Krungsri Asset Management points out that tech sector is still a mega (up) trend for the long term in the midst the COVID-10 crisis and changing consumer behavior, believing that current market corrections remain temporary and give tech investing opportunities for long-term returns.

After a sharp sell-off in US tech sector had erased more than 10% from the Nasdaq Composite Index early this month, leaving investors be uncertain over the valuation and future growth direction. Recently, Krungsri Asset Management Co., Ltd held a webinar on “Thriving Technology Sector despite a Rise of COVID-19”, where Mr. Kiattisak Preecha-anusorn, Krungsri Asset Management’s Vice President for Alternative Investment and two experts from global fund houses, namely Mr. Nick Beecroft, Portfolio Specialist from T.Rowe Price and Mr. Ben Bei, Product Strategist from BlackRock , who have been invited to share information involving tech investment direction and trend during the COVID-19 pandemic. Difference of both funds’ strategies and concepts for portfolio allocation has also been explained with ways to select stocks, risk management styles and past performance disclosure. Investors may use the information from webinar to make their investment decision, upon their individual preferences.

Mr. Kiattisak said that in the past five years, tech sectors have recorded strong performance. Based on S&P500 record, tech and e-commerce’s performance represented as high as 78% of S&P 500’s performance and when compared to growth rate, tech sectors growth reported a 170% rise, while other industries showed only 110% expansion.

Leaping in tech prices came from profit growth, based on robust fundamentals, this situation differs from the dot-com bubble bust in the late ‘90s which was caused by massive market speculation. Besides, the COVID -19 pandemic has fueled tech prices to skyrocket on changing behavior of global businessmen and consumers to live and work online. As a result, tech sectors’ earnings per share rose over 7%, in contrast with other industries hard hit by the COVID-19 crisis. Such trend is expected to continue amidst the ongoing economic crisis affected from the virus.

