News/Announcement

Promotions/Fund Highlight

KFWINDX...Access Widest Growth Potential of the World Equity Index ETF.

Opportunity to invest in MSCI ACWI Index, the world equity index composing of companies from both developed and emerging markets countries worldwide supported by the current economic outlook and various factors fueling the global stock markets growth.

- Positive signs of macro-economic factors: Declining trend of policy interest rate and inflation rate coupled with a lower possibility of economic recession providing positive signs for equity investment.(1)

- Consistent solid fundamentals: Corporate profitability tends to grow continuously and signs of analysts raising their earnings projections upward are emerging.(2)

- Prices are adjusted to attractive levels: The market is currently experiencing the fourth biggest drop in 5 years, pulling down P/E ratio to the level of 16 times, lower than the 5-year average of 18 times, despite strong growth of fundamentals.(3)

KF-WORLD-INDX: Krungsri World Equity Index Fund

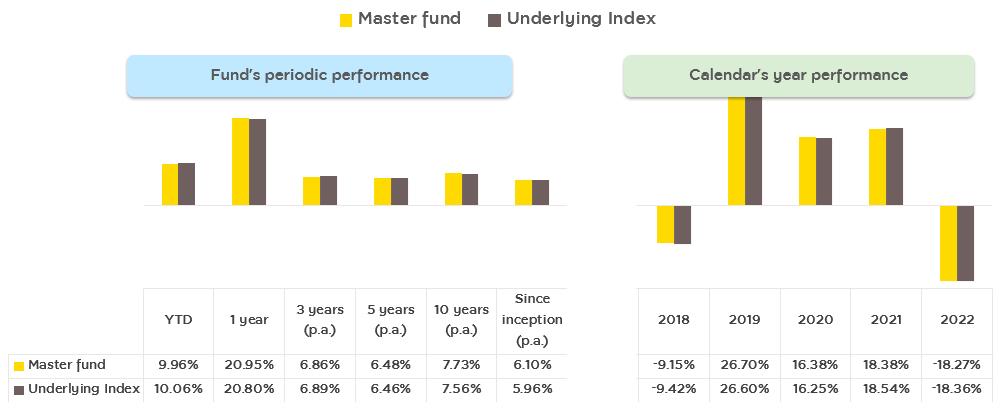

Strong capability of the master fund: iShares MSCI ACWI ETF

- The world’s biggest ETF reflecting the movement of MSCI ACWI Index with high liquidity and average daily trading volume at more than 10,000 million Baht.

- Reasonable expense ratio helping increase the fund's potential to reflect the index movement and generate the attractive long-term return.

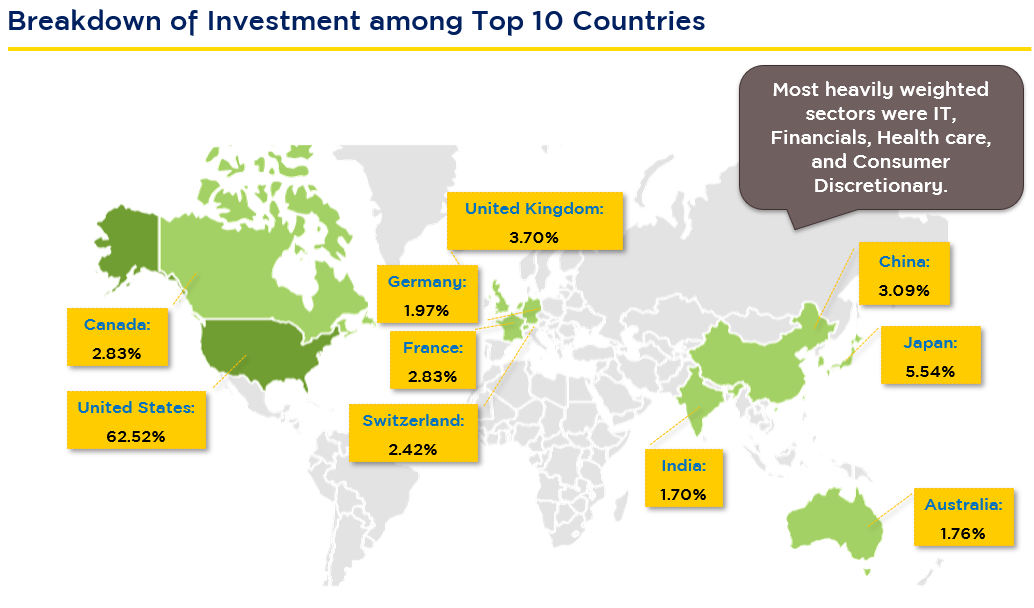

- Investment portfolio diversification of the Index across a diverse range of industries and regions around the world made their volatility not too dependent on the growth of any particular sector.

