Krungsri Asset Management Co., Ltd. (Krungsri Asset Management) reckons a chance for investment and returns with China’s five megatrends growing rapidly in the country’s new economy, mainly driven by a power of digital-market consumption in the large market with huge local purchasing power, advanced technologies, healthcare, clean energy and new transportation trends. Such trends are supported by the 14th long-term economic development plan in which the Chinese government is ready to pour a huge budget for development. This aims at upgrading Chinese people’s income and improving their quality of life, while shifting the country toward China 5.0 - the new economy which is driven by technology.

In this regard, Krungsri Asset Management had recently organized an online seminar titled

5 Megatrends to bring profits in the land of dragon, talking about trends and direction of the Chinese economy after the COVID - 19 crisis and introducing a launch of the Company’s new fund,

Krungsri China Mega Trend - Accumulation (KFCMEGA-A) that combines four global Exchange Trade Funds (ETFs) with five mega trends into one, One-Stop Solution. With this, investors are offered a chance to grow together with China’s economy development that has been mainly driven by the consumption sector.

At the seminar,

Krungsri Asset Management had invited Dr. Arm Tungnirun, Lecturer at the Faculty of Laws and Director of the Chinese Studies Center at Chulalongkorn University, and Ms. Pornchanok Rattanarujikorn, Krungsri Asset Management’s Assistant Vice President at Alternative Investment to discuss and share crucial views on investment.

Starting with Dr. Arm, he said that China’s economic direction from now will move in K-Shape, being divided into two economic systems. The first one is the old economy relying on traditional manufacturing sectors that have been affected from the COVID-19 crisis and are now on the recovery path. The 2nd system is the new economy that brings technologies for new inventions and are about to totally change the overall picture of the Chinese economy. Presently, domestic consumption is grouped into three types: offline market; online market (E-commerce), and virtual market - the new market type in China. Business giants like Alibaba, Tencent and Pinduoduo are providers of online market services in China, recording customers’ data nationwide and the highest growth in the world.

(Source: Bloomberg, KraneShares as of 31 Dec. 2020)

Ms. Pornchanok said that the new economy’s five mega trends provide an investment opportunity in the high-potential business sectors that will expand in parallel with the growing economy. Thus, in order that investors will not miss the opportunity for such growth, Krungsri Asset Management has offered the investment policy in line with that direction, combining four funds into the KFCMEGA-A for investment diversification and returns maximization. Such five megatrends include:

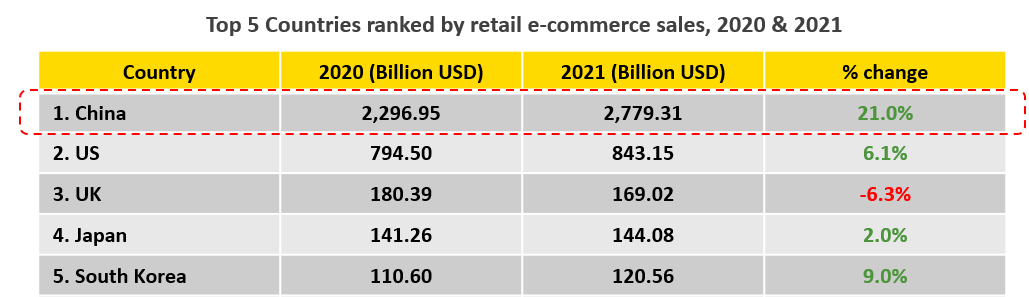

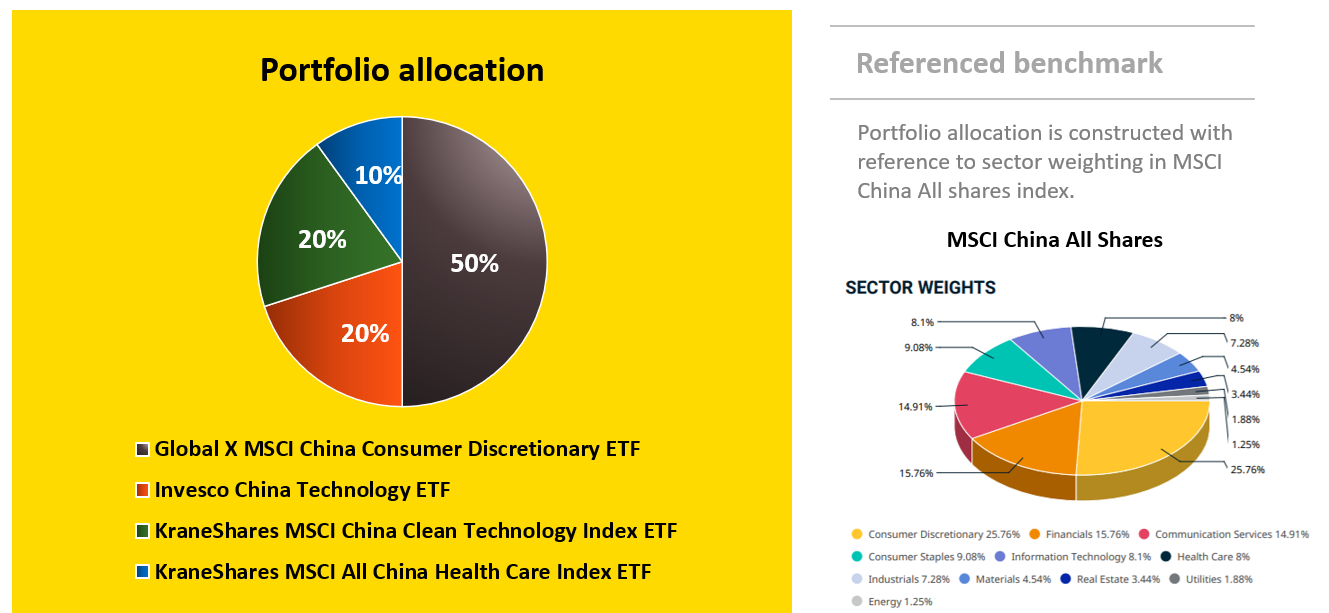

1) Power of domestic consumption: From the market with a total population of over 1,400 million with individual income being expected to double by 2030 (Source: NBS, Morgan Stanley Research (E) estimates as of Jan. 2021), according to the 14th economic development plan promoting domestic consumption, it is believed that these factors will greatly stimulate China’s economy. This is particular for growth of e-commerce market, which ranks the world’s highest sales from a spending on online purchases, education, entertainment, and tourism that tends to increase up to 21% from 2,296 million US dollar to 2,779 million US dollar during 2020 - 2021. As a result, China has given the highest opportunity for investment. The fund will invest 50% of its portfolio in Global X MSCI China Consumer Discretionary ETF.

