms. Siriporn Sinacharoen, Managing Director, Krungsri Asset Management, mentioned about the current investment situation, saying that it is relatively difficult this year from global economic slowdowns as a result of the US-China trade war. Investing in stocks carries high volatility, while fixed income investment provides relatively low returns. The 10-year US government bond yield is less than 1.5%. Therefore, Krungsri Asset Management is seeking new investment alternatives with higher returns and lower risks and volatility for investors.

At the seminar, Mr. Dylan Ngai, product specialist in fixed income from Manulife Global Fund - Preferred Securities Income Fund, and Mr. Kiattisak Preecha-anusorn, Krungsri Asset Management’s Vice President for Alternative Investment Department are invited to provide information involving funds investing in preferred securities, their attractiveness, investment opportunities and risks along with, the master fund’s details regarding its management strategy, asset selection, investment portfolio, past performance and expected returns.

Mr. Kiattisak explained that preferred securities are hybrid securities. In Thailand, this type of investment is known as subordinate debentures or subordinate debt securities which have potentials for good returns. Issuers are mostly strong companies. However, preferred securities are similar to general debt securities. Investors will have opportunity to receive returns in the form of fixed interest rates from issuers, but fixed interest rates are usually higher than general interest rates due to the hierarchy of capital return structure of this asset class.

In regard to reasons of issuing this type of securities, Mr. Dylan explained that the regulations were launched after the 2008 crisis when financial institutions went bankrupt with widespread impacts. The authorities have introduced regulations for companies to prepare for some reserves. However, equity issuance would bring dilution effect which would cause lower returns to shareholders and investors’ concerns over business operations. Thus, companies have issued preferred securities to mobilize fund instead. Even though issuing such debentures carries interest payment to investors, the costs remain lower than issuance of common shares. Importantly, debentures have high liquidity with higher flexibility for issuing companies. Their credit rankings remain good and issuing companies can call their debentures at any time. One more point is that there is high demand from investors who search for higher yields as now interest rates are low.

