.aspx)

Recently, Krungsri Asset Management Company Limited had organized the webinar on “Riding the US Mega Wave … Potential for Mega Returns”, expecting the US market to rise further after the results of US presidential election that declared the new leader winning the US presidency. Several factors continuously propel the US economic recovery and growth. Meanwhile, the agenda also included an announcement for the replacement of the new master fund, Baillie Gifford Worldwide US Equity Growth Fund, which came into effect since 2 November 2020.

At the webinar, Mr. Fraser Thomson, Product Specialist from Baillie Gifford & Co. and Ms. Pornchanok Rattanarujikorn, Krungsri Asset Management’s Assistant Vice President for Alternative Investment had provided information involving the US stock markets’ direction and trends after the US presidential election, growth and return opportunity, stock selection and portfolio strategy, current investment portfolio and record of fund performance. Also, KF-US has been recommended to invest for long-term investment opportunity in the US stock market, while the fund has invested in Baillie Gifford Worldwide US Equity Growth Fund, a five-star fund rated by Morningstar*.

Source: The master fund’s FFS as of 31 August 2020. Morningstar’s rating is not relevant with the Association of Investment Management Companies.

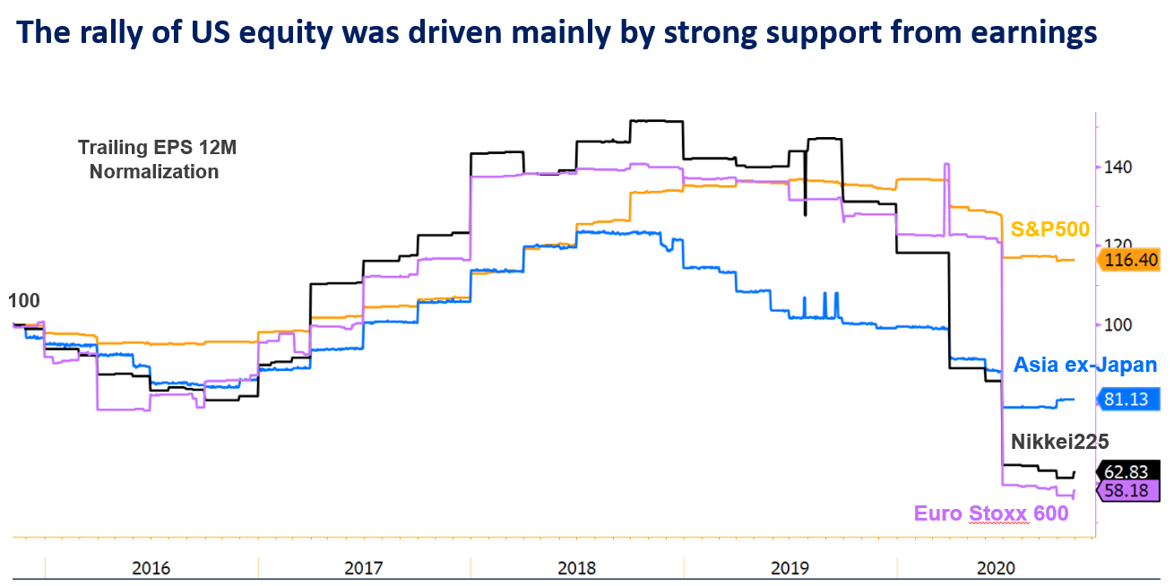

Ms. Pornchanok said that despite of sharp rises in US stock markets after the COVID-19 crisis starting early this year, such rises have come from strong fundamentals with real earnings, not speculation. In the past five years, the US market earnings increased sharply, compared to other stock markets.

Source: Bloomberg as of 3 Nov. 2020

In this regard, Krungsri Asset Management sees a high chance for the US stock markets to grow in the long term with four support factors;