Source: eMarketer as of Dec. 2020

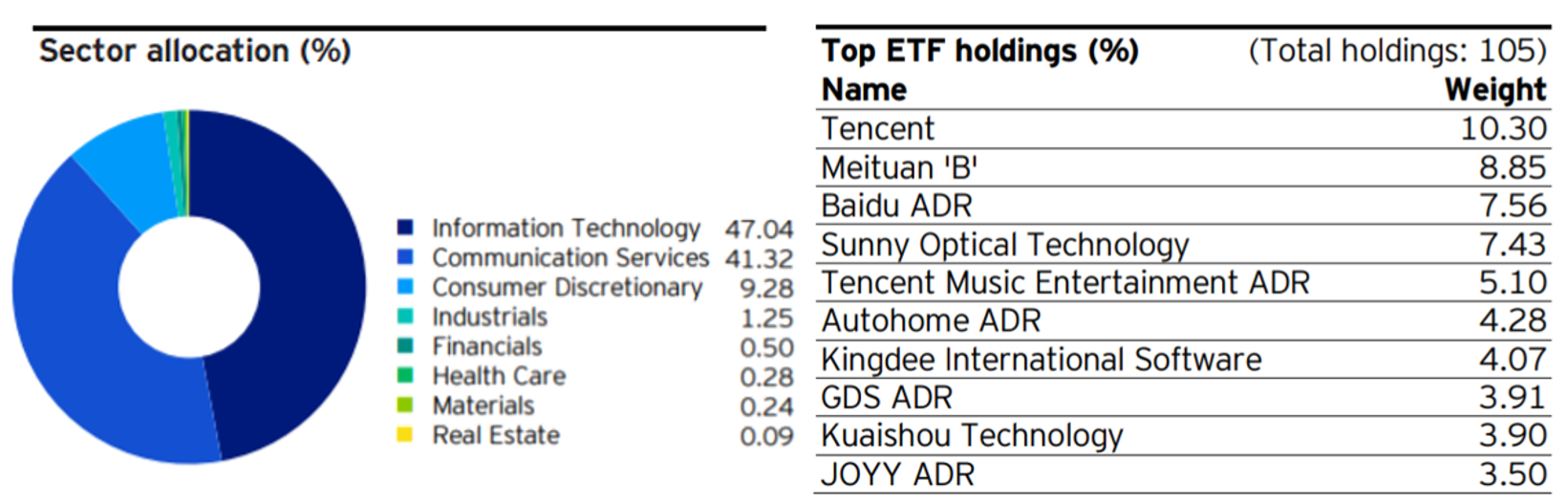

2) Technological advancement: COVID-19 crisis starting from last year have pushed demands for Internet skyrocketed, which accelerate an investment in research and development in fields of technologies particularly Artificial Intelligence (AI), 5G, Internet and technological infrastructures being planned toward China 5.0 with Smart City, Health Tech, Fin Tech and Ed Tech. Amid this plan, a strength of Chinese technology lies on the huge market with nearly 1 billion internet users nationwide (Source: CNNIC as of Jun. 2020). To the opportunity for this business trend, the fund places 20% of its portfolio into Invesco China Technology ETF which invests in Chinese tech firms.

Source: Invesco as of 31 Mar. 2021

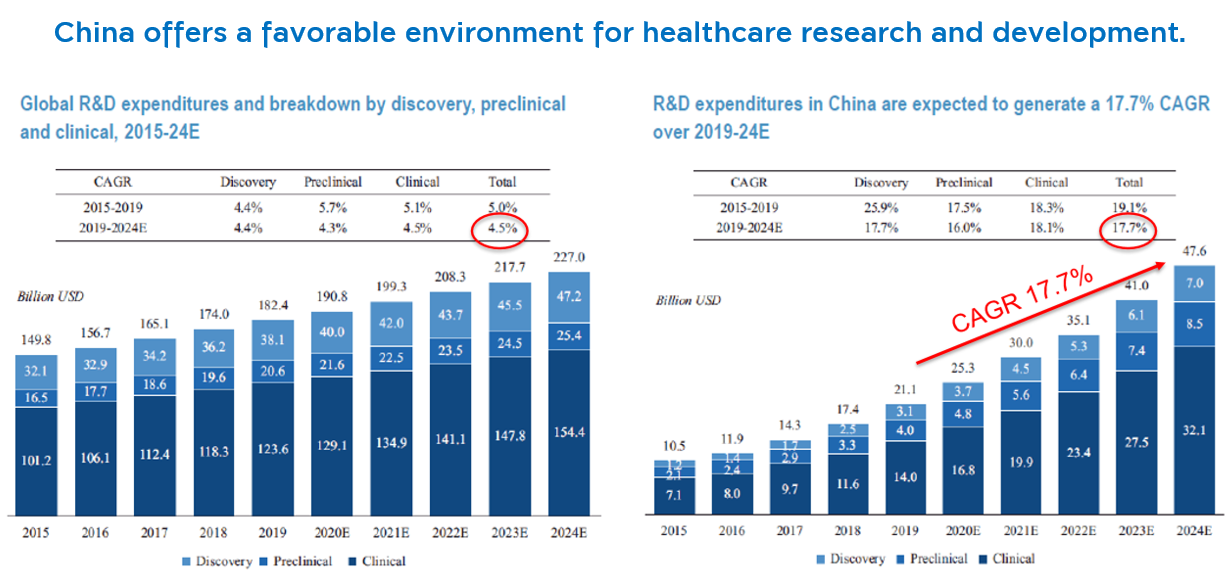

3) Healthcare: With an increase in the share of aged population, China is expected to see one-fifth of the country’s population as those aged by 2025. In this regard, the Chinese government has seen this estimated picture as an urgent matter for healthcare development and solutions, which will create growth opportunities for healthcare and health tech sectors. Throughout the past five years, China’s healthcare market grew highest in the world with 11% growth per year on average, higher than that of 4% in the United States. However, Chinese spending for health remains below that in the US. (Source: WHO as of 7 Apr. 2020 and KraneShares). Thus, China’s healthcare sector has a spacious room to grow from the entering into the aging society. For investment opportunity in this group, the fund will invest 10% of its portfolio in Krane Share MSCI World Healthcare Index ETF.

