Keep an eye on leapfrogging growth opportunities from disruptive innovations completely combined in KFINNO-A

Amid global market fluctuations and fund corrections, Krungsri Asset Management has continued to launch the new fund titled “Krungsri Disruptive Innovation Fund – Accumulation (KFINNO-A)” that invests in the master fund, Nikko AM Ark Disruptive Innovation Fund, a highly-successful fund with a leap growth under the investment advisor by ARK Investment.

Recently, Catherine Wood, CEO and CIO at ARK Investment Management, who sets and creates the investment phenomenon under the theme “Disruptive Innovation” backed with her over-40-year investment experience, together with Pornchanok Rattanarujikorn, Assistant Vice President for Alternative Investment at Krungsri Asset Management had come to discuss on unique investment strategies that made the fund succeed.

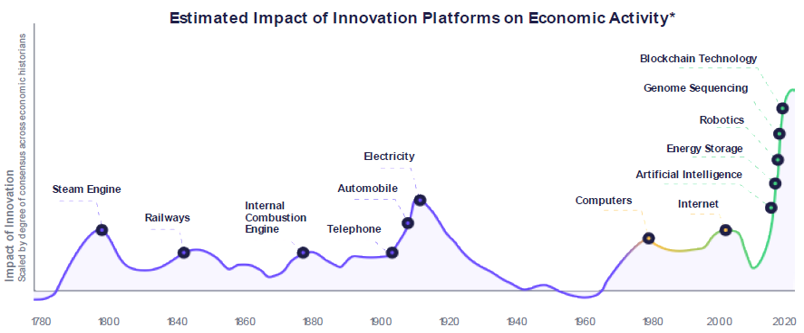

Catherine Wood said that the fund concept “Disruptive Innovation” comes with confidence that innovation will bring changes and pattern of the future society. Such phenomenon is similar to the early of 1900s when new innovations like phones, automobiles and electricity had led to changes across the world. In the present world, innovations will play a major role to bring about good changes to industries, people’s quality of living and the society and these will make a better world.

ARK Investment has divided disruptive innovation categories into four key themes

1) Industrial Innovation, 2) Next Generation Internet, 3) Genomic Sequencing and 4) Fintech. The fund thus focuses on making investment in businesses that involved in these thematic innovations, while these invested businesses will be supported by five major technology platforms extending from use of Robotics, advances in Energy Storage, DNA Sequencing technologies, Artificial Intelligence, and Blockchain Technology.

Source: ARK Invest, Nikko AM as of Jan.2021

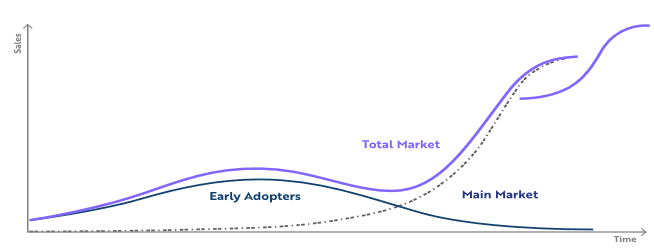

Catherine Wood added that innovations will improve productivity, increase GDP, add value to products and services, and more importantly, reduce operating costs dramatically. That’s why demands for innovation have risen from all industries. When the crucial element like technology brings down costs and reasonable prices, customer base will be expanded and market shares and revenues will increase. These three parts of improvement will help businesses achieve an exponential growth. And when the time is right, innovations will be unveiled after development phases.

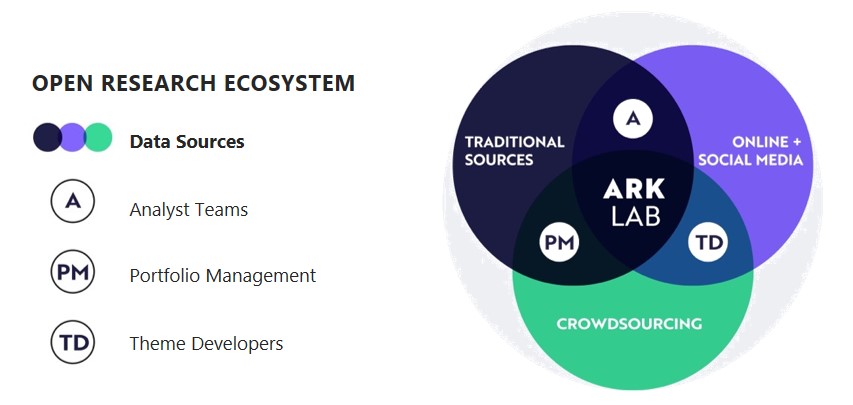

Having confidence in disruptive innovation makes ARK Investment different from others. Usually, other strategy , in general, has teams of analysts by industry sectors. But ARK’s strategy has determined for innovations that will change the world. Therefore, at ARK, we saw a team of new generations from several fields spanning from researchers, experimenters, innovators, consultants to those in fields of innovations. Each of them has experience and expertise in a thematic innovations to invest, while they share ideas and