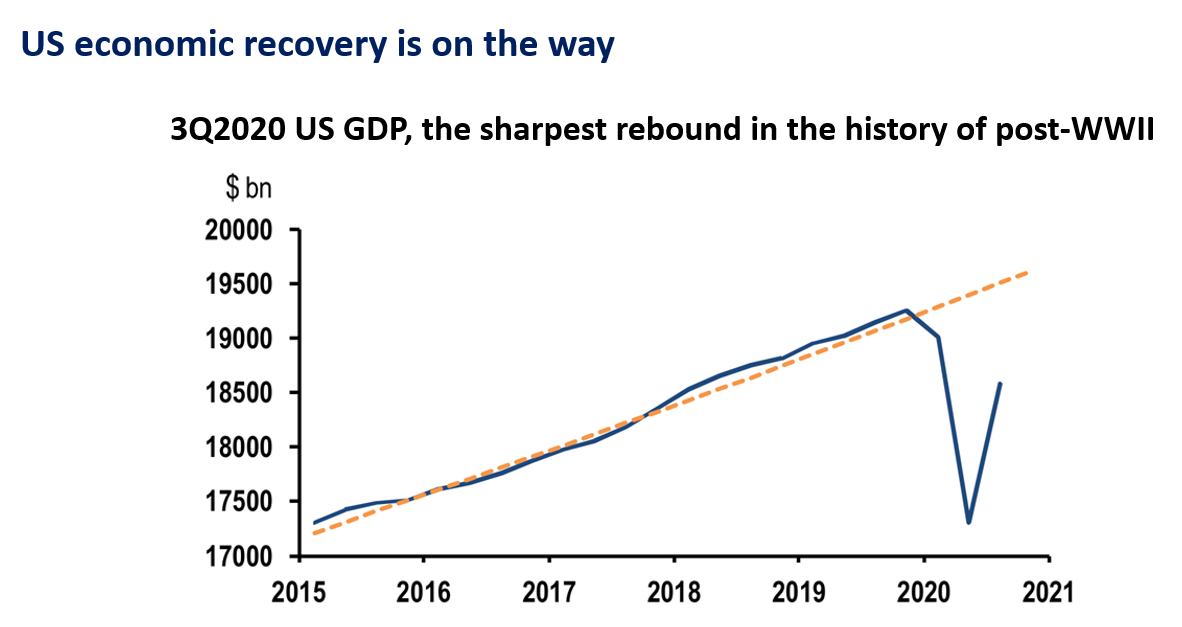

1) The US economy has recovered from its bottom in the second quarter and the third-quarter GDP expanded higher than expected at 33%. Therefore, the International Monetary Fund (IMF) revised up its forecast for the US GDP growth this year.

2) The Federal Reserve (Fed) is expected to maintain the low benchmark interest rates at least until 2023, while keeping the monetary policy and quantitative easing with asset purchases of no more than 120 billion US dollar per month as a means to inject money into the system.

3) Third-quarter earnings results came better than expected, rising 17% from the second quarter. As a result, analysts revised up their estimates for returns on US stocks and earnings. Next year, the US stock markets are expected to see better direction than other stock markets.

4) Political factors after election. As none of political parties gains the majority control over the US House of Representatives and the Senate. Therefore, it might be difficult for the concerned plans on the corporate tax increase or stricter regulations for big caps especially tech stocks. And it is believed that the new government will have the fiscal policy and launch urgent economic stimulus measures. Based on such factors, the US stocks are expected to rise much further.

Source: US Bureau of Economic Analysis, JPMorgan as of 29 Oct. 2020

Source: US Bureau of Economic Analysis, JPMorgan as of 29 Oct. 2020

Mr. Thomson added that the US stock markets are still suitable for investors who are seeking alternatives for long-term investment. And now is still the timing to invest in the US stock markets, despite of sharp increase, given the early period of growth. He believed that US is the market that consists the most of companies with innovations, particularly Internet and IT software, playing a major role in speeding up changes and growth to stocks without limitations, including opportunity to leverage investment and business expansion. Thus, it is a chance for long-term investment.

