KSAM organized a special seminar to introduce a new fund, enticing Thai investors to co-own real estate with high growth potential across the world through KF-GPROPD. In addition, the fund company invited an expert from Standard Life Investment Global SICAV – Global REIT Focus Fund, the master fund of KF-GPROPD.

Ms. Siriporn Sinacharoen, Managing Director of Krungsri Asset Management Public Company Limited who presided over the seminar, said the Company is determined to find new investment opportunities for Thai investors and considers that REIT (Real Estate Investment Trust) will be an asset class that is suitable for the present global economic situation, which is waiting to recover from an economic downturn.

Ms. Siriporn Sinacharoen, Managing Director of Krungsri Asset Management Public Company Limited who presided over the seminar, said the Company is determined to find new investment opportunities for Thai investors and considers that REIT (Real Estate Investment Trust) will be an asset class that is suitable for the present global economic situation, which is waiting to recover from an economic downturn.

Mr. Kiattisak Preecha-anusorn, Assistant Vice President, Alternative Investment Department of Krungsri Asset Management, cited the differences between REIT and property fund that Thai investors are more used to that REIT has many advantages that 1) it does not limit only to the real estate investments in Thailand but can also invest in the region with good growth potential and diversify investment into other types of property; 2) can generate returns from both dividend and capital gain; and 3) Thai property fund is currently overpriced causing higher investment risks, meanwhile, the prices of global REIT worldwide are offered with 7% discount from the fundamental value, so it has more opportunities to get better return with lower investment risks.

Mr. Kiattisak Preecha-anusorn, Assistant Vice President, Alternative Investment Department of Krungsri Asset Management, cited the differences between REIT and property fund that Thai investors are more used to that REIT has many advantages that 1) it does not limit only to the real estate investments in Thailand but can also invest in the region with good growth potential and diversify investment into other types of property; 2) can generate returns from both dividend and capital gain; and 3) Thai property fund is currently overpriced causing higher investment risks, meanwhile, the prices of global REIT worldwide are offered with 7% discount from the fundamental value, so it has more opportunities to get better return with lower investment risks.

REIT Market View

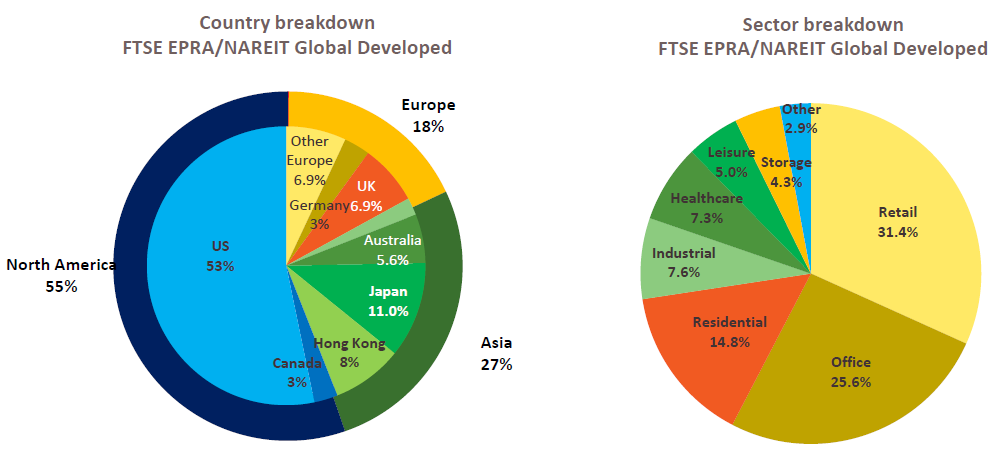

Mr. Luke Powell, Investment Director, Real Estate, Standard Life Investments, elaborated that REIT is an important asset class, especially in developed markets such as the United States, Europe and Asia-Pacific. The advantages of REIT are that investors can own various kinds of property, even some ‘iconic properties’ in the world. Standard Life Investment is a global fund house with long-term experience and expertise. At present, it is one of Top-20 asset management companies in the world. The Fund has two different approaches in selecting properties: Top-down approach which is to do research and analyses of real estate trends in every region throughout the world and identify the right opportunity and timing and to invest; and ‘Bottom-up’ approach by looking for companies that are changing themselves in accordance with the positive economic changes that will lead to growth. Standard Life Investments also adopts a dynamic investment strategy, meaning it is ready to change investment style to be in line with the changing economic situation as to acquire assets that are worth the investment to keep in the portfolio. At present, the Fund has 45 leading global properties in its portfolio such as Simon Property Group, which is the largest REIT in US and is one of the 100 largest companies in Standard and Poor (S&P) index. The company operates large shopping complexes in the US, Europe and Asia. Standard Life Investments also invests in Unibail-Rodamco, the largest shopping mall in Europe; and Public Storage – one of leading warehouse providers in the US. (Source: Standard Life Investments as of 31 December 2016. Benchmark: FTSE EPRA NAREIT Developed Index)

