Fund Type

Equity General

Dividend Policy

None

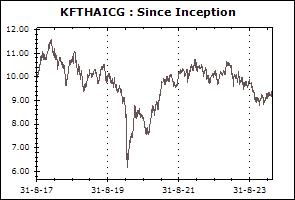

Inception Date

31 August 2017

Investment Policy

The Fund will invest in average no less than 80% of its NAV in each accounting year in equity instruments of listed companies in The Stock Exchange of Thailand and/or The Market for Alternative Investment (MAI) or other secondary markets of The Stock Exchange of Thailand with the primary focus on investment in good governance companies and companies that have been certified by Collective Action Coalition Against Corruption (CAC). Consideration on good governance may be based on CG Scoring of Thai Institute of Directors or other related organizations. (please see details in prospectus summary)

Fund Manager

Peeti Pratipatpong, Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (30 Dec 2025)

| Energy & Utilities | 23.44% |

| Banking | 22.57% |

| Food & Beverage | 9.02% |

| Commerce | 8.85% |

| Property Development | 8.59% |

Top Five Holdings (30 Dec 2025)

| PTT Plc. | 7.27% |

| Thanachart Capital Plc. | 6.56% |

| MBK Plc. | 5.07% |

| Gulf Development Plc. | 4.38% |

| Minor International Plc. | 4.30% |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock Fund (KFSDIV) | -2.97% | +9.70% | -8.87% | -8.87% | -8.42% | -3.80% | -1.74% | +4.82% | 6,340 |

| Standard Deviation of Fund | +10.13% | +13.08% | +16.34% | +16.34% | +13.45% | +12.70% | +14.71% | +15.43% | |

| Krungsri Dividend Stock Fund 2-D (KFSDIV2-D) | -1.68% | +13.48% | -9.31% | -9.31% | -8.36% | -3.62% | N/A | -1.48% | 6 |

| Standard Deviation of Fund | +12.08% | +13.73% | +17.05% | +17.05% | +13.94% | +13.05% | N/A | +13.70% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | -3.02% | +9.61% | -8.62% | -8.62% | -8.23% | -3.70% | -1.64% | +3.86% | 531 |

| Standard Deviation of Fund | +10.07% | +13.00% | +16.19% | +16.19% | +13.33% | +12.61% | +14.65% | +17.71% | |

| Krungsri Value Stock Fund-I (KFVALUE-I) | -3.02% | +9.62% | -8.62% | -8.62% | -8.23% | N/A | N/A | -7.28% | 0 |

| Standard Deviation of Fund | +10.08% | +13.00% | +16.19% | +16.19% | +13.33% | N/A | N/A | +13.18% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | -2.14% | +10.38% | -10.86% | -10.86% | -9.33% | -2.55% | -1.87% | +6.82% | 765 |

| Standard Deviation of Fund | +10.57% | +13.65% | +17.27% | +17.27% | +14.00% | +12.89% | +15.17% | +21.69% | |

| Krungsri Star Equity Fund (KFSEQ) | -2.15% | +10.10% | -10.89% | -10.89% | -9.34% | -2.60% | -1.93% | +2.85% | 688 |

| Standard Deviation of Fund | +10.46% | +13.43% | +17.08% | +17.08% | +13.88% | +12.82% | +15.09% | +19.02% | |

| Krungsri Star Equity Fund 2-A (KFSEQ2-A) | -2.08% | +10.66% | -11.43% | -11.43% | -9.54% | -2.62% | N/A | -0.76% | 0 |

| Standard Deviation of Fund | +10.88% | +14.08% | +17.57% | +17.57% | +14.15% | +12.99% | N/A | +13.35% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | -7.11% | +4.92% | -21.69% | -21.69% | -11.32% | +0.01% | +2.14% | +4.74% | 309 |

| Standard Deviation of Fund | +13.81% | +16.08% | +19.11% | +19.11% | +15.05% | +14.11% | +16.22% | +19.18% | |

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +5.41% | +18.56% | +9.33% | +9.33% | +1.97% | +6.35% | +5.66% | +7.41% | 1,607 |

| Standard Deviation of Fund | +9.99% | +10.15% | +13.45% | +13.45% | +12.77% | +13.22% | +16.80% | +20.86% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | -7.06% | +5.02% | -21.85% | -21.85% | -11.44% | -0.11% | +2.14% | +4.85% | 750 |

| Standard Deviation of Fund | +13.97% | +16.16% | +19.23% | +19.23% | +15.22% | +14.26% | +16.29% | +19.54% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | -2.06% | +10.05% | -10.60% | -10.60% | -9.36% | -2.67% | N/A | -7.51% | 10 |

| Standard Deviation of Fund | +10.70% | +13.51% | +16.83% | +16.83% | +13.87% | +12.76% | N/A | +15.66% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | -2.06% | +10.05% | -10.61% | -10.61% | -9.36% | -2.67% | -1.81% | +4.85% | 364 |

| Standard Deviation of Fund | +10.70% | +13.51% | +16.83% | +16.83% | +13.87% | +12.76% | +15.04% | +19.03% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +0.64% | +18.28% | -5.76% | -5.76% | -4.71% | -0.24% | +2.75% | +4.50% | 1,961 |

| Standard Deviation of Fund | +14.54% | +16.07% | +19.79% | +19.79% | +15.31% | +14.31% | +16.71% | +20.44% | |