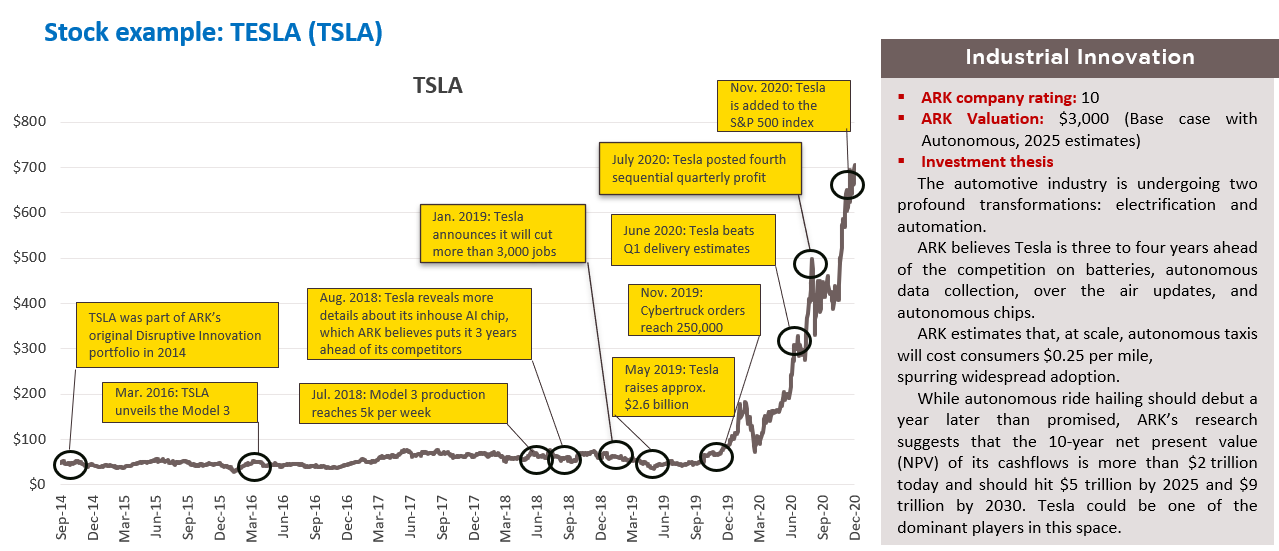

conducting Top-Down analyses that are assumptions for innovations and studies for possibilities. Opportunities for marketing and structural shifts of industries are also learned then backed with Bottom-Up analyses that will find interesting enterprises that have useful innovations, visionary leaders, competitiveness, and reasonable price before the final investment decision.

Source: ARK Invest, Nikko AM as of Jan. 2021

The example of such work process is the study of a possibility for autonomous vehicles and given the research findings, automotive sector has a chance to totally change with a replacement of autonomous system. In this regard, Tesla answers this question for this innovation given its battery technology that helps lower operating costs by 28%. Therefore, Tesla comes as the top in the fund’s investment portfolio in the industrial innovation theme.

Source: ARK Invest, Nikko AM as of 31 Dec 2020 | The graph above is shown based on a representative account for illustrative purposes. Reference to individual stocks does not guarantee their continued inclusion in the strategy’s portfolio or client portfolios. This should not be considered a recommendation to buy or sell these stocks.

Moreover, ARK Investment’s Open Research Ecosystem also differs from others by broadly disseminating its research and information through social media in order to allow others in innovation fields to join and sharing ideas. With this, the fund has broader information and that helps the fund to mitigate investment risks.

Source: ARK Invest, Nikko AM ascof Jan.2021

Source: ARK Invest, Nikko AM ascof Jan.2021

Apart from innovation, ARK’s another strategy is exploitation of market inefficiencies. Given its longer term of vision for investment in three to five years, ARK selects enterprises into its portfolios carefully and also sees opportunities to invest amid short-term market fluctuations by emphasizing on long-term return rather than short-term market volatility.

Source: ARK Invest, Nikko AM as of Jan.2021

Pornchanok urges investors to have KFINNO-A in their investment portfolios as the master fund has unique characteristics with capability for exponential growth in the future and risk mitigation of all investment themes under ARK Investment’s umbrella with a coverage of various business and industry sectors. Besides, master fund also shifts its investment more properly in each period as it has experts to monitor situations. Presently, the fund’s portfolios expand more into Asia. Earlier, the fund’s focuses on the United States.

KFINNO-A will fully hedge against foreign exchange rate risk. IPO is offered 22 – 30 March 2021 with a minimum purchase only at 500 Baht. Interested investors can purchase fund units at any branch of Bank of Ayudhya or selling agents, and through any transaction channel of Krungsri Asset Management (@ccess Online and @ccess Mobile) on every business day.

Disclaimer

• Krungsri Asset Management Co., Ltd. (“The Management Company”) believes the information contained in this document is accurate at the time of publication but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

• KFINNO-A invested 80% of NAV, in average of fund accounting year, in the Master Fund named, Nikko AM ARK Disruptive Innovation Fund, Class A (USD) (The master fund). The master fund has the policy to invest in global equity securities of companies that are relevant to investment theme of disruptive innovation. | Fund has risk level at 6: High risk.

• Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

For more information on funds, please contact:

Krungsri Asset Management Co. Ltd. Tel. 02-657-5757 or Bank of Ayudhya PCL.

For KFINNO-A details, click here