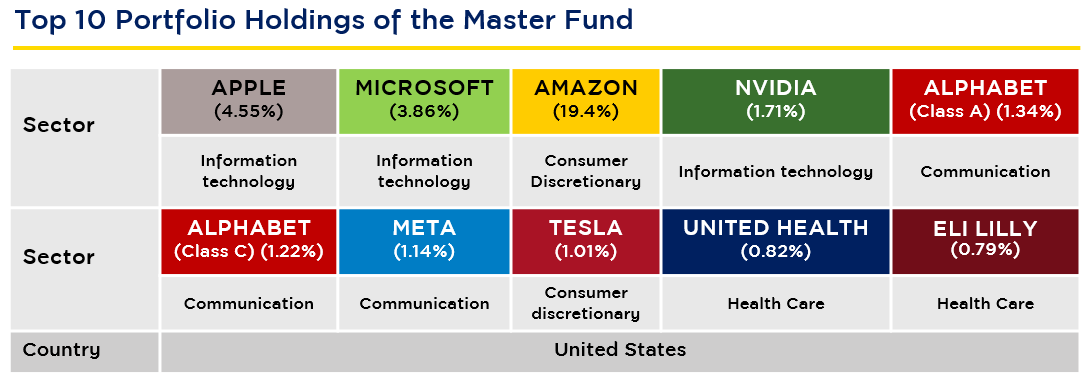

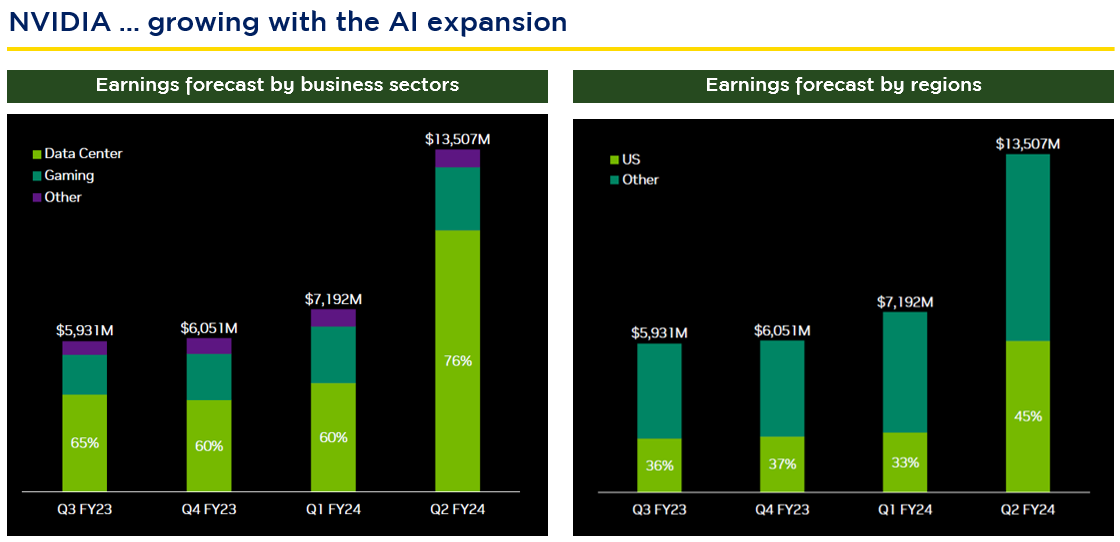

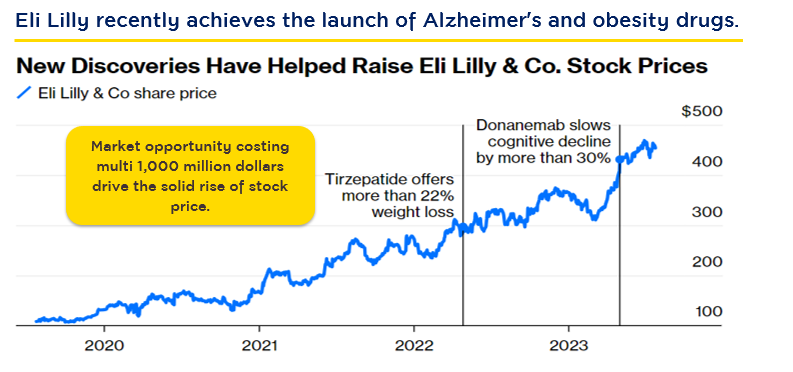

- Stocks in a portfolio have delivered the outstanding growth.