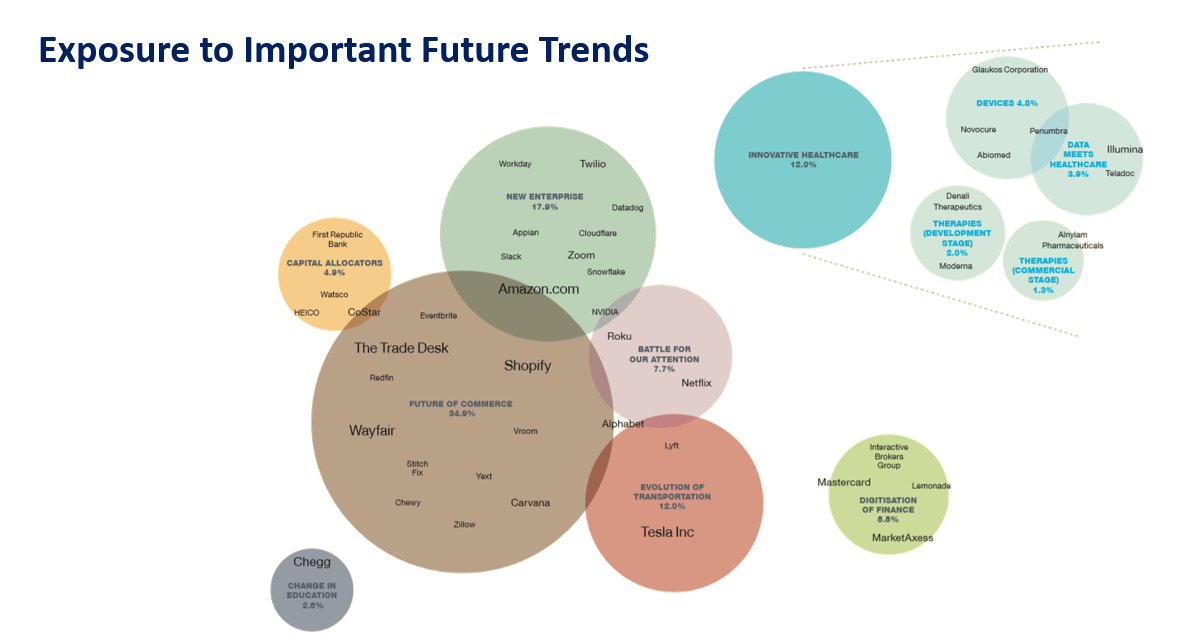

Source: Baillie Gifford as of 30 Sep 2020. Figures may not sum due to rounding. Excludes cash. This thematic risk analysis is reflective of the team’s views. Stocks may appear in more than one circle if they are exposed to the same thematic risk. Stock name size is representative of holding size.

Source: Baillie Gifford as of 30 Sep 2020. Figures may not sum due to rounding. Excludes cash. This thematic risk analysis is reflective of the team’s views. Stocks may appear in more than one circle if they are exposed to the same thematic risk. Stock name size is representative of holding size.

Being managed by the fund manager from the United Kingdom, Baillie Gifford Worldwide US Equity Growth Fund has been able to generate higher returns than rivals in the past years since the fund has different methods and stock selection strategy from others. The fund will search for quality firms with high profitability, upside potential and long-term returns. The fund has over 130 experts who analyze unseen firms with differentiated and outstanding businesses, and growth prospect. Besides, the fund is trying to seek for companies which use technology to grow and strengthen their businesses or bring new experiences to consumers. Examples are online and healthcare businesses. In the investment view, the fund is considering firms that are run by owners and have higher profitability than the market average. Once business opportunity and future are seen, the fund will invest in the businesses for at least 5-8 years.

.aspx) Source: Baillie Gifford & Co as of 30 Jun. 2020 | Images from Flaticon.com

Source: Baillie Gifford & Co as of 30 Jun. 2020 | Images from Flaticon.com

Presently, Ballie Gifford holds approximately 30 - 50 selected stocks. Quality stocks will be selected and overweight will be put in future-trend stocks like Innovative Healthcare, Future of Commerce, and Digitization of Finance, etc. These stocks are medium- to large-sized firms who are industry leaders with growth potential and market value of no less than 1.5 billion US dollar.

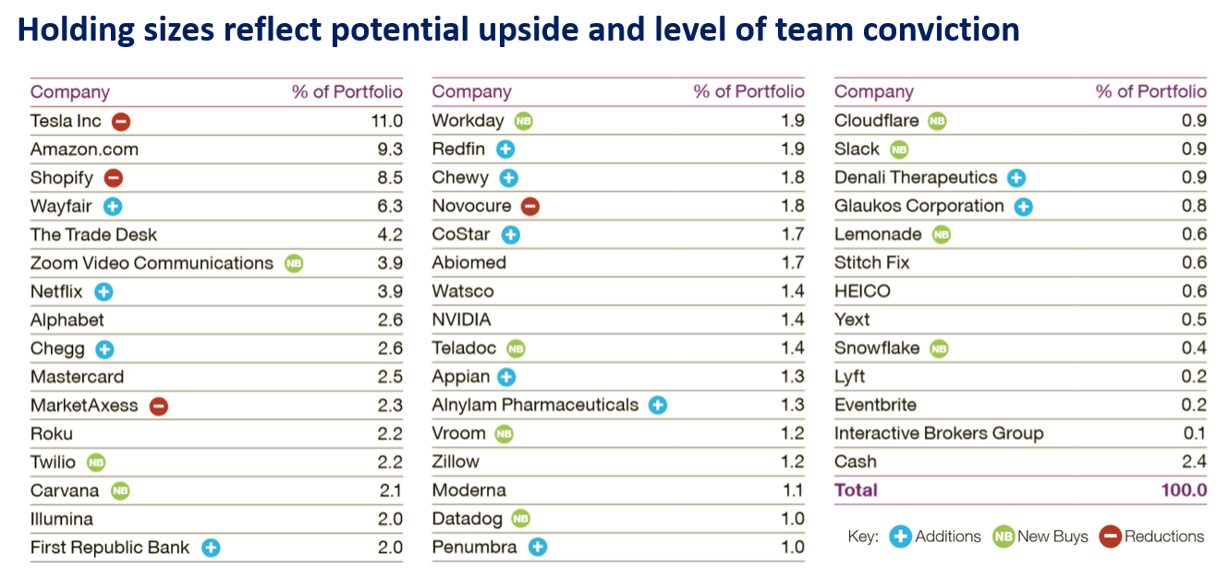

Source: Baillie Gifford as of 30 Sep 2020. Totals may not sum due to rounding. Transactions 12 months to 30 September 2020. Complete Sales: 2U, Activision Blizzard, Agios Pharmaceuticals, Facebook, Fortive, Grubhub, Markel, New Relic, Now Inc.