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | -4.58% | +9.08% | -19.02% | -19.02% | -16.03% | -3.24% | N/A | -1.62% | 122 |

| Standard Deviation of Fund | +10.75% | +13.75% | +18.04% | +18.04% | +14.88% | +14.44% | N/A | +15.79% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | -1.16% | +10.60% | -3.96% | -3.96% | -7.63% | -1.86% | N/A | -4.47% | 523 |

| Standard Deviation of Fund | +9.88% | +12.03% | +15.97% | +15.97% | +13.58% | +12.81% | N/A | +14.94% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | -1.16% | +10.60% | -3.96% | -3.96% | -7.63% | -1.86% | N/A | -6.51% | 463 |

| Standard Deviation of Fund | +9.88% | +12.03% | +15.97% | +15.97% | +13.58% | +12.81% | N/A | +15.33% | |

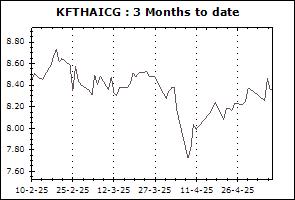

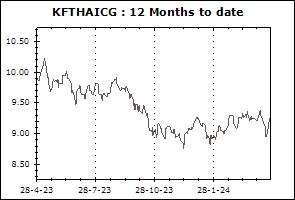

| Krungsri Thai Equity CG Fund (KFTHAICG) | -1.38% | +11.18% | -4.60% | -4.60% | -5.79% | +0.39% | N/A | -1.64% | 56 |

| Standard Deviation of Fund | +9.54% | +12.33% | +16.16% | +16.16% | +13.53% | +12.57% | N/A | +14.86% | |

| Krungsri SET100 Fund-A (KFS100-A) | +0.94% | +18.95% | -5.20% | -5.20% | -4.55% | +0.36% | N/A | +1.80% | 138 |

| Standard Deviation of Fund | +14.33% | +15.70% | +19.25% | +19.25% | +14.89% | +13.84% | N/A | +14.71% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.57% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +1.38% | +19.47% | -4.79% | -4.79% | N/A | N/A | N/A | -2.12% | 0 |

| Standard Deviation of Fund | +14.78% | +15.89% | +19.33% | +19.33% | N/A | N/A | N/A | +15.36% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.08% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.16% | N/A | N/A | N/A | N/A | |

| SET TRI | -0.59% | +17.33% | -5.99% | -5.99% | -5.63% | +0.47% | +3.05% | N/A | |

| Standard Deviation of Benchmark | +14.18% | +15.05% | +17.77% | +17.77% | +13.89% | +13.01% | +14.88% | N/A | |

| SET50 TRI | +1.86% | +19.70% | -3.65% | -3.65% | -2.69% | +1.42% | +3.41% | N/A | |

| Standard Deviation of Benchmark | +14.06% | +15.48% | +19.27% | +19.27% | +14.95% | +14.02% | +16.67% | N/A | |

| SET100 TRI | +1.34% | +20.00% | -4.63% | -4.63% | -4.22% | +0.57% | +2.98% | N/A | |

| Standard Deviation of Benchmark | +14.24% | +15.72% | +19.29% | +19.29% | +14.99% | +13.95% | +16.46% | N/A | |

| Krungsri SET50 Fund-A (KF-SET50-A) | +1.59% | +18.85% | -4.60% | -4.60% | -3.72% | +0.75% | N/A | +3.44% | 8 |

| Benchmark(4) | +1.82% | +19.66% | -3.68% | -3.68% | -2.70% | +1.41% | N/A | +4.35% | |

| Standard Deviation of Fund | +14.07% | +15.40% | +19.29% | +19.29% | +14.91% | +13.97% | N/A | +14.91% | |

| Standard Deviation of Benchmark | +14.05% | +15.47% | +19.27% | +19.27% | +14.95% | +14.02% | N/A | +14.94% | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.46% | N/A | N/A | N/A | N/A | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.01% | N/A | N/A | N/A | N/A | |

Remark