Promotions/Fund Highlight

KFAHYBON-A ... Enhancing returns, Capitalizing on Asia's recovery

KFAHYBON-A ... Enhancing returns, Capitalizing on Asia's recovery

According to recovery signals in Asia’s economy and the forecast in its strong economic growth, Asian High Yield bond deserves a place in your portfolio against near-zero interest rate environment by reason of its high-income potentials and delivery of more consistent risk-adjusted returns than equities.

Asian economic growth forecasts are strong.

.aspx) Source: BlackRock as of 31 Dec. 2020

Option Adjusted Spread Premium in Asia high yield looks attractive.

Source: BlackRock as of 31 Dec. 2020

Option Adjusted Spread Premium in Asia high yield looks attractive.

.aspx) Source: BlackRock as of 31 Mar. 2021 compared with 1) Asian USD high yield bonds that refer to the ICE BofAML Asian Dollar High Yield Corporate Constrained Blended index and 2) Asian Equities that refer to MSCI Asia ex-Japan Index

Source: BlackRock as of 31 Mar. 2021 compared with 1) Asian USD high yield bonds that refer to the ICE BofAML Asian Dollar High Yield Corporate Constrained Blended index and 2) Asian Equities that refer to MSCI Asia ex-Japan Index

Reasons why High Yield bond should belong in your portfolio

1. Risk diversification

Since High Yield bonds are less vulnerable to fluctuations in interest rates, they help diversify risks from interest rate directions and offer more opportunity to boost portfolio returns.

2. More opportunity for returns mainly be driven by income

Carrying a higher risk of default, High Yield bonds have always paid higher interest rates than other bonds.

3. Growth investing potentials

Potential increase in valuations from economic recovery or improved financial performance of the issuers

High Yield Bonds

High Yield Bonds

are bonds that have lower credit ratings than investment-grade bonds or being rated BBB- but they generate attractive returns in the event of an improvement or growing in the economy, or performance of the issuing company that tend to improve.

KFAHYBON-A (Krungsri Asian High Yield Bond fund - A)

Capitalize on the distinctive characteristics of Asian High Yield Bond through selecting BGF Asian High Yield Bond Fund, the Morningstar 5-star rated Master Fund managed by BlackRock, the world’s largest fund house*

Master Fund: BGF Asian High Yield Bond Fund

- Drive returns with a focus on best risk-adjusted income and sector allocation and security selection

- Core allocation focuses on High Yield Bonds having credits with high current income while investing opportunistically to capture capital upside

- Diversifying into multi high yield securities and sectors with Active Management approach seeking to maximize returns while managing the downside

- BlackRock’s capabilities span across traditional liquid and private credit strategies with proven track record