Source: BofA Research Investment Committee, Bloomberg July 18

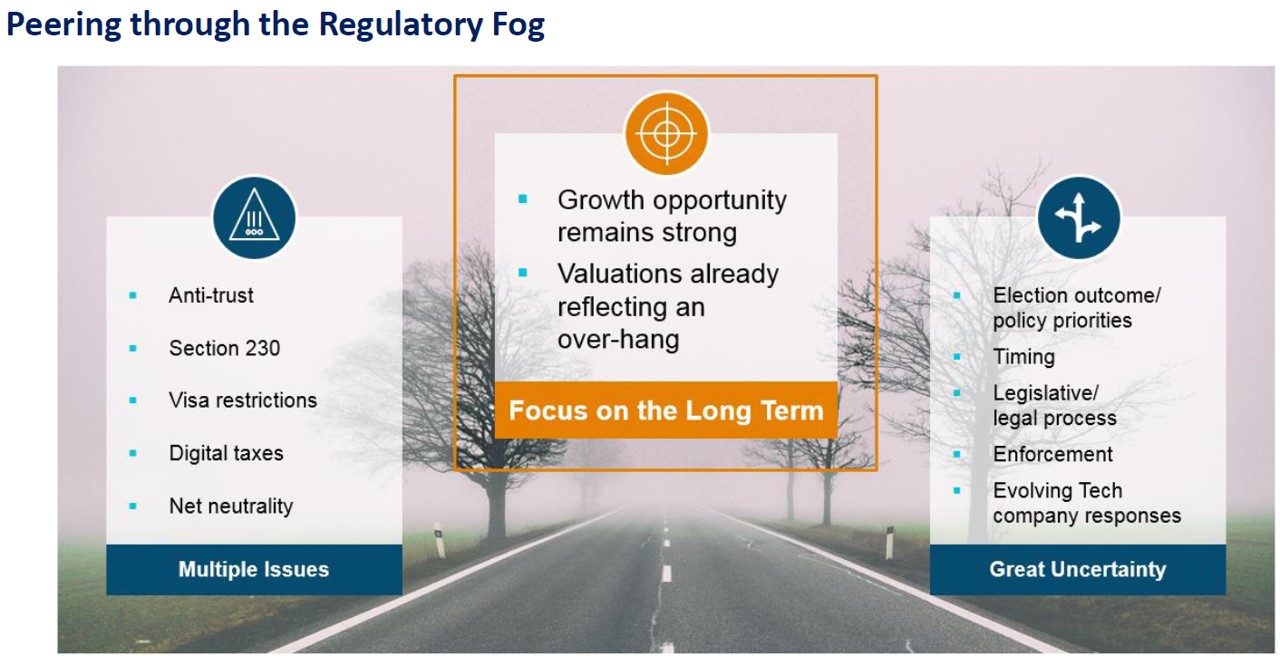

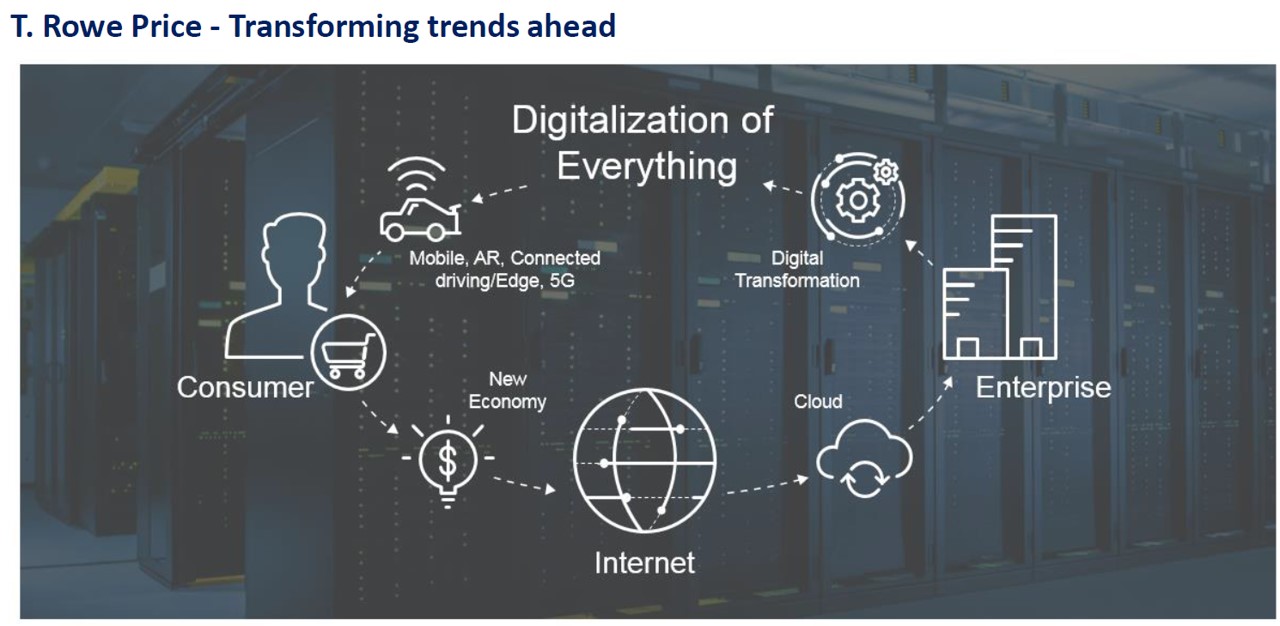

Mr. Nick Beecroft, Portfolio Specialist for T.Rowe Price that has managed the master fund of KF-GTECH, said that although high volatility of tech sectors from heavy profit-taking and impacts from a number of legal regulations and measures is normal for industry sectors, investors should pay more attention on the long-term trend. He viewed that the world has been transforming from the industrialization to the digitalization. This transformation will take several years, led by tech companies which could see high growth in the future.