Examples of high-performing stocks

Sources: NVIDIA: NVIDIA as of 7 Nov. 23 | Eli Lilly: Bloomberg.

- The Master Fund has delivered performance growing with the market.

KF-WORLD-INDX: IPO 20 – 27 Nov. 2023

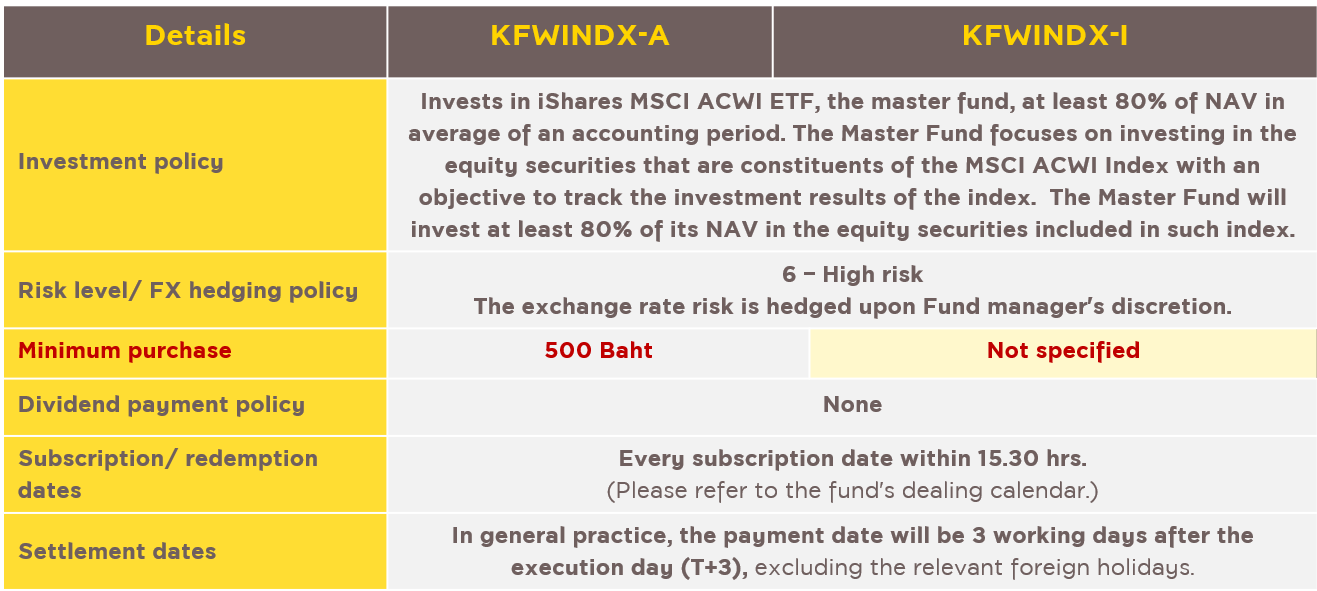

The fund has been divided into two share classes:

- Krungsri World Equity Index Fund-Accumulation Class (KF-WORLD-INDX-A)

- Krungsri World Equity Index Fund-Institutional Investor Class (KF-WORLD-INDX-I)

Disclaimer:

- This document is prepared based on the information compiled from various reliable sources as of the displaying date. However, the Management Company cannot guarantee the accuracy, credibility, and completion of all information. The Management Company reserves the right to change the information without any prior notice.

- The Fund is hedged against foreign exchange risk at the discretion of the fund manager and therefore may involve foreign exchange risk which may cause investors to lose or gain money from foreign exchange fluctuation/ or receive redemption proceeds less than the initial amount of investment.

- Investors should understand the fund features, conditions of returns and risk before making an investment decision. Past performance is no guarantee of future results.

To inquire further information or request a prospectus,

please contact Krungsri Asset Management Company Limited at Tel. 0 2657 5757 press 02.