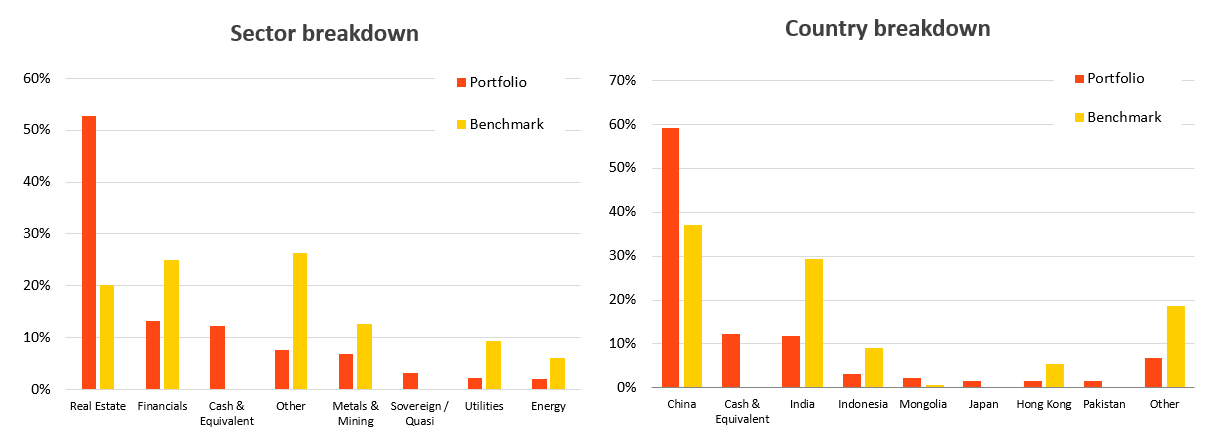

Source: BlackRock, 31 Mar 2021. The Fund is actively managed and its composition will vary. Fund characteristics are as of the date noted and subject to change. Geographic exposure relates principally to the domicile of the issuers of the securities held in the product, added together and then expressed as a percentage of the product's total holdings. However, in some instances it can reflect the country where the issuer of the securities carries out much of their business. Allocations are subject to change.

*Morningstar rating from Blackrock as of 31 Mar. 2021. The above awards and rankings are not relevant to the AIMC. | A fact that BlackRock is the world’s largest fund house refers to the source from Citywire.co.uk as of 16 Apr. 2021.

Source: BlackRock, 31 Mar 2021. The Fund is actively managed and its composition will vary. Fund characteristics are as of the date noted and subject to change. Geographic exposure relates principally to the domicile of the issuers of the securities held in the product, added together and then expressed as a percentage of the product's total holdings. However, in some instances it can reflect the country where the issuer of the securities carries out much of their business. Allocations are subject to change.

*Morningstar rating from Blackrock as of 31 Mar. 2021. The above awards and rankings are not relevant to the AIMC. | A fact that BlackRock is the world’s largest fund house refers to the source from Citywire.co.uk as of 16 Apr. 2021.

About Master Fund

| Fund inception |

1 December 2017 |

| Bloomberg ticker |

BGAHD2U:LX |

| Asset allocation |

- Bonds with potentials to generate income: 70-90% of portfolio

- Bonds with price appreciation as a major return contribution: 10-30% of portfolio

- Weight/ holding: Not over 5%

|

| Current yield |

Fund: 7.1%, Benchmark: 6.1% |

| Duration |

Fund: 2.2 years, Benchmark: 2.7 years |

| Average rating |

Fund: B+, Benchmark: BB- |

| No. of issuers |

105 |

Performance of the Master Fund

.aspx)

Source: Bloomberg, as of 31 Mar 2021. Inception date: 1 Dec 2017. Performance is shown on a closing bid to bid price basis with income reinvested. Fund performance figures are calculated net of fees. The Fund is actively managed, and the Investment Adviser (IA) has discretion to select the Fund's investments. In doing so, the IA will refer to the ICE BofAML Blended Index: ACCY, 20% LvI4 Cap 3% Constrained Index (the “ICE BofAML Asian $ High Yield Corporate Constrained Blended Index”) when constructing the Fund’s portfolio, and also for risk management purposes to ensure that the active risk (i.e. degree of deviation from the Index) taken by the Fund remains appropriate given the Fund’s investment objective and policy. The IA is not bound by the components or weighting of the Index when selecting investments. The IA may also use its discretion to invest in securities not included in the Index in order to take advantage of specific investment opportunities. However, the geographical scope and credit rating requirements of the investment objective and policy may have the effect of limiting the extent to which the portfolio holdings will deviate from the Index. This shows the performance of the master fund, so it is not complied to AIMC’s standard.

About KFAHYBON-A

| Investment policy |

Invest in BGF Asian High Yield Bond Fund Class D2 USD (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund aims to invest at least 70% of its total assets in high yield fixed income transferable securities, denominated in various currencies, issued by governments and agencies of, and companies domiciled in, or exercising the predominant part of their economic activity in the Asia Pacific region. |

| Risk level |

6 | Fully hedge against foreign exchange rate risk |

| Dealing date |

Daily (Please refer to Fund’s Non-Dealing Calendar) |

| Minimum purchase |

500 Baht |

| IPO |

18 – 24 May 2021 (After IPO: 1 Jun. 2021) |

- The fund is highly concentrated in Non-investment grade and less liquid credit, investors may be exposed to substantial risk of capital loss

- Past performance is not an indicative of future performance.

- Please study fund features, performance, and risk before investing. This fund is a risky / complex fund, investor should seek an additional advice before investing.

Back