Krungsri Asset Management organized Global Fund Forum 2016 to recommend investment strategies for Thai investors during the uncertain global economy.

Ms. Siriporn Sinacharoen Managing Director, Krungsri Asset Management

Ms. Siriporn Sinacharoen Managing Director, Krungsri Asset Management

Amidst the uncertainty of the global economy since the start of 2016, local Thai investors might be concerned about their investment strategies portfolio. To help relieve their anxiety and boost up confidence of Thai investors, Krungsri Asset Management (KSAM) has recently organized a global fund forum entitled: "Two Decades of Investment Expertise and the Way Forward" at Plaza Athenee Bangkok Hotel, Wittayu road.

Miss Siriporn Sinacharoen, Krungsri Asset Management’s Managing Director gave opening and welcoming remarks to all invited veteran fund managers from reputable global fund houses including J.P. Morgan Asset Management, Schroder Investment Management and PIMCO, who shared the overviews of global economic trend in 2016 and give investment guidance to Thai investors.

All the experts from leading fund houses shared similar viewpoints that the global economy in 2016 will continue to be volatile and instable, similar to the 2015 economic situation. This is due to various factors such as the US Federal Reserve’s announcement to hike interest rates, the US dollar appreciation, falling oil prices, political conflicts in Europe and the Middle East, the economic slowdown in China, lower exports in ASEAN and the sluggish economy in several emerging markets. However, all of them have expressed confidence that there are various positive factors that will continue driving the global economy towards stability, though the growth might not be as impressive as it used to be. There are still opportunities for long-term investment but investors should be more cautious and selective in their investment to reduce risk and maintain good return on investment.

Mr Tai Hui, Managing Director & Chief Market Strategist of J.P. Morgan Asset Management, said investors should understand that the market is fluctuated as the world is rebalancing the economy. Though economy is some regions is cooling down, some markets are getting better. Take the United States as an example. Though the market is still at risk due to the increase of interest rates, consumers are still confident to spend as the market has seen rising automobile sales. It is expected that the US economy in 2016 will grow by 2-2.5%. This is similar to the European market where consumers are still spending, so the economy will continue growing through slowly. As for Asian market like China, the overall economy may be slowing down but the market structure is changing with higher growth and expenditure in the service sector. As for global oil prices, it is believed that the genuine price will reflect in the long term. Therefore, 2016 is a challenging year for investment. He believes that there is a huge sum of money flowing in the world’s economy and looking for investment where opportunities exist.

Mr Tai Hui, Managing Director & Chief Market Strategist of J.P. Morgan Asset Management, said investors should understand that the market is fluctuated as the world is rebalancing the economy. Though economy is some regions is cooling down, some markets are getting better. Take the United States as an example. Though the market is still at risk due to the increase of interest rates, consumers are still confident to spend as the market has seen rising automobile sales. It is expected that the US economy in 2016 will grow by 2-2.5%. This is similar to the European market where consumers are still spending, so the economy will continue growing through slowly. As for Asian market like China, the overall economy may be slowing down but the market structure is changing with higher growth and expenditure in the service sector. As for global oil prices, it is believed that the genuine price will reflect in the long term. Therefore, 2016 is a challenging year for investment. He believes that there is a huge sum of money flowing in the world’s economy and looking for investment where opportunities exist.

Mr. Ricky Tang, Associate Product Manager, Multi-Asset, Schroder Investment Management, also said the global economy is severely affected by the Chinese market. However, there are still some growth in service, retail, and banking sectors in replace of manufacturing and industrial which are slowing down. Other Asian markets also see an export slump, causing the fluctuation in economy. However, the positive side of such market situation is that the stock price is quite cheap. Based on its analysis, it is found that around 25% of Asian stocks is lower than the market price. There is also buying signal. During the past 9 years, the market saw buying signal twice; first in 2008, during the Hamburger crisis, and, second in 2011 during the economic crisis in Europe. Here comes another buying time. Investors who buy stocks at this time are likely to see a satisfied return within the next 18-20 months. This is the right timing to invest in high-dividend stocks and fixed income, especially dividend stocks in Asia. He also advised investors who already hold shares in the stock market to keep calm and not sell in panic.

Mr. Ricky Tang, Associate Product Manager, Multi-Asset, Schroder Investment Management, also said the global economy is severely affected by the Chinese market. However, there are still some growth in service, retail, and banking sectors in replace of manufacturing and industrial which are slowing down. Other Asian markets also see an export slump, causing the fluctuation in economy. However, the positive side of such market situation is that the stock price is quite cheap. Based on its analysis, it is found that around 25% of Asian stocks is lower than the market price. There is also buying signal. During the past 9 years, the market saw buying signal twice; first in 2008, during the Hamburger crisis, and, second in 2011 during the economic crisis in Europe. Here comes another buying time. Investors who buy stocks at this time are likely to see a satisfied return within the next 18-20 months. This is the right timing to invest in high-dividend stocks and fixed income, especially dividend stocks in Asia. He also advised investors who already hold shares in the stock market to keep calm and not sell in panic.