Mr. Luke Powell, Investment Director, Real Estate, Standard Life Investments, elaborated that REIT is an important asset class, especially in developed markets such as the United States, Europe and Asia-Pacific. The advantages of REIT are that investors can own various kinds of property, even some ‘iconic properties’ in the world. Standard Life Investment is a global fund house with long-term experience and expertise. At present, it is one of Top-20 asset management companies in the world. The Fund has two different approaches in selecting properties: Top-down approach which is to do research and analyses of real estate trends in every region throughout the world and identify the right opportunity and timing and to invest; and ‘Bottom-up’ approach by looking for companies that are changing themselves in accordance with the positive economic changes that will lead to growth. Standard Life Investments also adopts a dynamic investment strategy, meaning it is ready to change investment style to be in line with the changing economic situation as to acquire assets that are worth the investment to keep in the portfolio. At present, the Fund has 45 leading global properties in its portfolio such as Simon Property Group, which is the largest REIT in US and is one of the 100 largest companies in Standard and Poor (S&P) index. The company operates large shopping complexes in the US, Europe and Asia. Standard Life Investments also invests in Unibail-Rodamco, the largest shopping mall in Europe; and Public Storage – one of leading warehouse providers in the US. (Source: Standard Life Investments as of 31 December 2016. Benchmark: FTSE EPRA NAREIT Developed Index)

Mr. Kiattisak added that the reason why Standard Life Investment is chosen as the master fund is because they have similar investment philosophy to Krungsri Asset Management that is focusing on finding assets or properties which have good growth potential and the market has not yet discovered to provide return on investment as much as possible.

Both experts said it is now the right timing for Thai investors to add REIT investment in their portfolios due to several reasons including a fact that the global economy is now recovering, creating demand for real estate so the fund is able to grow in line with the economic recovery. Moreover, REIT contains low risk while it can provide good return quite constantly. During the past ten years, the fund can maintain a satisfactory return despite of some difficulties during the global economic downturn in 2008. However, with the right strategies in selecting assets for investment, the fund could make a satisfactory return continuously since 2009 onwards.

Investors can ask for more details on the Fund at

-

Krungsri Asset Management, call 02-657-5757; or

-

Any branch of Bank of Ayudhya; and

-

Distributors of investment units on behalf of KSAM.

Remark: Bank of Ayudhya Public Company Limited (as a distributor of investment units on behalf of Krungsri Asset Management Co., Ltd. only)

Disclaimers

-

Investment contains risk, investors should study fund feature, condition of return and risk before making investment decision.

-

Past performance is not a guarantee of future results.

-

KF-GPROPD primarily invests the master fund, Standard Life Investments Global SICAV – Global REIT Focus Fund which has the policy to invest in the registered Real Estate Investment Trust (REITs); or securities and listed real estate developers around the world. Therefore, the Fund may have risks from economic and/or political and/or social changes in the country where the master fund invested in.

-

The Fund may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

-

The master fund has specific investment in single sector, so it may has risk and price volatility higher than general mutual funds with diversification in several industries. Therefore, investors should study information of such industry for their investment decision-making.

-

The Thai Fund and/or Master Fund may invest in or enter the futures contracts to enhance efficiency in investment management and, then, may have higher risks than general mutual funds. So, KF-GPROPD is more appropriate for investors who expect high return and can also take higher risks than general investors. Investors should invest in a mutual fund only when they perceive its risks in the contract with regards to their investment experience, objectives of investment, and financial status.

-

The asset management company is under the supervision of Securities and Exchange Commission (SEC). The SEC approves of the establishment of KF-GPROPD, however, does not take responsibility for the fund management and does not guarantee the fund’s unit price.