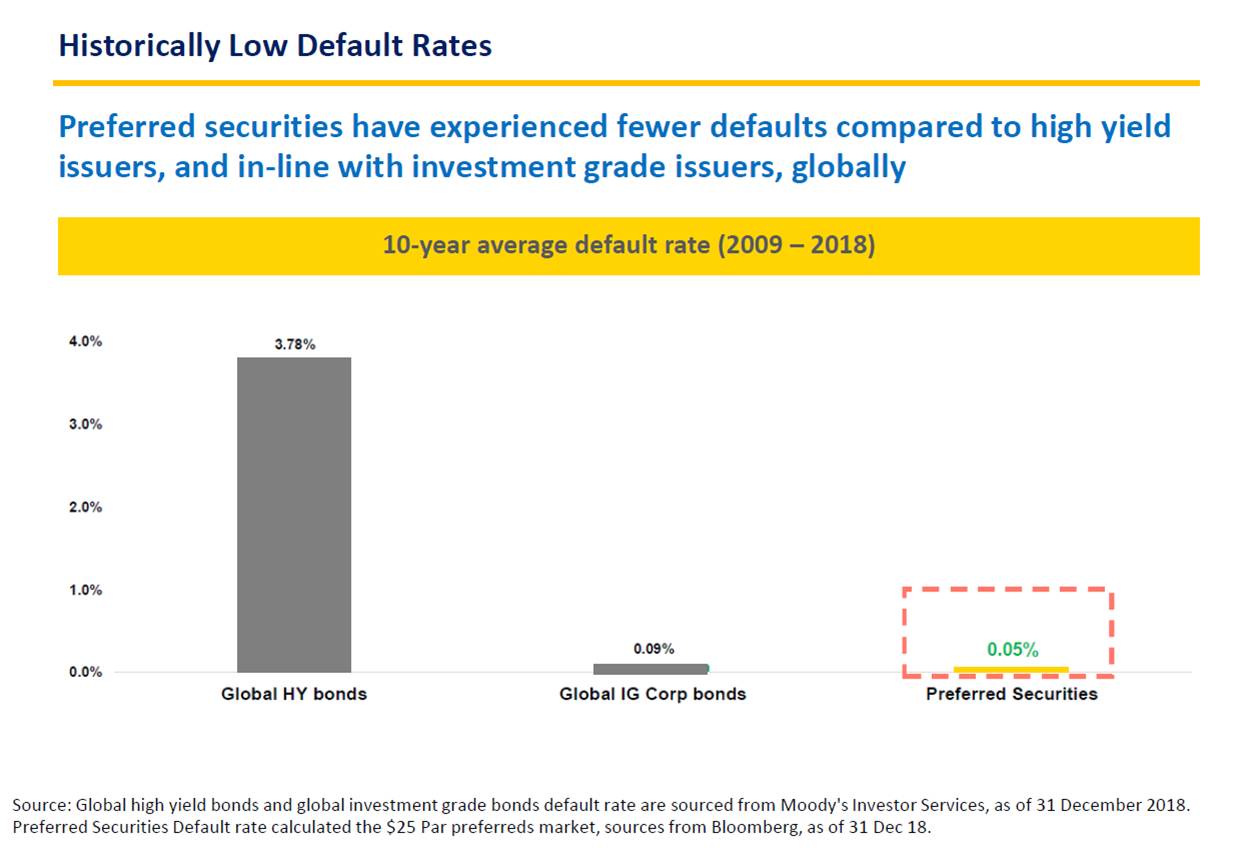

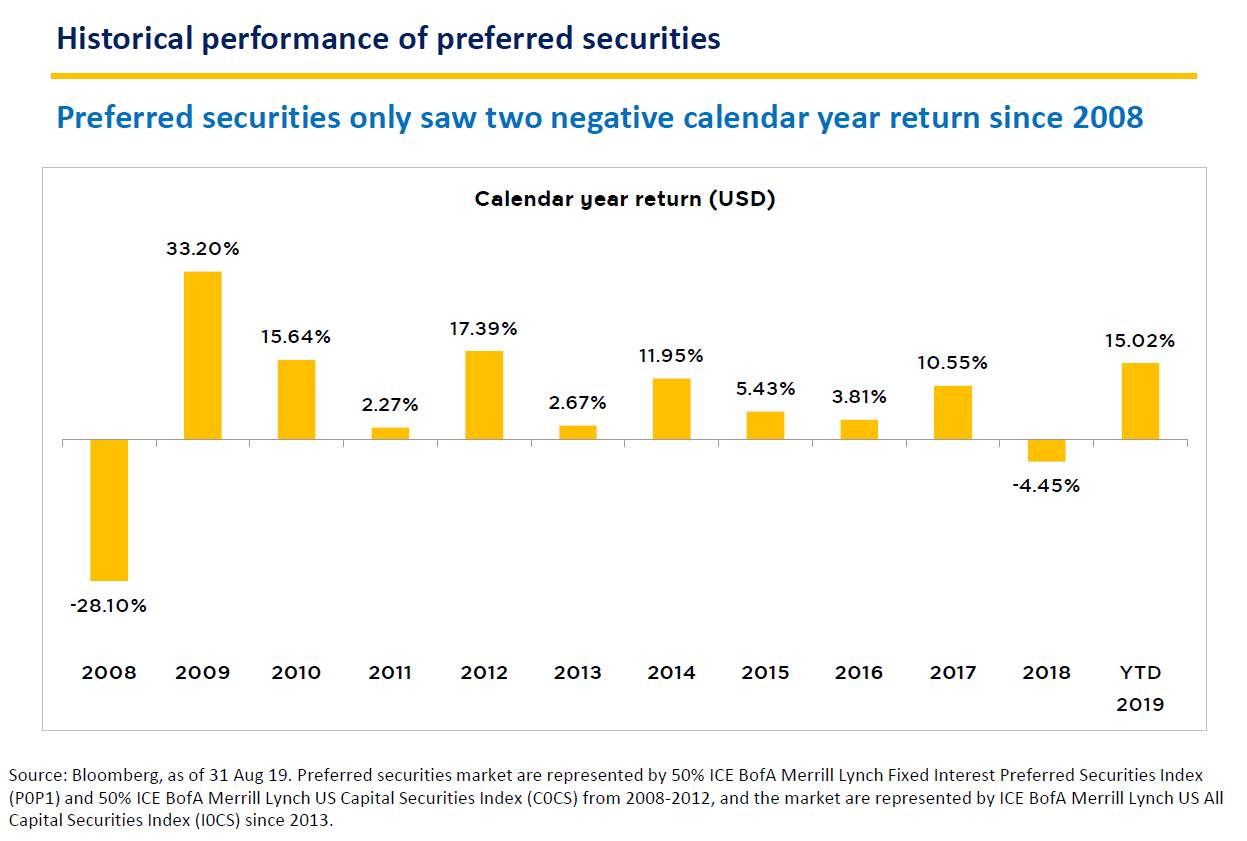

Mr. Dylan added that preferred securities exist for a long time since early 1900 with stability. The main market of preferred securities is the United States sharing about two-thirds of total market valued at 900,000 million US dollar, slightly lower than US high yield bond market. In terms of the past five-year returns, preferred securities generate higher returns than an average of fixed income market but shows lower volatility. In the meantime, default rate was relatively very low at only 0.05% in 10 years during 2008-2018, while global high yield bonds’ default rate was 3.78%. And in 10 years, there were only twice for preferred securities’ negative returns. One was in 2008 when the big crisis adversely affected globally and in 2018 when found a negative return of minus 4.45%.

In 2019, preferred securities generate returns at 15.02% and this trend is expected to continue if interest rates remain low, while market demand for preferred securities will rise and this type of fund will be an attractive alternative for investment.