Dr. Luke Spajic, Portfolio Manager of PIMCO, one of the world’s largest fixed income fund house, said those who invest in fixed income might be worried about the FED’s measure to increase interest rates which might affect the return on investment. However, PIMCO believes that the rate of increase of interest rates will be slower than historical rate cycles and end at a lower terminal value. PIMCO’s investment strategies during this economic environment will be careful and selective as it looks for attractive opportunities across global fixed income markets. Some examples include underweighting interest rates in the US, holding TIPS as protection against inflation risk, actively managing credit risk and overweighting the US Dollar. Overall, investing in fixed income provides investors with income, diversification and helps dampen portfolio volatility.

Dr. Luke Spajic, Portfolio Manager of PIMCO, one of the world’s largest fixed income fund house, said those who invest in fixed income might be worried about the FED’s measure to increase interest rates which might affect the return on investment. However, PIMCO believes that the rate of increase of interest rates will be slower than historical rate cycles and end at a lower terminal value. PIMCO’s investment strategies during this economic environment will be careful and selective as it looks for attractive opportunities across global fixed income markets. Some examples include underweighting interest rates in the US, holding TIPS as protection against inflation risk, actively managing credit risk and overweighting the US Dollar. Overall, investing in fixed income provides investors with income, diversification and helps dampen portfolio volatility.

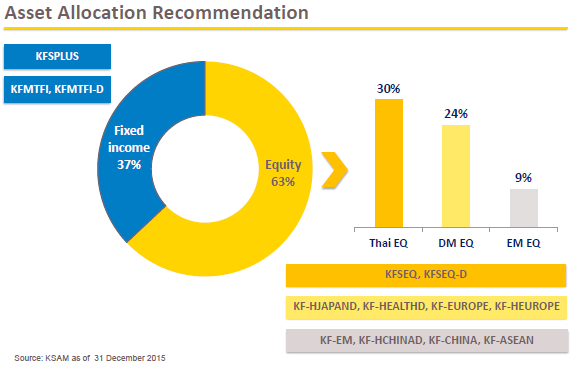

Meanwhile, Mrs. Supaporn Leenabanchong, Acting Chief Investment Officer, Krungsri Asset Management said at the seminar that the Thai economic trend is likely to follow the global economy. The interest rates will remain low, meanwhile, the economic stimulus package and public-private investment in infrastructure projects as well as tourism sector will be important factors to drive growth. She advised investors to look for opportunities to invest in stocks during such the low interest rate circumstance. She said the 2016 stock market should have an upside of 10% with P/E of 14 times. In terms of asset allocation, KSAM advised investors to invest 63% in stocks and 37% in fixed income assets.

Meanwhile, Mrs. Supaporn Leenabanchong, Acting Chief Investment Officer, Krungsri Asset Management said at the seminar that the Thai economic trend is likely to follow the global economy. The interest rates will remain low, meanwhile, the economic stimulus package and public-private investment in infrastructure projects as well as tourism sector will be important factors to drive growth. She advised investors to look for opportunities to invest in stocks during such the low interest rate circumstance. She said the 2016 stock market should have an upside of 10% with P/E of 14 times. In terms of asset allocation, KSAM advised investors to invest 63% in stocks and 37% in fixed income assets.

Disclaimer 1. Investment contains risks. Investors must study fund features, conditions of return, and risks before making investment decision.

2. Past performance is not a guarantee of future results.

3. KF-HJAPAND, KF-HEALTHD and KF-EUROPE primarily invest in foreign equities. Therefore, the Fund may have risks from economic and/or political and/or social changes in the country where the master funds invested in.

4. KF-HJAPAND will enter into a forward contract to hedge against the exchange rate risk in Baht equivalent at a particular time for the value of at least 90% of the foreign investment value, in which case, may incur costs for risk hedging transaction and the increased costs may reduce overall return.

5. KF-HEALTHD and KF-EUROPE may contain foreign exchange risk. The Funds may enter into a currency swap within discretion of fund manager which may incur transaction costs that may reduce overall return.

To request more information and a prospectus:

-

Krungsri Asset Management Company Limited | Tel. 0 2657 5757

-

Bank of Ayudhya Public Company Limited

-

Selling and Redemption Agents

Remark: Bank of Ayudhya Public Company Limited simply acts as a distributor of investment units on behalf of Krungsri Asset Management Co., Ltd.