Source: Baillie Gifford as of 30 Sep 2020. Totals may not sum due to rounding. Transactions 12 months to 30 September 2020. Complete Sales: 2U, Activision Blizzard, Agios Pharmaceuticals, Facebook, Fortive, Grubhub, Markel, New Relic, Now Inc.

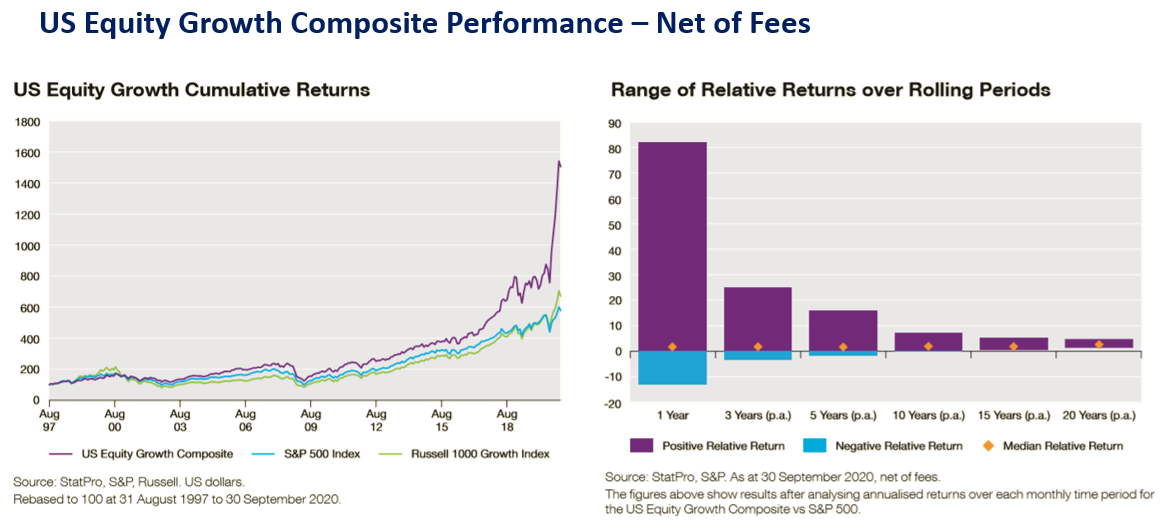

Throughout the past five years, the fund made above-market returns despite of factors that impacted markets and included COVID-19 and political factors, which have been seen as short-term ones. Meanwhile, the fund pays attention on profitability rather and will invest in interesting companies which are expected to grow in line with changes in consumer behavior. Earlier, the fund has invested in electronic vehicles maker Tesla, the US’s largest online retailer Amazon, and the leading online furniture and home decor distributor with the augmented reality (AR) Wayfair. These ventures all bring new experiences to consumers and deploy technology to change and grow industries.

Source: Baillie Gifford & Co as of 30 June 2020| This fund performance is that of the master fund and is not relevant to the Association of Investment Management Companies standards.

Source: Baillie Gifford & Co as of 30 June 2020| This fund performance is that of the master fund and is not relevant to the Association of Investment Management Companies standards.

So far, at Krungsri Asset Management, we have three US equity funds on shelf: KF-HSMUS; KF-HUSINDX; and KF-US. KF-HSMUS focuses on investment in small- and medium-sized businesses, while KF-HUSINDX is the passive fund whose returns follow an Index. For the last fund, KF-US invests through the master fund - Baillie Gifford Worldwide US Equity Growth Fund which employs active investment strategy with expertise in searching for long-term investment opportunity and proven investment success.

KF-US has the policy to hedge against foreign exchange risks according to fund managers’ discretion. Minimum purchase amount is only 2,000 Baht. Investors who are interested in this fund can purchase its units through any transaction channel of Krungsri Asset Management on every business day.

Now you can redeem your Krungsri credit card accumulated points to invest in any Krungsri mutual funds, see more details, click here

Disclaimer

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

- This document is produced for general information based on the trustworthy source of information, but the Management Company does not provide any warranty of its accuracy.

- Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

- Since KF-US’s investment is highly concentrated in the north of United States and therefore investors should consider diversify the risks in their portfolio.

- KF-US may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

For more information on funds, please contact:

Krungsri Asset Management Co. Ltd. โทร. 02-657-5757 or Bank of Ayudhya PCL.

See KF-US detail