Source: Frost & Sullivan, Joinn Laboratories, JP Morgan as of May 2021

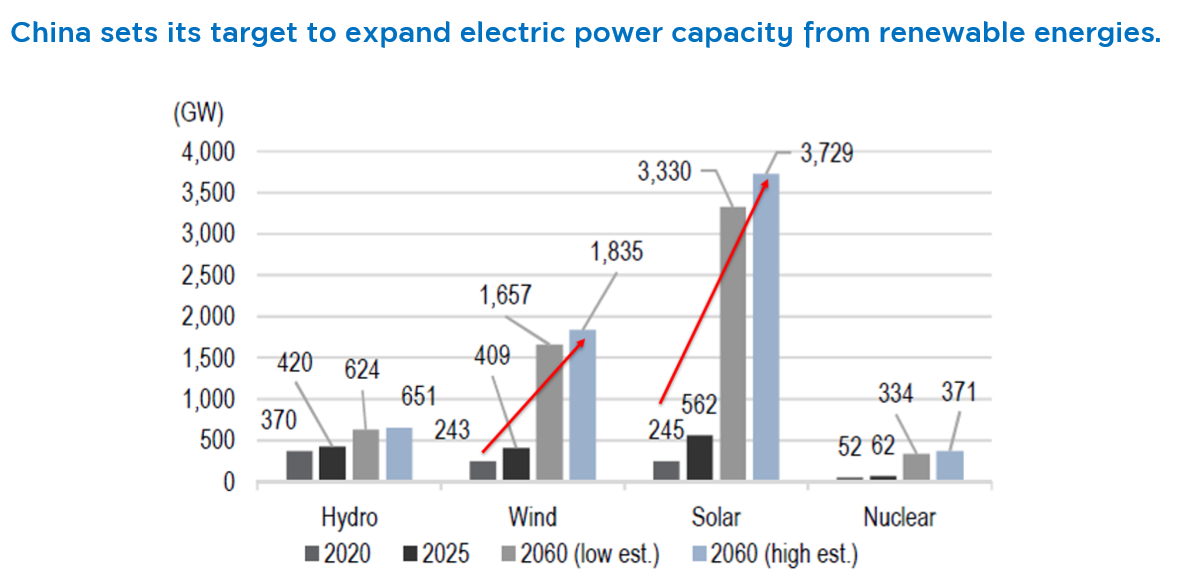

4) Clean energy: The Chinese government has focused on the environment in parallel with the long-term economic development with an aim to achieve zero carbon within 2060. Plans for this target include an establishment of a strategic committee for energy and investment for the country’s energy reform. With this plan, China sets its target to increase a production of renewable energies such as solar, wind by 145% within 2030.