Source: T. Rowe Price ณ ส.ค. 2563

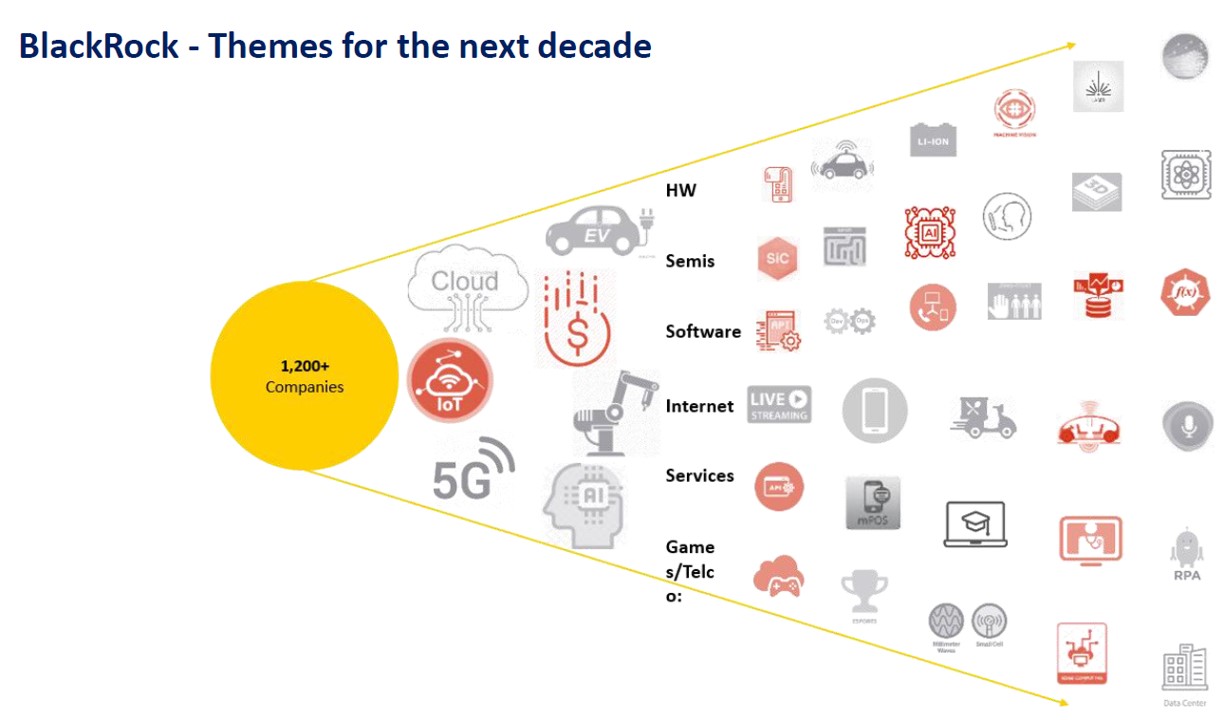

Mr. Ben Bei, one of fund management leaders from BlackRock that has managed the master fund of KFHTECH-A, cited the US-China trade tensions have been another key factor impacting tech sectors. However, he believed that this factor will not highly affect a growth of these sectors as the global tech trend will continue growing further. Besides, China has poured massive investment budget for technology development, which helped Chinese tech firms to overtake the US ones. And this has given opportunities for Chinese tech companies to grow more in the global stage. Technology is thus believed to play a vital role in driving an economy to grow largely in the long run.