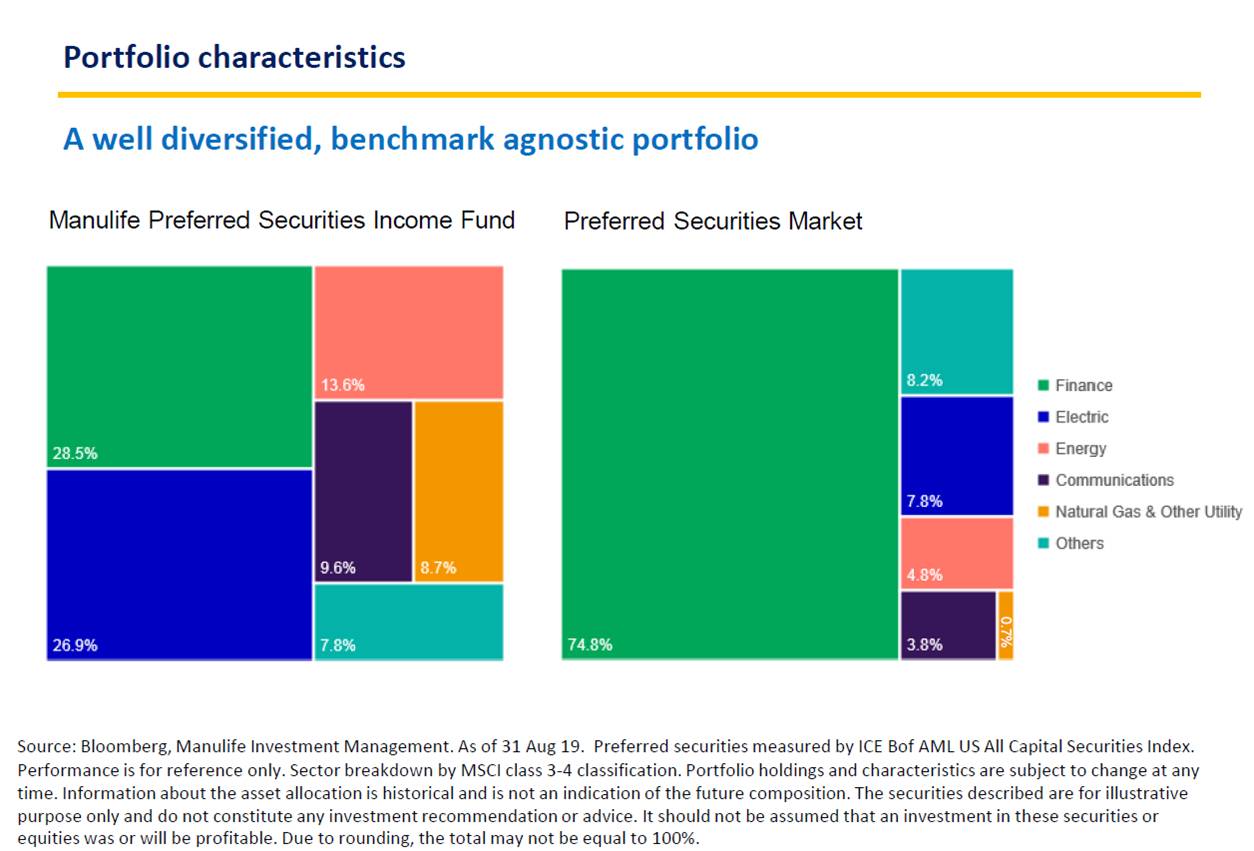

Mr. Kiattisak said that Krungsri Asset Management has selected Manulife Global Fund - Preferred Securities as the master fund which is the global fund having expertise in preferred securities investment. Presently, the master fund has investment value of over 4.6 billion US dollar (Source : Manulife Investment Management as of 31 Dec. 2018). The master fund currently has 74 securities in its portfolio. These high-quality assets are in several industries with average credit ratings of no less than BBB- and the master fund reviews and analyzes prudently these assets and has confidence that they will provide good returns. Industries the master fund relatively highly weighs on are utilities, insurance, banks, energy and telecommunications due to their recurring income. Industries the fund gives less investment weight are financial group. The master fund gives overweight on the United States and Canada due to their largest market size of total developed markets. The remaining investment is in other developed markets in the Europe and Japan. (Source : Manulife Investment Management as of 31 Aug. 2019)

The master fund employs active strategy, having teams of analysts specializing in investing in preferred securities and searching for companies with sound fundamentals, stable income and good credit ratings despite the master fund’s one is at BBB-. However, credit rating of issuer companies is BBB+. The master fund also reviews the overall economic situations. If there is any changes which could affect assets to have risks, they will consider selling such risky assets to protect investment. This strategy makes the master fund to bring higher returns than interest rates. (Source : Manulife Investment Management as of 31 Aug. 2019)