Source: Tsinghua, J.P. Morgan estimates as of Jan. 2021

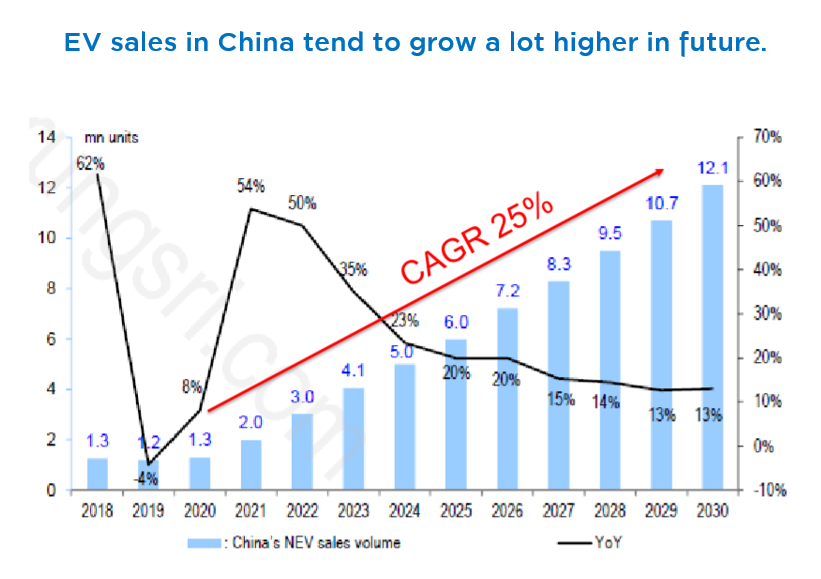

5) Modern transportation systems: Given Chinese technologies, growing electric vehicle (EV) industry and the state’s clean energy policy that bring about infrastructure developments like EV battery charging places, demands for EV are thus projected to rise in the future even though China currently sees EV sales of only 1.3 million units per year. However, the figure is forecasted to rise to 12 million units per year in 2030, while electric vehicle makers and related businesses will likely gain from the policy and such growth trend.

Source: Thinkercar, Credit Suisse estimates as of Jan. 2021

For the clean energy and modern transportation systems, Krungsri Asset Management selects KraneShares MSCI China Clean Technology Index ETF that invests in clean energy, solar/wind energy, water management, pollution control and electric vehicles. The fund invests 20% of its portfolio in this fund.

Given risks associated with the Chinese government’s earlier restrictions on some businesses, Dr. Arm explained that those measures were employed to prevent the economy from overheating and business monopoly with protection of consumers and labors. Financial risks will also be mitigated for long-term economic stability. Now, those stringent control has passed and growth is believed to be stronger.

Ms. Pornchanok added that China’s economic recovery has seen quicker than other countries, while the stock market had also dropped first. Previously, the stock market had taken a break for 2-3 months and has now started to recover after the Chinese government has eased its control measures over economic activities. Also, the Chinese market has already responded to such concerns, while the market’s valuation is relatively cheap at the price to earnings ratio of only 15 - 16 times and key factors are likely to grow continuously. Thus, we believe that this is the interesting time to reinvest in the Chinese market.

For KFCMEGA-A, the fund will invest in Chinese stocks listed in China, Hong Kong, and the US with reference to MSCI China All Shares Index. The fund has investment strategy to invest in China’s 5 megatrends that belong to the new-economy system and tend to build the long-term growth. In the meantime, the fund’s management style is flexible while portfolio will welcome the new themes that are attractive and have potential to grow. Besides, the fund will rebalance its investment portfolio on a quarterly basis, based on the fund manager’s consideration.

KFCMEGA-A will hedge against currency risk upon fund manager’s discretion. Generally, the Fund will hedge against the exchange rate risk on average of 90% of the foreign investment value. Fund’s IPO will be made during 7 – 15 June 2021 with a minimum purchase at only 500 Baht. Receive more 100 Baht of KFCMEGA-A with every 100,000 Baht investment (please study terms & conditions). Interested investors can invest through Bank of Ayudhya, our Selling Agents and online channels of Krungsri Asset Management (@ccess Online Service/ @ccess Mobile).

Investment policy and disclaimer

- Krungsri Asset Management Co., Ltd. (“The Management Company”) believes the information contained in this document is accurate at the time of publication but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute.

- KFCMEGA-A will invest in units of foreign equity funds and/or Exchange Traded Funds (ETFs) that has investment policy focusing on investment in listed securities in China and/or which main business or majority of revenue comes from business operations in China that are related to beneficiaries of the rise of mega trends such as the growth of e-commerce, technological advancements, aging society or economic structural change in the future etc. The fund will invest on average no less than 80% of its NAV in an accounting year in at least 2 funds and the exposure per each fund will not exceed 79% of NAV. Exposure in each foreign equity funds and/or ETFs will be upon fund manager’s discretion which is subject to change based on market situation in each period.

- Fund’s risk level at 6 - high risk | Hedge against currency risk upon fund manager’s discretion. Generally, the Fund will hedge against the exchange rate risk on average of 90% of the foreign investment value.

- This mutual fund concentrates its investment in specific sector. Thus, investors may incur a substantial loss of investment.

- The fund may enter into a currency swap within discretion of fund manager which may incur exchange rate risk and investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future result.

For more information on funds, please contact:

Krungsri Asset Management Co. Ltd. Tel. 02-657-5757 or Bank of Ayudhya PCL.

For KFCMEGA-A details, click here