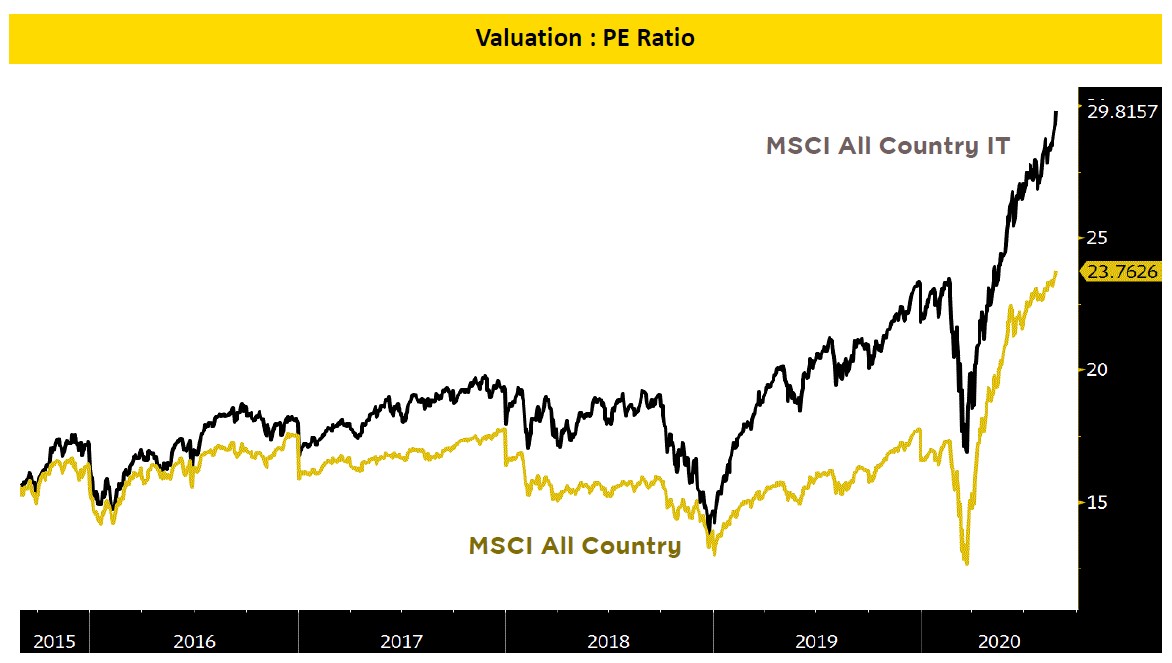

Mr. Kiattisak added that a fact that tech sectors have made recent corrections, trading at a lower P/E of 25 times from the earlier 30 or down more than 10% did not occur often. In the past five years, the Nasdaq has made only three market corrections in 2018, 2019 and 2020. Thus, now is a proper timing for investment despite of relatively high valuations. However, compared with the dot-com bubble with the P/E ratio of 80 - 90 times, he viewed that the current market valuation is not too high thanks to sound-fundamental stocks with ability for fast recovery.