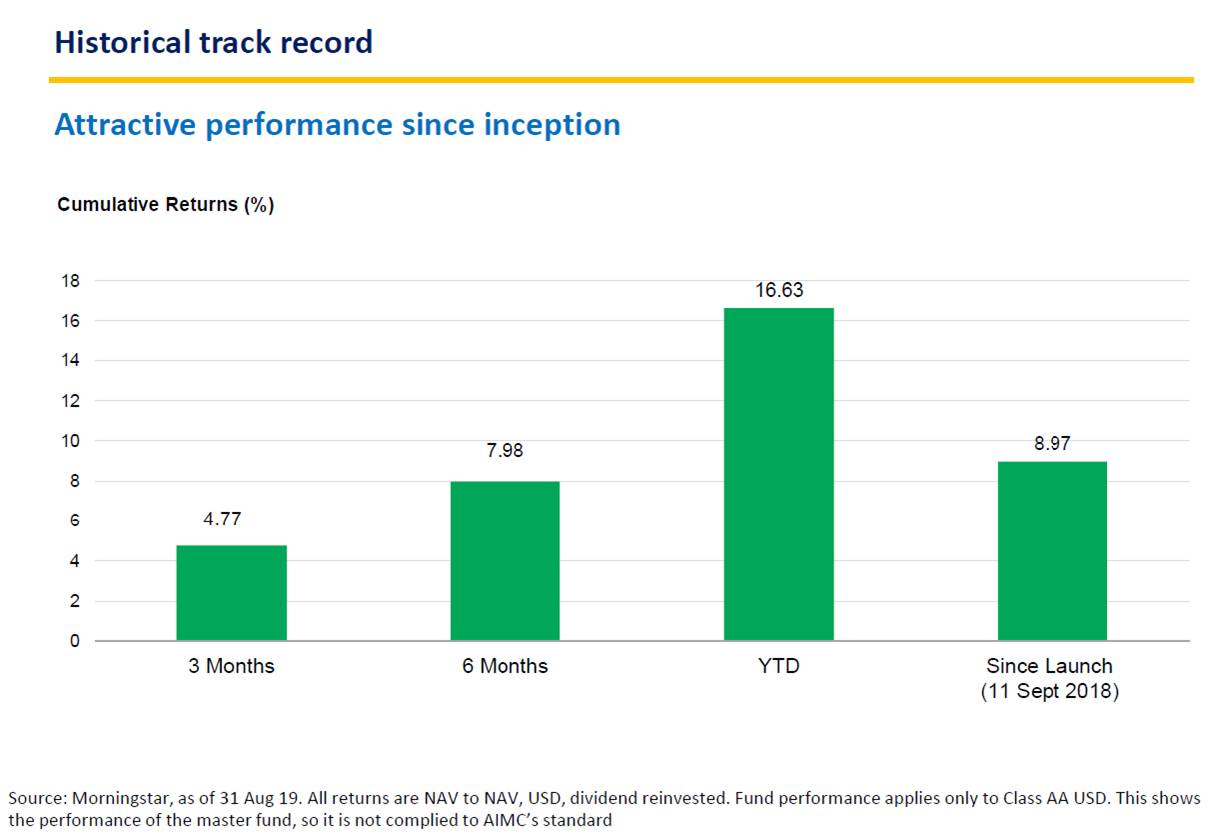

The master fund was incepted in September 2018 and its return was as high as nearly 9% since its inception. This year-to-date return is 16.63% from correct investment expectations which has led to profit margins from investment. The master fund expects this year's return to lower to the proper level at 6%, higher than interest rates and return rates of general fixed income funds.

Mr. Kiattisak added that preferred securities can be used as a complement to investors’ debt securities portfolios to raise returns and lessen investment volatility.

Krungsri Asset Management makes an initial public offering of KFPREFER-A during 21 - 30 October 2019. The promotion includes reduction of the front-end fee from 1% to 0.75% for a subscription of 30 million Baht onwards. The fund hedges against foreign exchange risks at 100%.

Disclaimer

-

KFPREFER-A invests in the master Fund named Manulife Global Fund - Preferred Securities Income Fund (Class AA (USD)) (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has investment policy to invest in preferred securities listed or traded on any Regulated Market in the world, which include preferred stocks (including convertible preferred stocks) and subordinated debt securities. Therefore, the Fund may have risks from economic and/or political and/or social changes in the country where the master fund invested in.

-

KFPREFER-A has risk level at 5 – moderate to high risk.

-

The fund may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

-

The funds will enter into a forward contract to fully hedge against the exchange rate risk, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

-

The fund and/or master fund may invest in or make available a forward contract to enhance efficiency in investment management. This means the fund may contain higher risks than other funds and therefore the fund is suitable for investors who prefer higher return with higher risk tolerance than general investors. Investors should make investment only when they understand the risks of the contract by considering their investment experience, investment objectives and financial status.

-

Before remitting in money, please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results. This document is not the fund’s prospectus, produced for general information only. Shall you have any queries, please contact the Management Company.

For more details or to request for the Fund Prospectus, please contact:

Krungsri Asset Management Co., Ltd.

Tel: 02-657-5757 | E-mail: krungsriasset.mktg@krungsri.com | Website: www.krungsriasset.com

Or any branch of Bank of Ayudhya or selling agents

Back