Source: Bloomberg as of 27 August 2020

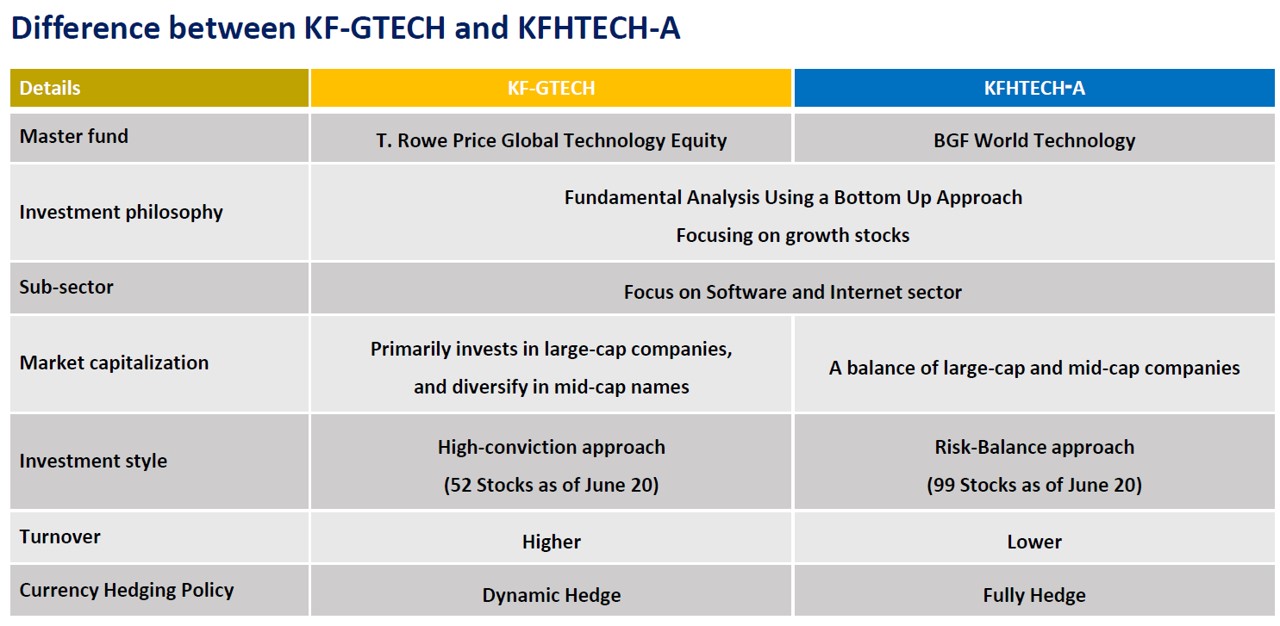

Both T.Rowe Price and BlackRock are the global fund companies showing perspectives and confidence in tech growth. Their main investment theme involves software, internet and semiconductors. Meanwhile, their strategies, concepts and portfolio allocation are relatively different.

“T. Rowe Price Funds SICAV – Global Technology Equity Fund” (Master Fund of KF-GTECH)

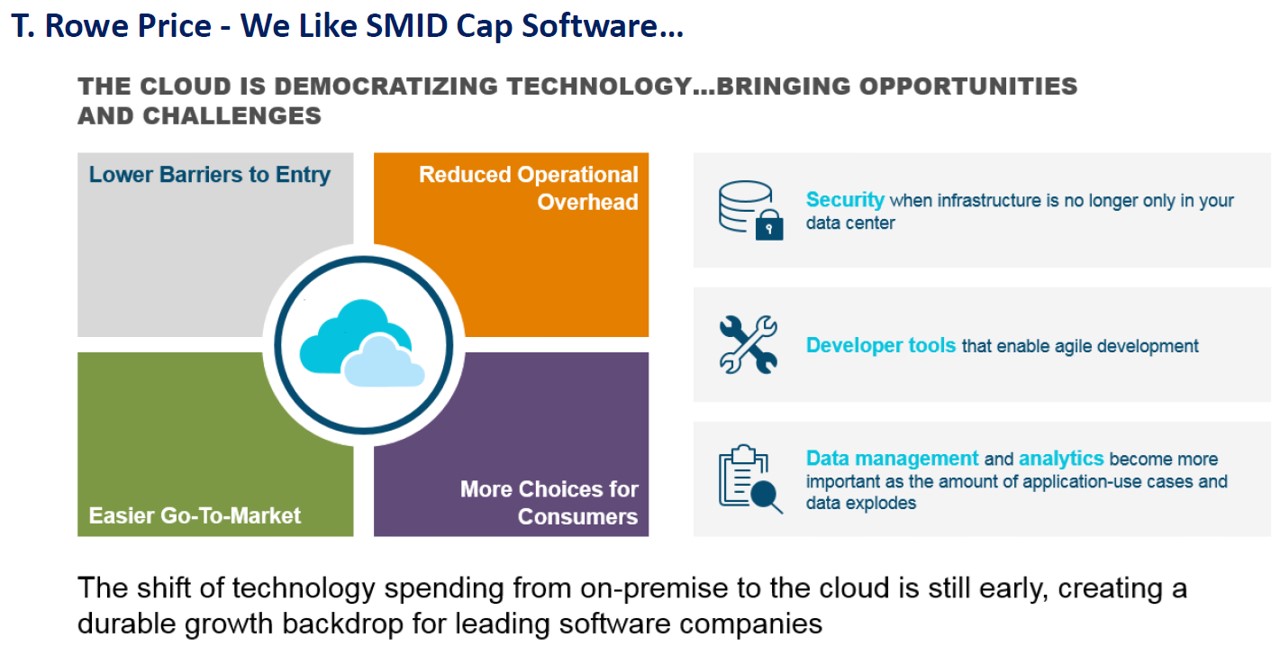

T.Rowe Price weighs about half of its investment portfolio in large-sized tech companies and the rest in medium caps and small caps. So far, the fund consists of 40 - 50 carefully selected stocks with strong fundamentals. Presently, the fund weighs about 40% of its investment portfolio in software firms providing services through Cloud, seeing this trend is only at a start period with a room to grow in the future. Those operating businesses with internet platform like e-commerce giants (Alibaba, Amazon and Shopify) follow. These companies register very high usage rate during the COVID-19 pandemic. 30% of the fund invests in these giants, while another 20% invests in semiconductor stocks which will grow in parallel with rising demand for tech equipment like mobile phones and electric vehicles. Based on a careful selection of individual stocks, its top-ten stocks are quite different from the benchmark. Given its active investment strategy, the fund reallocates its investment portfolio every six months, while regularly seeking new investment opportunities to maintain its growth.

Source: T. Rowe Price as of August 2020

“BGF World Technology Fund” (Master Fund of KFHTECH-A)

BlackRock is always seeking a chance to invest in small- and medium-sized businesses with high growth potential from development of Cloud Computing, Internet of Things (IoT), 5G, artificial intelligence (AI) and electric vehicles. The fund weighs on the Internet-related sector which lead to the digital economy’s expansion, the semiconductor and software which help promote the new economy. The fund also focuses on small and medium caps with sustainable growth potential in the future such as online gaming or streaming video content, businesses which, as a result of lockdown and social distancing, confront technology disruption or a business platform shift from offline to online such as online learning and e-Payment, as well as medical and healthcare services like telemedicine and tele doctor. The fund’s management strategy is to diversify risks. Thus, it has over 100 holdings in its investment portfolio. Its top-10 stocks account for only 22% of total portfolio and the rest in small caps and medium caps worldwide with sustainable growth potential in the next 10 years.

Source: BlackRock as of August 2020

Source: Fund Fact Sheets and Morningstar as of 14 August 2020

In terms of currency hedging policy, KFGTECH hedges against foreign currency exchange upon its fund managers’ consideration. Now, the fund hedges against FX risks at 50% of total investment portfolio. For KFHTECH-A, it has the policy to hedge no less than 90% of total investment portfolio against FX risks. Investors may select to invest in a fund with preferable investment policy or can invest in both funds.

Disclaimer

-

Krungsri Asset Management Co., Ltd. (“The Management Company”) believes the information contained in this document is accurate at the time of publication, but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

-

Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

-

KF-GTECH invests in T. Rowe Price Funds SICAV – Global Technology Equity Fund, on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has investment policy to invest mainly in a diversified portfolio of stocks of technology development or utilization companies, with a focus on leading global technology companies.

-

KFHTECH-A invests in the master Fund named BGF World Technology Fund, on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has investment policy to invest globally in the equity securities of companies whose predominant economic activity is in the technology sector.

-

Both funds may be exposed to risks from economic, social, and/or political changes in countries where the master fund invest in.

-

Both funds concentrate their investments in Technology Sector. Therefore, the investors may face a substantial loss of investment.

-

KF-GTECH may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

-

KFHTECH-A will enter into a forward contract to hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

-

Both funds may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

-

KF-GTECH and KFHTECH-A have risk level 7: High risk

For more details or to request for the Fund Prospectus, please contact:

Krungsri Asset Management Co., Ltd.

Tel. 0 2657 5757 or Bank of Ayudhya PCL. / Selling agents